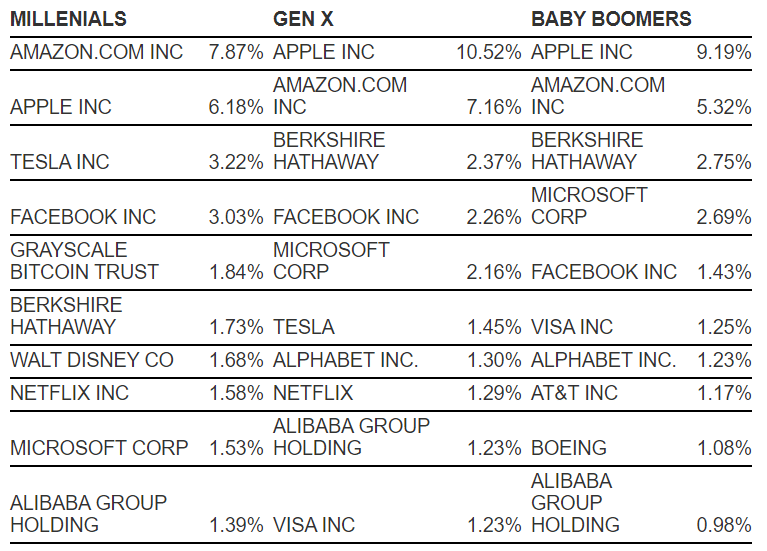

Millennials are investing more in Bitcoin than they are in Disney, Netflix, and Microsoft, but less than Facebook, Tesla, Apple, and Amazon--that is, if you go by Charles Schwab’s SDBA Indicators Report, published on Wednesday of this week.

The report found that more millennials, who are aged 25-39, were buying into the Grayscale Bitcoin Trust (1.84 percent) than in Berkshire Hathaway (1.73 percent), Walt Disney Co. (1.68 percent), Netflix Inc. (1.58 percent), Microsoft Corporation (1.53 percent), or Alibaba Holding Group (1.39 percent).

Source: Charles Schwab

Schwab’s report, which is published quarterly, collects data from 142,000 retirement plan participants who have balances between $5,000 and $10 million in their Schwab Personal Choice Retirement Accounts.

According to Schwab’s survey, the Grayscale Bitcoin Trust did not make it into the ten-most popular asset lists of either GenX or Baby Boomer investors. Interestingly, though, a survey commissioned by Grayscale published earlier this year revealed that “the average investor is 45 years old, and the average investor interested in bitcoin is 42,” according to The Motley Fool.

The survey also found that “over one-third (36 percent) of U.S. investors would consider an investment in bitcoin, which roughly translates to 21 million people.”

Grayscale Bitcoin trust could have more competition in the future

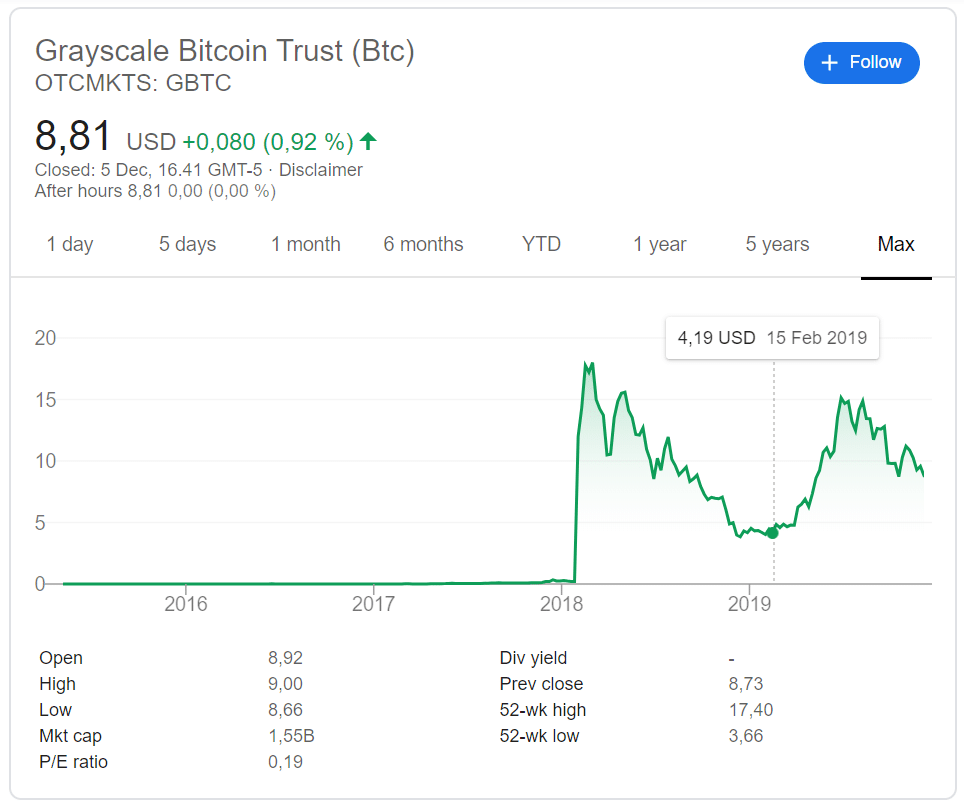

The Grayscale Bitcoin Trust (GBTC) was launched in 2013 and granted permission FINRA (Financial Industry Regulatory Authority) to offer publicly-traded shares in 2015. Since then, the fund has risen to become one of the industry’s most successful crypto-related investment products; The Block reported that capital inflows into the fund increased 200 percent in Q3. At press time, GBTC’s market cap was approximately $1.55 billion.

Source: Google

However, as Kyle Samani, Managing Partner at Multicoin Capital pointed out on twitter, part of the reason for its success could be the simple fact that it doesn’t face much competition.

Why aren't there any competitors to Grayscale's trust products?

— Kyle Samani (@KyleSamani) October 14, 2019

However, with the ongoing race to gain approval for a Bitcoin ETF and to create other crypto-based investment products for institutional investors, there could be more competition on the horizon in the relatively near future.