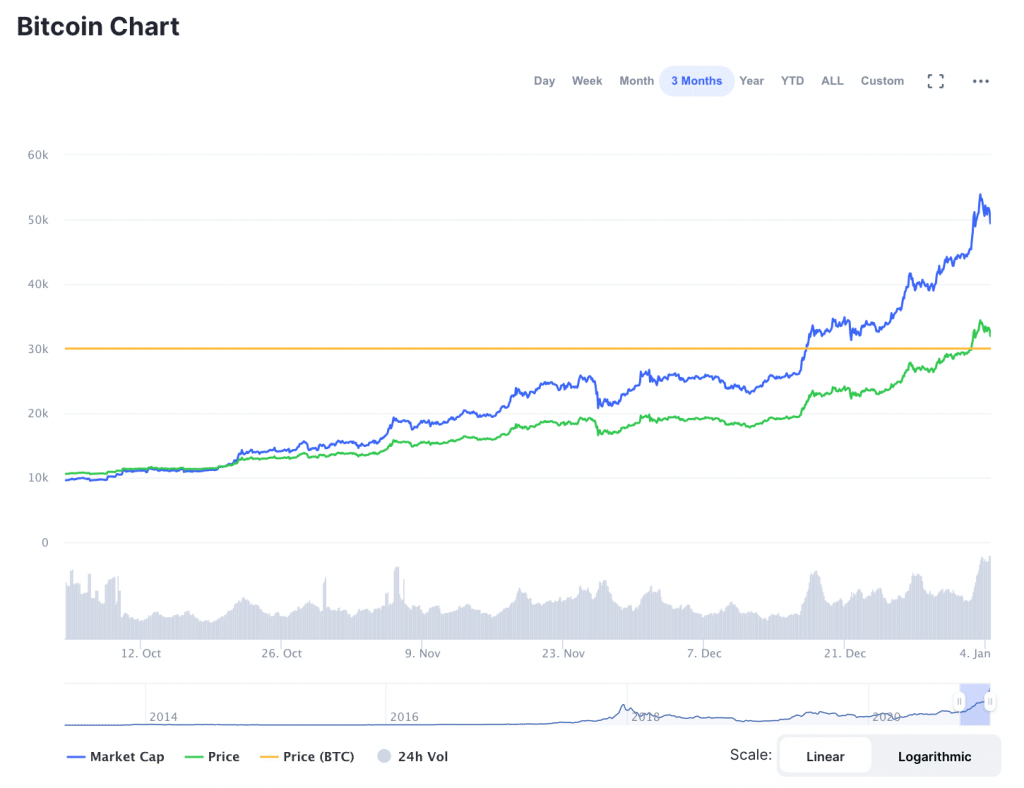

After surpassing $34,000 yesterday, Bitcoin hit yet another record high – the latest of many in December. Some analysts are betting that Bitcoin is not going to stop anytime soon. Therefore, it may be some time yet before hopeful buyers can jump into BTC at a lower price.

via CoinMarketCap

For example, Antoni Trenchev, the Chief Executive of London-based crypto lending firm, Nexo, told LiveMint that he believes the digital asset will “be on the road to $50,000 probably in the first quarter of 2021.”

Bitcoin in 2021: $50K, $100K, $500K?

Tom Lee, Managing Partner and the Head of Research at Fundstrat Global Advisors, also has bullish predictions for Bitcoin. On Wednesday of last week (before Bitcoin hit its latest high of $34K), Lee said that he believes bitcoin will surge another 300% in 2021.

In a Tweet, Lee pointed out that because of the halvening that took place last year, 2020 was a lot like 2016 in the BTC world. Therefore, he believes that 2021 could be a lot more like 2017 when Bitcoin’s previous all-time-highs were set.

Thus, Bitcoin could see a “parabolic rise” in 2021, Lee tweeted.

Similar to that, Fundstrat's Digital Asset Strategist, David Grider said on Wednesday that he expects Bitcoin to hit at least $40,000 this year, and with $34K already in the bag, $40K seems like it could be a piece of cake.

Bitcoin Is Due for a Correction, Eventually. Therefore, Buyers May Be Better-Served to Wait.

Still, the path forward may not necessarily be linear.

In fact, some analysts are already gearing up for a retracement. A crypto trader who operates under the moniker 'Mr. Anderson' tweeted on January 1st that a metric known as Bitcoin’s 'monthly momentum reading' has not been as high as it is now for quite some time, and the last time that it reached its current levels, disaster struck.

“The last and only time that $BTC saw a Monthly momentum reading this high we saw a 38% retrace,” he wrote. However, the retrace gave way to “a recovery intra-month and continued exponentially.”

Therefore, Mr. Anderson said that the retrace was “something interesting that I'll be on guard for (interesting, but, not actionable by itself).”

"Step 1: Resist the Urge to Buy Bitcoin at $32k."

Prior to Bitcoin’s rise past $25,000, Celsius Chief Executive, Alex Mashinsky predicted that Bitcoin would retrace to $16K before it would surpass $26K. Of course, $26K is far in the rearview mirror, but a retrace is still likely in the cards.

Additionally, Joaquim Matinero Tor, a cryptocurrency observer and Blockchain Associate at Roca Junyent, previously told Finance Magnates that he expects Bitcoin to fall under $18,000 before making significant movement upward.

“I think the price of Bitcoin will fall under 18,000 dollars and then rise back,” he said. “Whale investors will sell once the financial year is over. So, January may be a rollercoaster ride for the cryptocurrency market.”

However, it is hard to know exactly how far back Bitcoin will retrace. Ramp Capital pointed out on Twitter that “Bitcoin would have to drop 50% from here just to get back $16,500 — the level hit on Thanksgiving 2020.”

Still, some analysts are advising buyers that it may be better to wait for BTC to drop before jumping in. Video producer and WVFRM host, Marques Brownlee tweeted late on Sunday: “Step 1: Resist the urge to buy Bitcoin at $32K.”

What is step two? “Regret not buying Bitcoin earlier.”

However, those that did manage to buy Bitcoin earlier should be wary that the IRS is eyeing their wallets.

Finance Magnates previously reported that in an article for Law360, Don Fort (who previously headed the IRS’ criminal investigation division) said that while the tax agency was previously taking a more 'educational' attitude toward cryptocurrency hodlers, school days are over: the time for 'enforcement' has come.

“The IRS has been not-so-quietly positioning itself for a smooth transition from education to enforcement in 2021 and beyond,” he wrote. The article was co-authored by Lawrence Sannicandro, a lawyer who has focused his career on federal and state tax controversies. Both men are part of the team at Kostelanetz & Fink, LLP.