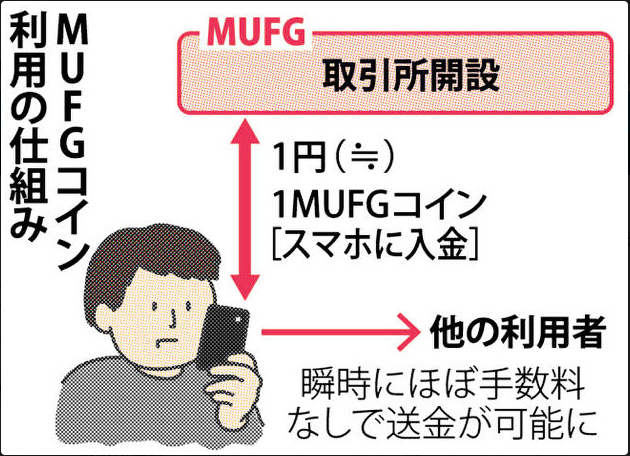

Mitsubishi UFJ Financial Group wants to launch its own cryptocurrency, along with a cryptocurrency exchange to trade it on, according to local media. The token will be called MUFG Coin.

Discover credible partners and premium clients at China’s leading finance event!

The bank plans to open the exchange in 2018, and it will be the first Japanese bank to take such a step.

Source: mainichi.jp

According to The Mainichi, a Tokyo-based newspaper, MUFG plans to "suppress" price fluctuations on the exchange in order that cryptocurrency can be used safely.

The article points that according to Japanese law, transfers of one million yen (approximately 9,030 USD) or more cannot be conducted without using a bank, and if a digital coin is pinned to the yen, the same rules will apply. Conversely, if the coin is issued as virtual currency, a greater amount can be freely transferred on the Blockchain , but the price will no longer be stable because it is not pinned to the yen.

This is why the bank is opening its own exchange, according to the article. The bank aims to "stabilize" the MUFG Coin at a value of one coin to one yen - "inducing coin prices to be approximately 1 yen" - but not fix the value. By doing so, the blockchain can be used to transfer Payments .

The bank has already notified the Japanese financial watchdog of its plans, which include "organizing contests" for MUFG Coin-based business ideas in March 2018.

MUFG is Japan’s largest financial group and the world’s second largest bank holding company. It is also the second largest public company in Japan. A few weeks ago, we reported that Mitsubishi UFJ Trust and Banking, MUFG's trust banking arm, is planning to launch a cryptocurrency safety net to be sold to cryptocurrency exchanges. It will work by recording and analysing all transactions, and halting any that appear suspicious in order that they can be investigated. Exchanges making use of this system would be able to offer customers more security, at the expense of anonymity.