[April Fool's!] In a shockingly sudden April fools 1st decision, the United States Securities and Exchange Commission has made the decision to approve not one, but two applications for Bitcoin -based exchange traded funds (ETFs.) Early next month, Bitcoin ETFs will be launched by Bitwise Asset Management and investment management firm VanEck.

The decision to approve the ETFs follows more than six months of delayed decision-making; the SEC has postponed the date that it said a decision on the applications more than three times. The most recent of these delays was announced just last Friday, March 29th.

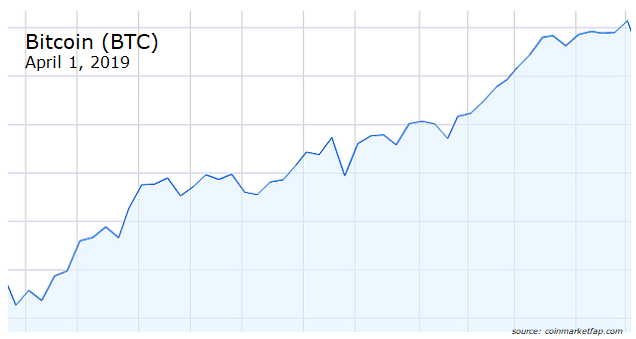

Predictably, cryptocurrency markets have responded positively. In the time since the announcement, the total cryptocurrency market cap has added $13.8 billion; the price of Bitcoin increased from roughly $4080 to over $6000.

Rash Action or Rational Action?

However, an announcement posted just after midnight today, April 1st, explained that the SEC held an emergency meeting over the weekend to reconsider the decision following public outrage at yet another delay. According to a Reuters report, SEC Chairman Jay Clayton phoned the members of the Commission on Saturday morning to make the decision once and for all.

The move has been criticized as unorthodox and perhaps even unnecessary.

“I believe Clayton was attempting to counteract the narrative that the American government is unable to act without shutdowns and other shades of political chaos,” said Violet Baudelaire, professor of Economics and Public Policy at MIT, in an email to Finance Magnates. “However, this kind of rash action could send the message that the SEC is perhaps not acting with as much caution as it should be exercising.”

VanEck’s most recent Bitcoin ETF application was filed in January. Bitwise originally filed its application last month on February 15th with the condition that the SEC would take just 45 days to reach a decision on the application. The Commission was permitted to extend its decision-making time to 90 days if needed.

Last Friday, the extension was indeed deemed necessary--a presentation that Bitwise gave to the SEC last week caused major shockwaves around the industry as the firm postulated that 95% of reported Bitcoin trading volume is fake.

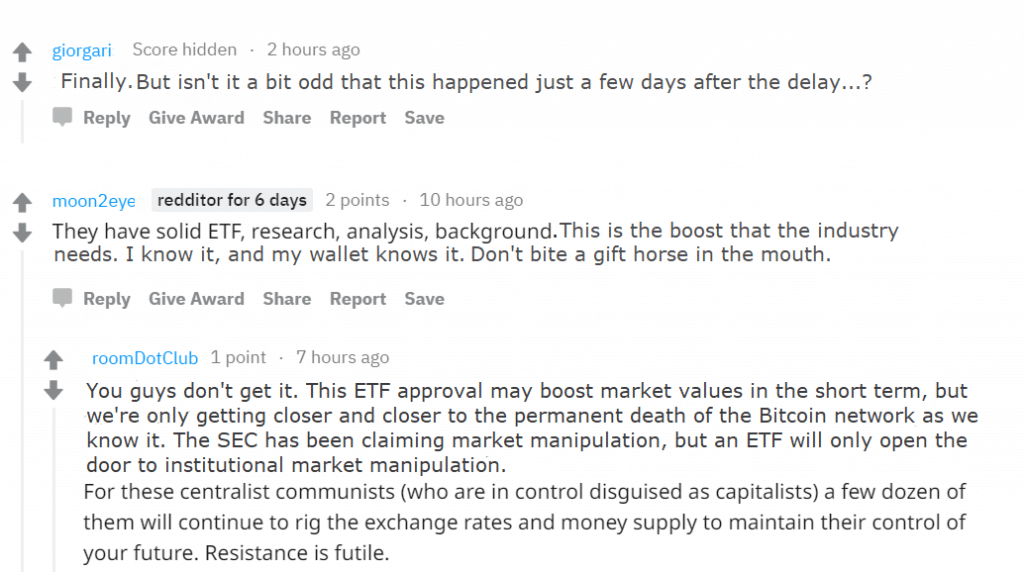

The cryptocurrency community’s response to the sudden approval has been mixed. Some believe that the launch of the ETFs is the cure to the bear market that has plagued the industry for months, while others believe that the ETFs are only the latest iteration of centralization on the Bitcoin network.

Clayton himself has remained publicly silent on the matter so far, save for four astounding words: “Happy April Fool’s Day.”

![[April Fool’s!] SEC Drops the Bomb: Approves Bitcoin ETFs](https://www.financemagnates.com/wp-content/uploads/2019/04/Bitwise-VanEck.jpg)