In August, Prof. Shmuel Hauser, the Chairman of the Israel Securities Authority (ISA), announced that an internal committee had been established and mandated. Its purpose was to determine whether or not Initial Coin Offerings (ICO) and Cryptocurrencies should be regulated, and if so – should they be subject to Israeli securities law.

Discover credible partners and premium clients in China's leading event!

However, the Commission's initial submissions are still forthcoming and are due by December 31, 2017. An ICO represents an unregulated way of raising funds for a new digital coin or token venture.

It is a way to bypass all the red tape associated with capital-raising by venture capitalists and banks. The first token sale, or ICO, was held by Mastercoin in July 2013. In 2014, Ethereum raised approximately $2.3 million in its first 12 hours. Brave, a new web browser, generated approximately $35 million in under 30 seconds with its ICO.

As of November 2017, there were currently fifty ICOs per month. There is no doubt that, for organizations that need investment, an ICO is a quicker and easier way to fundraise.

Ethereum changing the world

It is also cheaper as there are no bank fees to be paid. But ICOs are a lot more than a way of raising money. They are one of the major mechanisms for the development of the Blockchain technology. Ethereum was not only a successful money raising exercise.

It took the blockchain technology one step further, and in that aspect it changed the world. Every digital token that is being created through an ICO offers some kind of functionality, and it is this collective effort that will contribute to the development of the blockchain technology and real-life application.

In light of their growing popularity and magnitude, it is clear why regulators around the globe are looking closely at ICOs, and considering the appropriate approach towards this new method of crowdfunding.

In this context, it is clear why the ISA would want to regulate ICOs. However, it is unclear why Prof. Hauser felt compelled to compare ICOs to binary options, or in his words, that the ISA must ensure that "ICOs do not become the new binary options". It is unclear and to some extent concerning, that Prof. Hauser felt compelled to announce that he is considering to follow the Chinese example and ban ICOs altogether.

Admittedly, not all ICOs are launched by honest entrepreneurs. The same can be said about IPOs (Initial Public Offering of securities), as well as many other regulated activities. Regulation doesn't prevent wrongdoing, and it should not be confused with enforcement. Regulation is intended to address market deficiencies.

A few bad apples?

So why should a few bad apples in the industry who have, unfortunately, defrauded and harmed innocent investors and entrepreneurs, result in a complete ban on the industry. This is the same industry, which also Prof. Shmuel Hauser admits is an “innovative industry with the potential to transform the financial world as we know it, both in Israel and abroad”; an industry in which "Israel's unique characteristics and global standing can significantly contribute to the growth of the Israeli economy”.

It was Robert King Merton, the American sociologist, who coined (should we now beware of the "C" word?) the phrase "unintended consequences". Unintended consequences are unforeseen or unintended results following a decisive action. So what has been the result of China’s ban on ICOs?

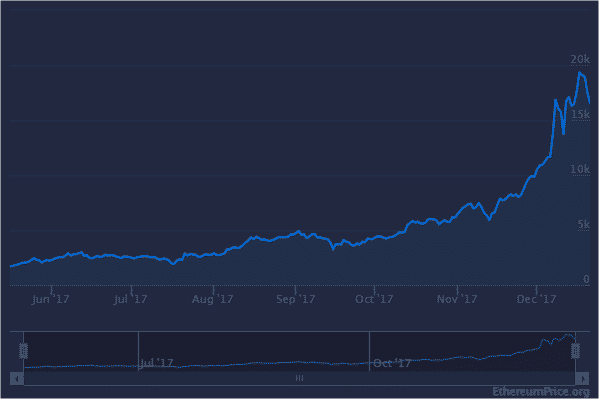

Well, there has been a resurgence in the market and all of those investors have registered funds where it is legal for them to participate; so nothing has really changed. Yes, the price of Bitcoin did drop from $4900 to below $4200, but within two days, the price returned to above the $4600 mark. Currently, the price of Bitcoin is just under $19495, and who knows what it will be tomorrow?

Bitcoin price

Before I continue, I would like to be perfectly clear: I do not believe that ICOs should remain unregulated. Digital coins and tokens must be regulated. If they – in effect – fall under the definition of a security – they should be treated as securities.

However, if they don't – they require the creation of a new and innovative regulatory regime that matches their technological characteristics, which the world is only beginning to develop and understand.

Such regulation should most certainly include Anti-Money Laundering and Know Your Customer restrictions and policies, but should also address issues like cyber security, transparency with regards to the use of proceeds etc. Instead of comparing ICOs to binary option trading platforms, the ISA should try to seize this unique opportunity and turn Israel into an ICO jurisdiction of choice THROUGH regulation.

What is Wrong with Fear-Based Regulation?

Veronique de Rugy, in her online article entitled “The Fear Based Campaign to Control the Net”, states quite interestingly that “Public fear is an ally of big government. When fear sets in among the populace — often with encouragement from self-interested politicians — the result is usually an expansion of governmental power and a loss of individual rights.

Politicians typically stoke fear by exaggerating some perceived threat or by inventing one out of whole cloth. They then declare that government alone can provide the answer.”

In late October 2017, the Israeli parliament has approved the second and third reading of the Binary Options Law, prohibiting trading platforms operating in Israel from offering binary options to investors in and outside Israel.

Prof. Hauser has stated that “trading platforms that offer trading in binary options cause grave, destructive damage to Israel’s image, which is quickly gaining momentum and fuels antisemitism against Jews in general and Israelis in particular, and undermine Israel’s foreign relations”.

One could certainly argue whether this was the correct measure to take against the bad apples of the binary options industry, but now, Prof. Hauser is comparing ICOs to binary options.

First of all, I fail to see the comparison. Second, assuming that he is referring to the risk of using an ICO as means of defrauding the public, is fear-based regulation the answer? I believe this is a fundamental mistake.

If a drunk driver causes an accident resulting in the death of a person, is the answer to ban the entire country from driving? “Let us take away their cars” the Ministry of Transport should shout from the rooftops. No. That is not the answer. The answer is to use enforcement to combat drunk driving.

Revoke the drunk driver’s driving license and put him behind bars. Regulation is used to ensure that only people with sufficient skills and physical abilities will be able to drive, and to provide for the requirements for obtaining a driver's license. Regulation and enforcement are two different things, with different purposes, and should not be confused.

The Urbancorp fiasco is a perfect example illustrating this point. In December 2015 the Canadian property developer raised approximately $50M by offering bonds on the Tel Aviv Stock Exchange. Urbancorp did so after obtaining the ISA's approval of its prospectus and after it had complied with the expansive regulatory rules that govern IPOs in Israel.

In April 2016, only five months after its Israeli public bond offering, Urbancorp filed for bankruptcy in Canada. Fortunately, Prof. Hauser is not calling for a ban on securities offerings of non-Israeli companies on the Tel Aviv Stock Exchange, because he knows that any alleged wrongdoing on the part of Alan Saskin, Urbancorp's CEO and controlling shareholder should be addressed through private and public enforcement actions, not through regulation.

As with anything in life, whether it is regulated or not, there are risks involved. As the saying goes, "the only things in life that are certain are death and taxes".

Cryptocurrencies and digital tokens are the way of the future and are here to stay. Regulate them and enforce the rules; do no rule with an iron fist. Moreover, a complete ban on ICOs in Israel will have no real impact. Currently, many Israelis are involved in ICOs and developments of blockchain technologies, but the vast majority of them are doing so through foreign non-Israeli legal entities; the ICO founders will not even see this as a hurdle.

The only thing that will really happen here is that Israel will miss an opportunity to use regulation in order to provide legal certainty and by doing so attract ICO founders and entrepreneurs to establish their businesses in Israel, employ talented Israelis and contribute to the Israeli economy and to the development of blockchain technologies worldwide.