Last week the United Kingdom’s Financial Conduct Authority (FCA) published a set of rules that officially banned the sale of derivatives and exchange-traded notes (ETNs) that are based on the sale of certain kind of cryptocurrencies to retail consumers. In other words, crypto derivatives and ETNs can no longer be sold in the UK.

The FCA said that the reasons for its decision were primarily because of the potential harm they pose to retail clients.

This potential for harm is said to extend from a number of areas, including the inherent nature of the underlying asset, which are said to have no reliable basis for valuation. Extreme volatility, the prevalence of cybertheft, a general level of inadequate understanding among consumers, and a lack of a legitimate 'need' to invest in these products was also mentioned.

Why did this happen? And what's next?

Was the FCA’s Derivatives Ban Coordinated with the BitMEX Indictments?

Bob Morris, chief compliance officer at Apifiny, told Finance Magnates that the ban is the latest development in a growing wave of regulation to crack down on the derivatives part of the cryptocurrency industry.

Bob Morris, chief compliance officer at Apifiny.

Morris specifically pointed out that the FCA’s crypto derivatives ban “comes on the heels of The Commodity Futures Trading Commission’s (CFTC),” which is “the United States regulatory agency that is the watchdog for the derivatives markets.”

Earlier this month, the CFTC filed “a civil enforcement action in the U.S. District Court for the Southern District of New York that charged five entities and four individuals that own and operate the BitMEX Trading Platform with operating an unregistered trading platform and violating multiple CFTC regulations.”

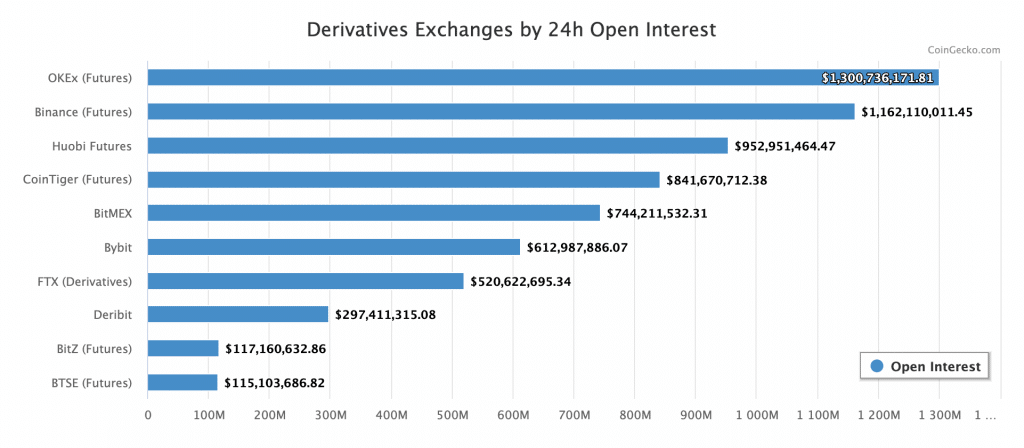

Indeed, BitMEX is one of the largest cryptocurrency derivatives trading platforms in the world. It has long been the subject of lawsuits and rumours that have claimed the exchange is a haven for illicit activity – a factor that may have attributed to negative views of the crypto derivatives space as a whole.

Therefore, the FCA’s decision to ban crypto derivatives could have been a reaction to the CFTC’s confirmation that BitMEX was a hub for cybercrime: “both actions came simultaneously and were probably coordinated, given the importance of each marketplace,” Morris said.

Indeed, while regulators on the securities side of the crypto industry are slowly chipping away at the crypto landscape, Morris said that derivatives may have been a bit of an easier target: “regulators can flush out 100x leverage products that pose huge risk,” he said.

“The FCA does have the knowledge and expertise, along with the muscle, to enforce these bans. These enforcements are meant to protect investors from highly leveraged derivatives, offered by unregulated firms.”

How Effective is the FCA's Crypto Derivatives Ban?

And indeed, the FCA says that its ban will prevent £53m in losses by retail investors.

Read our final rules banning the sale of crypto-derivatives to retail consumers, saving them around £53m. #cryptoassets https://t.co/UIYAGcnj4M pic.twitter.com/O9mEBWHYHv

— Financial Conduct Authority (@TheFCA) October 6, 2020

However, while UK-based exchanges may no longer have the ability to sell crypto derivatives products to retail investors in the country, retail investors still have the ability to purchase and trade derivatives on platforms based outside of the UK.

Indeed, “those still keen on trading crypto derivatives will just find ways to open accounts in unaffected regions,” Don Guo, CEO of Broctagon Fintech Group, told CoinDesk. “There is a stark risk that retail traders will simply trade on unregulated exchanges, which in fact puts them at more risk.”

Additionally, Sui Chung, chief executive of CF Benchmarks, a firm that provides price indexes to exchanges like CME Group, told CoinDesk that currently, only a few U.K.-based retail investors trade crypto derivatives products directly. Instead, they normally trade through contracts for difference (CFD) providers.

What Will the Impact of the FCA's Ban Be?

In other words, the FCA ban likely will not have a major effect on the crypto derivatives space as a whole – an opinion that seems to be shared by a number of analysts in the cryptocurrency space.

For some firms, though, the impact is very real. Anton Altement, co-founder of Osom.finance and former Credit Suisse director, told Finance Magnates that certain companies that offer crypto-based CFDs, such as eToro and Binance, “will have to reduce their offerings to UK customers.”

However, Indacoin CBDO, Guilherme Jovanovic told Finance Magnates that it is difficult to determine exactly what the global impact of the FCA ban is for “several reasons.”

First of all, “earlier this year, FCA revealed that 83% of U.K. residents who had at least once purchased Cryptocurrencies had done so through non-U.K. based platforms, which highlights that the market share of U.K. based exchanges is rather small,” Jovanovic said.

Indacoin CBDO Guilherme Jovanovic

Additionally, “the FCA considers that particular types of regulated activities with crypto assets can still be authorized, which decreases the share of banned platforms even more,” he explained. “That being said, it's still a remarkable precedent that is yet to be considered by other countries.”

Is more Regulation Headed to Crypto Derivatives Markets Elsewhere?

And indeed, some iteration of the FCA crypto derivatives ban could be coming in other jurisdictions.

“Bans will be forthcoming across the globe for exchanges that offer 100x leveraged derivatives,” Apifiny's Bob Morris told Finance Magnates. “The enforcement actions have just started and will increase across the world.”

This is because many of the opinions expressed by the FCA on crypto derivatives are shared by other regulators in the space: “regulators view the products themselves as being too sophisticated for the average investor,” Morris explained.

Additionally, on some crypto derivatives exchanges, “the appropriate disclosures explaining the risks to customers were non-existent. The exchanges did not hire licensed investment professionals and had very little compliance.”

Therefore, in the long run, more regulations in the crypto derivatives space could benefit the image of the industry. However, Osom.Finance’s Anton Atlement hopes that further regulatory actions will take a more balanced approach toward the crypto derivatives space.

“We see these actions as a continued indication that regulators are moving further toward the legitimization of the digital asset space. However, regulators should adopt a more consultative approach to let the industry thrive instead of the ‘whack-a-mole’ ways of today,” he said.

Osom.Finance’s Anton Atlement.

Additionally, Atlement stressed the importance of regulators moving in a more coordinated way in the future: “unless the consolidation of regulatory efforts are carried out in a more unified direction, everyone will lose. Operators will have to move into less stable jurisdictions, users will benefit from the lower level of protection and the regulator will limit the levers available to them.”

As Crypto Gets More Popular, Regulators Feel More Pressure to Act

While there has not been an explicitly coordinated move on the crypto derivatives space by global regulators, it seems that regulators are finally moving in coordinated steps in other areas of the cryptosphere.

For example, the Group of 20 (G20) announced on Tuesday that it is working with the International Monetary Fund (IMF), the World Bank, and the Bank for International Settlements (BIS) to begin the process of formalizing the use of central bank digital currencies (CBDC) in global banking.

While the fruit of this collaborative effort is still a ways from being borne, it seems that the collaboration could also be the first successful attempt at developing some kind of international regulatory and technical framework for the cryptocurrency industry as a whole.

Moreover, these regulatory efforts may be accelerated by the growing usage of cryptocurrencies and decentralized finance platforms

Indacoin’s Guilherme Jovanovic explained that the “trend on global decentralization of economic processes intensified by COVID-19 and following lockdown, contributed to the mass adoption of crypto assets and brought to the surface major risks of dealing with cryptocurrencies and especially crypto-derivatives without proper knowledge.

“Since this trend is uninventable, and more and more platforms offer margin trading with sometimes impracticable leverage, it's understandable that FCA decided to take action as soon as possible,” he said.