A new version of the XRP Ledger (version 1.2.0) has been launched, according to an announcement from Ripple.

The new version of the ledger will implement the MultiSign Reserve Amendment, a change that will reduce the reserve requirement for Multisign signer lists. In other words, an XRP user will be required to hold fewer XRP in order to act as a transaction signer. Previously the requirement was between 10-15 XRP; now it is just 5 XRP.

The update also introduces a new measure against fraudulent transactions. Servers will gain the ability to automatically detect transaction censorship attempts and “issue warnings of increasing severity for transactions that a server believes should have been included in a closed ledger after several rounds of consensus,” according to the announcement.

Servers are required to update to the newest version of the XRP Ledger by February 27 or else be rendered incapable on transaction confirmation.

XRP’s Steady Decline

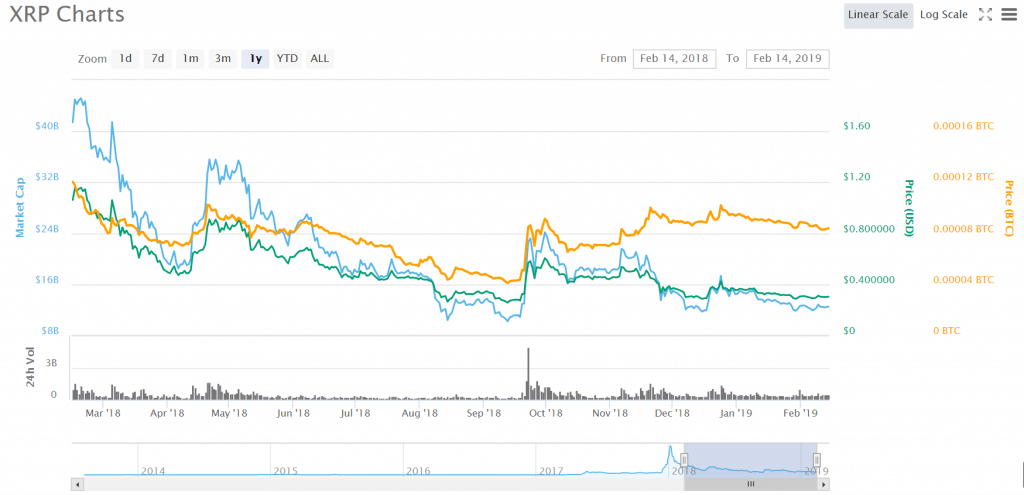

The price of XRP, Ripple’s cryptocurrency, has slowly been sinking over the past year, very much in line with the bear markets that have negatively affected cryptocurrency prices across the industry. At the time of writing, XRP was worth $0.30 per token and had a market cap of roughly $12.5 billion. Exactly one year ago, XRP was worth $1.03 a pop with a market cap of $41 billion.

XRP recently encountered some controversy in the Finnish cryptocurrency when Finland-based cryptocurrency exchange Coinmotion wrote a blog post entitled “XRP is a Centralized Virtual Currency.” The exchange had added XRP to its trading platform a short time before the blog post was published.

“Investing in XRP is more like buying a share on a company than investing in a cryptocurrency,” wrote Pessi Peura, the post’s author. “Ripple is developed by a single company brings some risks that other Cryptocurrencies don’t have to deal with. If the central organization, Ripple Labs, is compromised, it could affect the whole ecosystem.”

The exchange’s decision to post the article has caused an outcry from the greater XRP community:

XRP is a Blockchain , a cryptocurrency and it is NOT centralized. Ripple runs 6% of the nodes and 27% of the UNL validators. If ripple were to dissapear the network would continue to operate.

— Leonidas (@LeoHadjiloizou) February 12, 2019

However, one of Pessi’s claims may have some truth to it: he urged prospective XRP investors to learn about the difference between Ripple and XRP. “Ripple and XRP are terms that can sometimes be confusing,” he said.

XRP introduced a new token logo last year to differentiate itself from Ripple Labs, its parent company.

And indeed, Ripple Labs has made an effort to distance itself from XRP following some confusion that may have benefitted the company in the past. Finance Magnates previously reported that “for example, the price of XRP spiked following an announcement that one of Ripple Labs’ products would be adopted by the UAE Exchange. However, this particular product (the xCurrent network) does not use XRP by default.”

In a Business Insider report last year, eToro analyst Mati Greenspan said that “a lot of newcomers are of the understanding that holding on to XRP tokens is somewhat similar to holding shares in Ripple Labs, which is completely false.”