After operating in stealth mode for the past few months, Rari Capital, a robo-advisor for the DeFi ecosystem, has announced its official launch this Tuesday, as well as laid out its plans for the future.

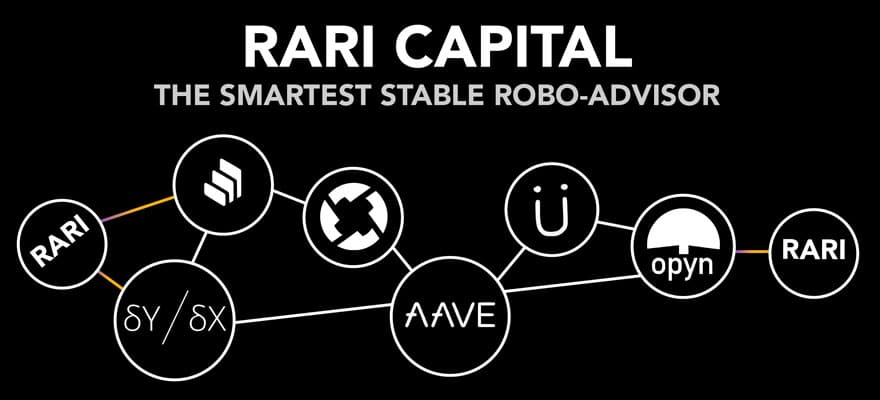

The main service of Rari Capital is to build technology that allows traders to earn interest on their idle capital, without user intervention. The company’s robo-advisor is run via the company’s algorithms, which automatically monitor DeFi protocols and reallocates funds based on potential.

Initially, Rari Capital will launch a Dapp where traders can deposit their crypto-assets. These assets will be automatically rebalanced through its smart contract for maximum Yield , the company said in its statement today.

“The team has worked hard on a risk assessment protocol which they will be sharing in the coming weeks to provide transparency to the public about how they handle integrations,” Rari Capital said in its statement today.

“Rari’s first implementation will be lending, as with most of their competitors, but Rari has multiplied yield through their own unique strategy: rebalancing not just between protocols, but between stablecoins as well.”

Rari Capital team

The team at Rari Capital consists of Jack Lipstone, David Lucid and Jai Bhavnani. Lipstone and Bhavnani previously co-founded Ambo in 2018, which was then acquire by MyCrypto. Lucid, on the other hand, was the Chief Technology Officer (CTO) of CRAFT Scooter before returning to the crypto ecosystem.

“With Rari’s potential for these “exotic” strategies by incorporating different facets of DeFi, they expect to outperform Compound by 2x within the first year,” the company said. “Even as lending rates trend lower, Rari’s future strategies will continue to offset the loss. The team expects to launch the first version of its product by the end of Q2 2020 and is currently running a wait list sign up on their website.”