As we reported, the SegWit update of Bitcoin was adopted by the world's two largest exchanges, Coinbase and Bitfinex, at the end of last month.

Now that a couple of weeks have gone by, have we seen any results?

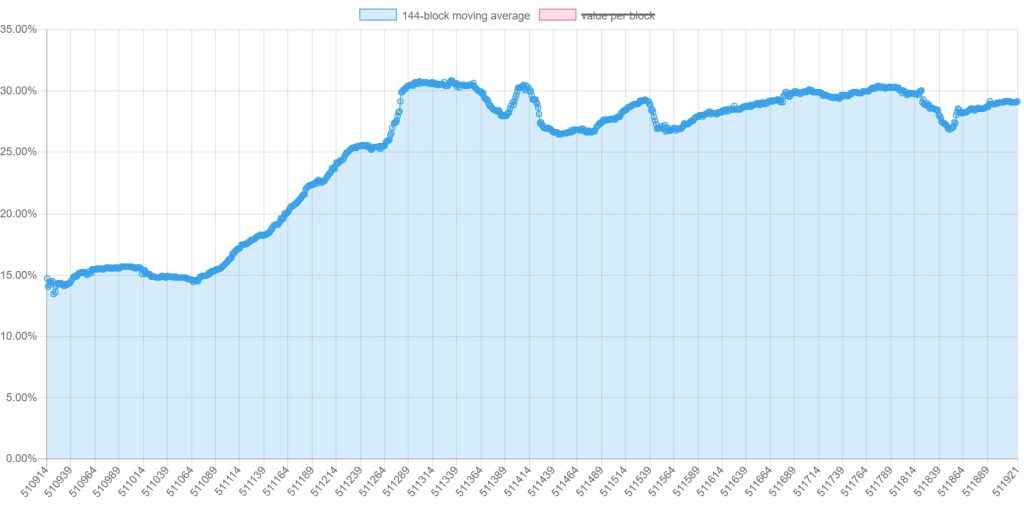

Source: SegWit.party

As you can see from the chart above, the percentage of SegWit-enabled transactions has begun to rise dramatically. It now stands at around 30 percent, and the voluntary upgrade appears to be becoming widespread for the first time since its implementation in August 2017.

Discover credible partners and premium clients at China’s leading finance event!

Binance and Kraken, another two major cryptocurrency exchanges, dramatically reduced their withdrawal fees on the 1st of March, which could be seen as a move to compete, as SegWit is expected to lower transaction fees for customers using Bitfinex and Coinbase.

Developer Nicolas Dorier told Bitcoin Magazine back in 2016: “Segregated Witness is a net win, there is not any downside to adopt it at all.”

The upgrade basically separates and re-organises the data stored with each transaction on the Bitcoin Blockchain , effectively halving their size. This means bigger blocks, which means faster transaction times, which should mean cheaper transactions too.

Interestingly, Kraken released a post in January reminding its customers that it has actually been supporting SegWit since October 2017. Several people responded by asking the exchange why its prices were still so high.

PSA: Kraken has supported segwit since October 31. Deposits are made to segwit addresses and withdrawals are sent in segwit format. Just wanted to clarify since we are still getting many requests to support segwit.

— Kraken Exchange (@krakenfx) January 6, 2018

This demonstrates that customers are becoming aware of the benefits of the upgrade, which suggests that adoption will snowball.

Another key point of the SegWit upgrade is that use of the Lightning Network is not possible without it. This is a programme developed to speed up the slow-moving and expensive Bitcoin blockchain. It works by moving mining off-grid, that is, small transactions are verified away from the chain and added in one go when there is a significant collection of them. This prevents the blockchain from being clogged up by small transactions. In theory, SegWit and the Lightning Network could make Bitcoin a day-to-day currency.

On the other hand, at least one developer thinks that the network will be hugely vulnerable to DDoS attacks, according to NewsBTC.

As for the Lightning protocol, I'm willing to predict it'll prove to be vulnerable to DoS attacks in it's current incarnation, both at the P2P and blockchain level.

While bad politics, focusing on centralized hub-and-spoke payment channels first would have been much simpler. — Peter Todd (@peterktodd) February 26, 2018