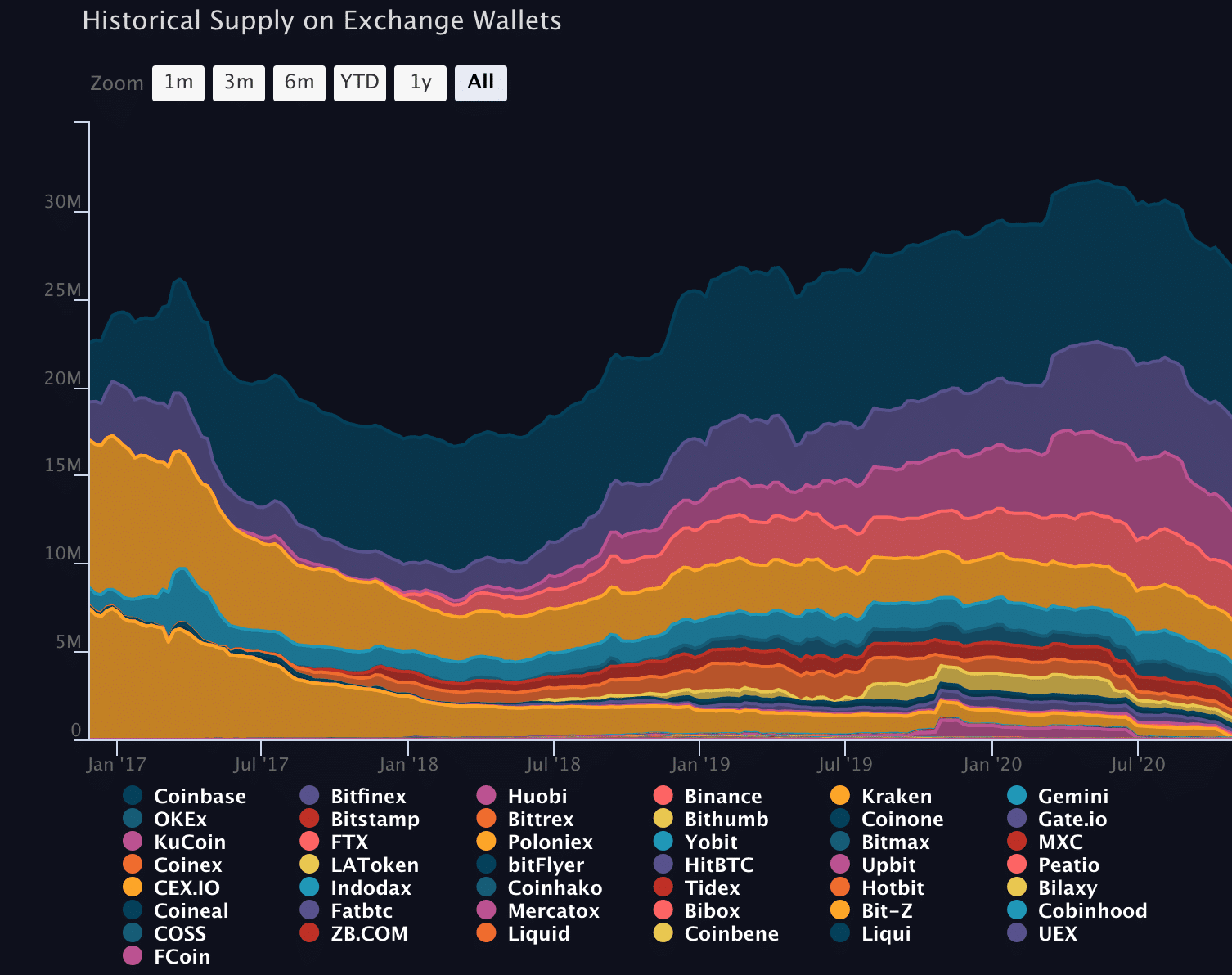

Crypto Analytics platform ViewBase has recently found that nearly one-fourth of the circulating supply of Ether (ETH) tokens are held on cryptocurrency exchanges. Specifically, CoinTelegraph reported that 26,768,260 ETH are on exchanges, which equates to roughly 23.6% of all circulating ETH tokens. At press time, this equated to $10.3 billion.

via Viewbase

Notably, nearly all of the 26 million tokens are being kept on 10 centralized exchanges. Coinbase alone has custody of 8,.5 million ETH tokens, roughly 7.5% of the supply.

By comparison, the total number of BTC stuck on cryptocurrency exchanges equates to approximately 8.1 percent of the circulating supply of Bitcoin.

Analysts say that ETH hodlers are looking to sell while BTC hodlers are stashing their coins

This could imply that BTC hodlers are much less eager to sell their coins that ETH hodlers. Earlier in October, renowned cryptocurrency analyst, Willy Woo wrote on Twitter that when the number of coins kept on cryptocurrency exchanges drops, “It’s a sign that new buyers are coming in to scoop the coins off the markets and moving them into Cold Storage .”

In other words, coins are being bought and transferred into private digital wallets for long-term hodling. Therefore, Woo said low numbers of coins on exchanges is “macro bullish.”

By contrast, a high number of coins on exchanges could indicate that hodlers are eager to offload their coins. Therefore, ETH hodlers could be looking to cash out.

However, Bitcoin seems to be growing in popularity as a long-term investment asset. Earlier this month, Finance Magnates reported that BTC’s migration off exchanges has reached its highest point in months.

At the same time, data from Glassnode shows that there has been growth in the number of new Bitcoin wallet addresses being created each day: 480,000 — roughly six times the number of new Ether wallets that are being created daily.

Furthermore, Finance Magnates reported that Bitcoin’s Fear and Greed Index, which measures the likelihood of market participants to buy (greed) or sell (fear) their coins, has been decisively skewed toward greed for most of the month of October.