Only 32 percent of cryptocurrency exchanges in the US and EU conduct full identity checks of their customers, according to Analytics house P.A.ID Strategies. The study was commissioned by Mitek, a company that sells identity verification technology.

The news was reported by UK-based public relations company RealWire.

'Know Your Customer' checks, known by the acronym KYC, are a central facet of regulatory law. The objective is to stop companies from being used for criminal activity by denying criminal elements the ability to hide their identity. KYC checks are mandatory for all banks in the US and the EU.

Cryptocurrency is famous for being an anonymous form of payment, but big cryptocurrency companies such as exchanges and wallet providers have had to comply with local law in many places in order to continue operations.

For example, the European Parliament’s Committee on Economic and Monetary Affairs ruled in December 2017 that cryptocurrency companies would have to register the identity of all customers within 18 months. KYC is also a requirement in the US despite regulatory confusion in other respects. In February, the country's tax authority ordered local cryptocurrency Exchange Coinbase to surrender the data of its more successful customers so that they could be taxed.

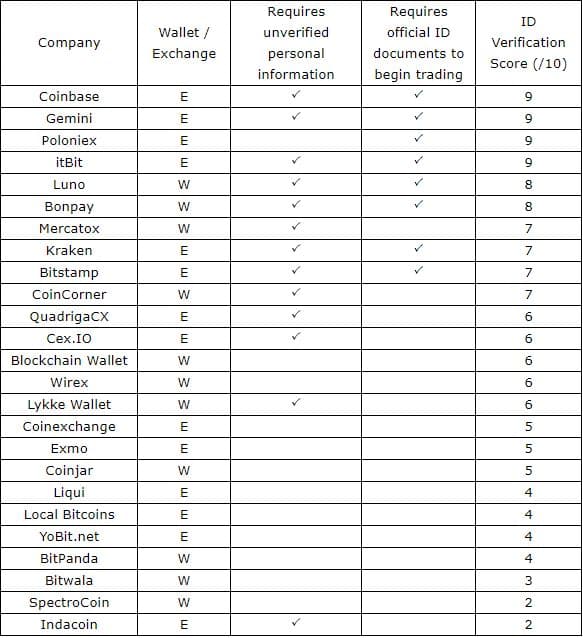

The study checked 25 major companies in these two jurisdictions and found that 68 percent of them do not require customers to formally identify themselves. This means that they only require customers to provide an email address and mobile phone number, which are quite straightforward to obtain anonymously (or pseudonymously).

Source: RealWire

John Devlin, an analyst at P.A.ID Strategies, said: “Cryptocurrency wallets and exchanges want to enjoy the same trust as the wider traditional financial services, but for this to happen they need to rise above the sometimes-dubious reputation of cryptocurrency’s past and be seen as ‘model citizens’ of the economy. Meeting regulatory demands ahead of AMLD5 coming into force could go a long way to changing this sector’s reputation as being something of a ‘wild west’.”

AMLD5 is the 5th Anti-Money Laundering Directive of the EU, passed into law in April 2018. This is an extension of AMLD4 (July 2016) which requires, among other things, that al member countries have a centralised register of national bank accounts and a centralised data retrieval system. It also expands the power of financial intelligence units to access these registers. It will be enforceable by 2019.