BitConnect has been hit with another class-action lawsuit, according to Law360.com.

The complaint, filed in a Kentucky court by plaintiff Brian Paige, alleges that the company's investment platform is actually a Ponzi Scheme , and seeks an undisclosed amount in damages. This is the second such complaint this week - the first was filed on the 24th of January by six investors who are seeking over $770,000 from BitConnect and the YouTube representatives who helped promote it.

Discover credible partners and premium clients at China’s leading finance event!

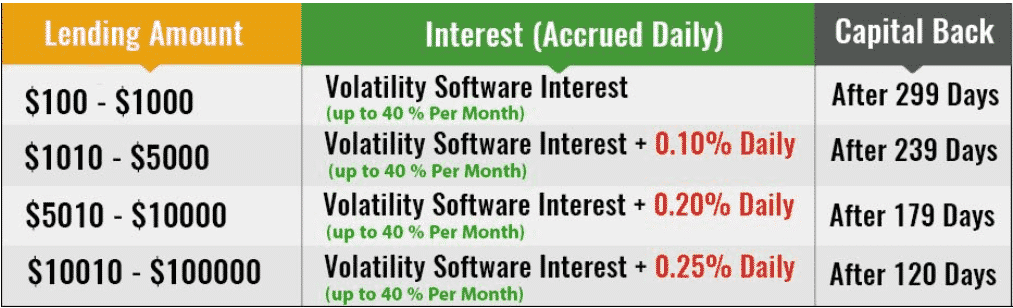

BitConnect was launched in February 2016, and its coin, BCC, in November. It was advertised as a lending platform, and investors would contribute money to the system for a pre-arranged amount of time in order to receive profit - in fact, a guaranteed 40 percent. The Bitconnect website reads:

“The moment you acquire BitConnect Coin it becomes an interest-bearing asset with 120% return per year. It is that simple.”

The company actually had some success with this model, at one point reaching a market capitalisation of over $2 billion, which put it in 8th place in the cryptocurrency premier league.

https://youtu.be/kbR1SXIje1U

Ponzi schemes have been around since the 1920s, reaching a peak with Bernie Madoff's $64.8 billion masterpiece. Cryptocurrency has given this kind of scam a new lease of life for a number of reasons.

Firstly, Ponzi schemes rely on investors trusting in a vaguely explained business model that they don't really understand themselves, which is a more or less accurate description of even legitimate ICOs nowadays. Secondly, financial watchdogs still haven't caught up with this industry, giving scam artists some leeway to operate before the net closes in and the loopholes close. And thirdly, the use of tokens means that, unlike in a traditional Ponzi scheme, investors are not strictly speaking left empty-handed - the tokens may be worthless, but they serve the purpose of allowing the ruse to continue for longer.

Yeah, if 1%/day is what they offer then that's a ponzi.

— Vitalik Buterin (@VitalikButerin) November 2, 2017

BitConnect was eventually served with cease-and-desist orders in both Texas and North Carolina (it is a UK-based company so this was the most that these authorities could do), and shortly afterwards closed down its platform. Upon doing so, the value of its BCC coin instantly dropped by about 90 percent, due to the fact that it became utterly useless.

It has tanked even more now upon the news of this second lawsuit.

According to the complaint: “With this transaction, BitConnect promised to plaintiff and the class fixed returns as well as a guarantee that the principal investment/loan amount would be paid in full on date certain. Instead, BitConnect shut down its platform, took all of plaintiff and the class’s money, and left them with BCC, which is either entirely worthless or has significantly less value than BitConnect promised.”

Jasper Ward, representing Paige, told Law360: “We filed this to try to recover for those scammed by BitConnect and its promoters, and to put others on notice that they can’t take advantage of this emerging technology to hurt consumers.”