The Securities and Exchange Commission, the regulating authority of the US, has once again decided not to allow the trading of Bitcoin ETFs. Specifically, it has rejected five proposals made by a subsidiary of the New York Stock Exchange.

“SEC denies Bitcoin ETF” is the “China bans Bitcoin” of 2018.

— Riccardo Spagni (@fluffypony) August 22, 2018

Bull and Bear Shares

NYSE Arca, as the subsidiary is called, is dedicated to exchange-traded funds, claiming on its website to handle 92 percent of these financial derivatives in the US. It made its application in January for the following products:

- Bitcoin Bear 1X Shares;

- Direxion Daily Bitcoin 1.25X Bull Shares;

- Direxion Daily Bitcoin 1.5X Bull Shares;

- Direxion Daily Bitcoin 2X Bull Shares; and

- Direxion Daily Bitcoin 2X Bear Shares.

The 'X's denote the proportionate returns/losses that each fund promises to investors. All have been rejected.

Why Have They Been Rejected?

According to official documentation, the SEC says that its rejection should not be understood as a comment on the value of Bitcoin or Blockchain technology, including as an investment, but rather because NYSE Arca failed to make adequate arrangements to make the contracts safe.

As the SEC said, the applicant failed "to demonstrate that its proposal is consistent with the requirements of the Exchange Act Section 6(b)(5), in particular, the requirement that a national securities exchange’s rules be designed to prevent fraudulent and manipulative acts and practices."

What Are Exchange Traded Funds?

Exchange traded funds are arrangements in which a body owns and trades a certain asset, and sells shares of that asset to investors. By owning these shares, investors can profit or lose according to the performance of the fund. They do not however actually own any part of the asset. These shares can also be traded on financial exchanges, thus becoming a kind of asset in and of themselves.

In February 2018, there was a fairly serious stock market crash which some people blamed on the ETF market, arguing that the passive investment market has a tendency to snowball because too much money is acting homogeneously. The market value of these financial derivatives surpassed $4.5 trillion in January 2018, according to Business Insider, and this market has actually increased five-fold since the 2008 financial crisis.

The Bitcoin ETFs as proposed by NYSE Arca would have an extra layer of complication because they would be connected to the Bitcoin futures sold by other US exchanges. Bitcoin futures are another complicated financial derivative.

Surveillance Sharing

The documentation says that the exchange had not made adequate arrangements to protect against market manipulation. Specifically, it would have had to "enter into a surveillance-sharing agreement with a regulated

market of significant size" to provide a deterrent, and it has not done this.

NYSE Arca did undertake to share surveillance with CME and CBOE, which are the two corporations that trade Bitcoin futures. However, because these are the entities that handle the underlying asset, and because they are not a significant enough in size, the SEC did not accept this arrangement.

This is similar to its reasoning for rejection of a similar proposal from the Winklevoss twins, the millionaire owners of cryptocurrency exchange Gemini, in July. The brothers have been trying to get a Bitcoin ETF through since 2013, and have even registered a patent for an "exchange-traded-product holding digital math-based assets."

This month, they enlisted Nasdaq to provide surveillance on their cryptocurrency exchange and set up a new self-regulatory organisation. Bloomberg suggests that these may be moves to sway future SEC decisions in their favour.

What Does This Mean for the Market?

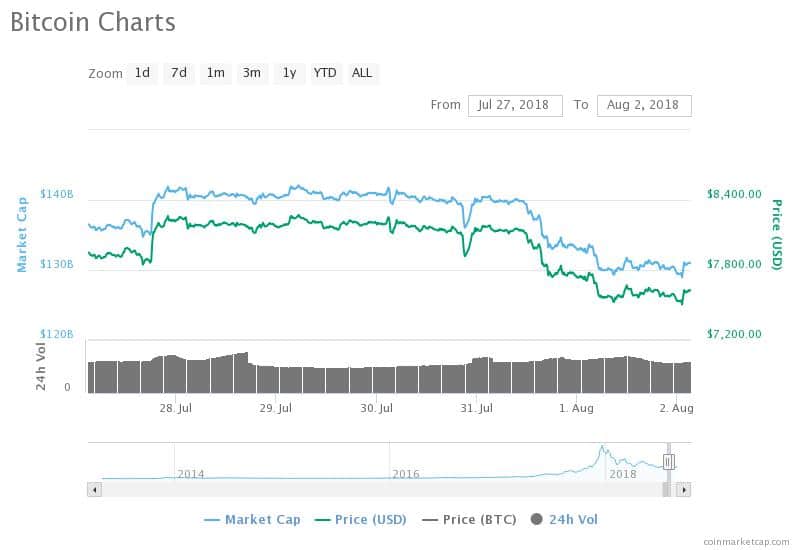

The cryptocurrency market has generally been declining in value this year, and some see these new financial derivatives as a way of injecting it with new life. As evidence of this, see the rise and fall in the price of Bitcoin prior to and following the SEC's latest rejection of the twins:

Source: coinmarketcap.com

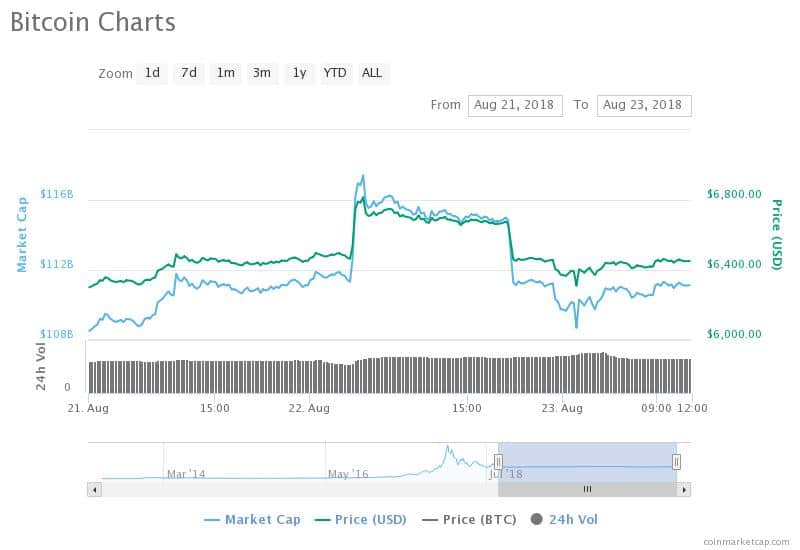

The price behaved similarly around Wednesday's decision:

Source: coinmarketcap.com

Not all agree that financial derivatives are good for anything other than speculation:

I think there's too much emphasis on BTC/ETH/whatever ETFs, and not enough emphasis on making it easier for people to buy $5 to $100 in cryptocurrency via cards at corner stores. The former is better for pumping price, but the latter is much better for actual adoption.

— Vitalik Non-giver of Ether (@VitalikButerin) July 29, 2018

As of now, the SEC has one more ETF-based decision pending, that of financial corporation VanEck. This is the company's third attempt; the decision is due in September.