MyBit, an Ethereum-powered ecosystem that connects the global IoT industry, has integrated Bancor’s decentralized Liquidity network support to its platform to help it offer decentralized applications that are more user-friendly.

Bancor, with cross-chain liquidity service, is one of the largest Liquidity Providers to the crypto industry. MyBit’s users can now convert any two tokens without a counterparty at an automatically calculated price, which is done using the “connector” token method.

Mentioning the advantages of Bancor, MyBit wrote: “And this means we can avoid all of the usual problems associated with them — like trusting others to hold your crypto, excessive fees, a lack of liquidity and having to manually find buyers and sellers.”

MyBit will also extend Bancor’s services to all its DApps. In the official announcement, the firm noted: “We’ll incorporate a one-click buy option within the DApp itself. Plus, any token on the Bancor Network can be converted in a few simple clicks from the MyBit platform.”

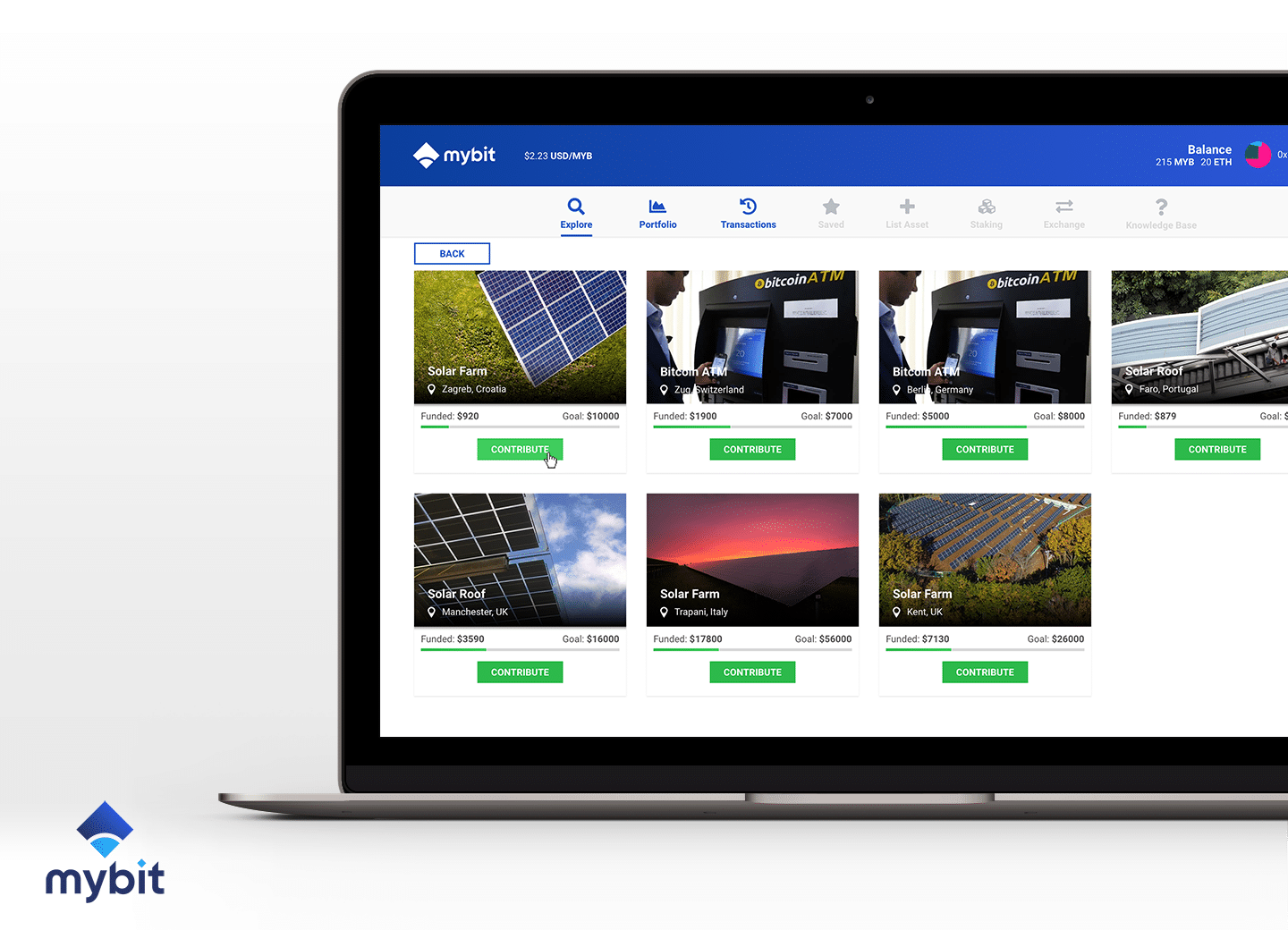

MyBit is leveraging the rapid expansion in the field of internet-of-things (IoT) and has developed an investment ecosystem for the booming sector. Anyone, using MyBit’s decentralized investment platform - MyBit DApp - can invest in revenue-generating IoT devices such as robotics, autonomous vehicles, 3D printers, drones, cryptocurrency ATMs, and miners.

Expanding services

MyBit has also recently announced the launch of a decentralized asset exchange - MYDAX - to trade stakes of IoT industry. Moreover, earlier this month, the firm partnered with Ability Concept.

Despite the partnerships and developments, MyBit-issued coins (MYB) has dropped significantly in the bear-clutched market. With a dip of five percent in the daily chart, MYB is trading at $0.08 and has a market cap of little more than $5 million.