Cryptocurrency exchange software provider Ibinex recently published its Global Cryptocurrency Market Report, that presents a thorough summary of the state of the industry worldwide.

With prices and regulations endlessly shifting and more than two thousand coins to choose from, and 19 countries talking about launching their own national cryptocurrencies, it is sometimes important to get a general picture of what is going on.

1. Why is Cryptocurrency so Popular?

The report begins by explaining what cryptocurrency is exactly, and why it is popular, citing distrust of the financial system and the fact that the US dollar, the world's pre-eminent fiat currency, has lost approximately 80 percent of purchasing power over last 40 years.

In January of 2019, the market capitalisation of all cryptocurrencies reached approximately $800 billion, before falling to $417 billion in February of 2018. As of now, this figure is $219.9 billion, according to coinmarketcap.com.

The market share of Bitcoin has fallen from 94.29 percent in April 2013 to 40 percent in June 2018, but even with this drop, Bitcoin's market capitalisation is larger than 97 percent of S&P 500 companies and the money supply of countries like Columbia, South Africa, and Argentina.

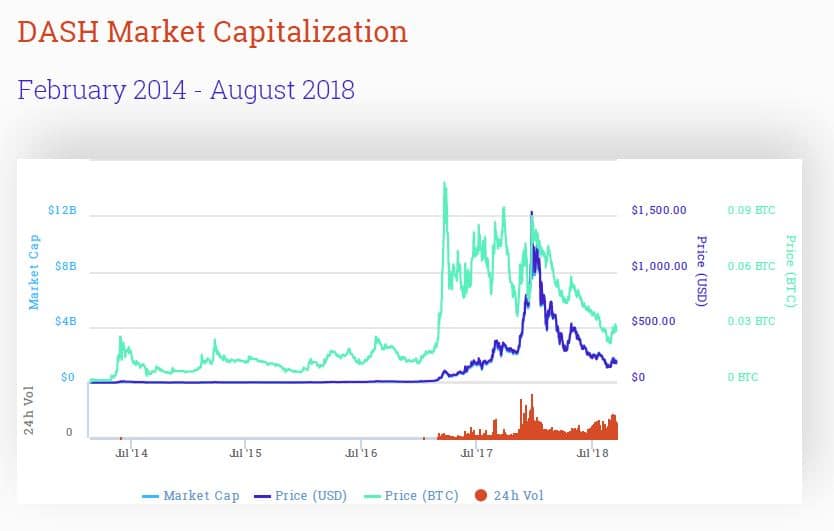

Bitcoin reached a peak of 20,000 transactions a day in December 2017. The fastest rising cryptocurrencies in this sense in the last half of 2017 were Bitcoin Cash and DASH.

Altcoins and Tokens

Altcoins are cryptocurrencies other than Bitcoin, many of which have very respectable values. The report lists the prominent altcoins and displays their financial performance:

Ethereum

Source: Ibinex

Bitcoin Cash

Source: Ibinex

Dash

Source: Ibinex

There are also tokens, which are cryptocurrencies built atop existing blockchains. These can have wider uses than just as digital currency. The report lists a few prominent tokens and displays their financial performance:

IOTA

Source: Ibinex

Veritaseum

Source: Ibinex

Ontology

Source: Ibinex

2. A Young User Population

Citing figures from bitcoinx.io, the report shows that 80 percent of Bitcoin users are below the age of 45. It also shows that 87 percent of users are male. Finance Magnates wrote an analysis of this disparity in September.

Interestingly, almost three-quarters of users are situated in North America and Europe, and only 18 percent in Asia. This could be seen as surprising, as the latter continent has been a dominant force in the cryptocurrency market.

3. Asian Tiger

According to the report, Japan is responsible for around half of all cryptocurrency trading volumes, with 3.5 million active traders. Japan has been something of a trendsetter in this industry, recognising Bitcoin as legal tender in April 2017.

But it is not the only significant Asian country. As of July 2018, 31 percent of South Koreans were involved somehow in cryptocurrency investment. This country is also responsible for 40 percent of Ethereum traffic.

Taiwan and Singapore are two emerging cryptocurrency centres. Finance Magnates reported on several cryptocurrency developments in the latter; for example, in May, a Singaporean company released Bitcoin banknotes, and in September, Chinese exchange Binance opened a new exchange which can handle both crypto and fiat currency.

Overall, the continent is a mixed bag as regards regulation. ICOs are currently banned in China and South Korea, and many other countries have restricted them in some way.

The two countries with the most developed legal framework for cryptocurrency are Thailand and Japan - both have integrated digital assets into their existing financial system. South Korea is hot on their heels with a government warming up to the whole business after initially treating it with suspicion.

The only Asian country where cryptocurrency is illegal in Vietnam.

4. Cryptocurrency in the Middle East

In the Middle East, where Islam is the predominant religion, Islamic finance law rules. A prominent legal expert ruled in April 2018 that some aspects of the cryptocurrency trade are compatible with Sharia law, and the market saw a jump as a consequence.

In Iran, cryptocurrency was banned in April 2018, but as international sanctions have had their effect, the government drafted a proposal for a national cryptocurrency. Dubai has developed its own cryptocurrency - the Dubaicoin - while Saudi Arabian banks have already signed a partnership with Ripple and will use this Blockchain -based system to transact between each other. This latter country is the world's biggest remittance market, so Ripple technology, which is designed to facilitate easy and cheap international Payments , could find its niche there.

In Israel, court rulings have prevented banks from blocking cryptocurrency transactions, but laws clarifying the industry's legal status has been postponed until October. Tax rules, however, have been set up, and the country's securities regulator recently integrated blockchain technology into its internal systems.

5. American Confusion

The USA is the world's leading economy, and as such, cryptocurrency regulation there is particularly significant. However, the federal government has still not decided exactly how to govern this industry, and different states have different rules.

Source: Ibinex

Only last week, a consortium of cryptocurrency industry representatives converged on Washington to plead to a Congressional hearing that the government give them some certainty.

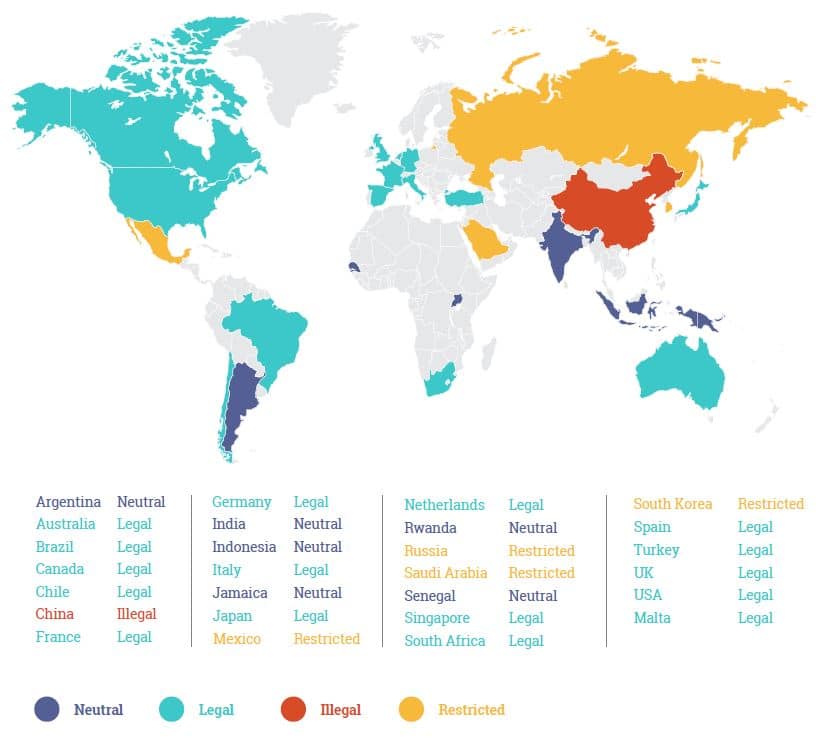

6. Global Regulation Jigsaw

Globally, the varying legal state of cryptocurrency makes a pretty patchwork:

Source: Ibinex

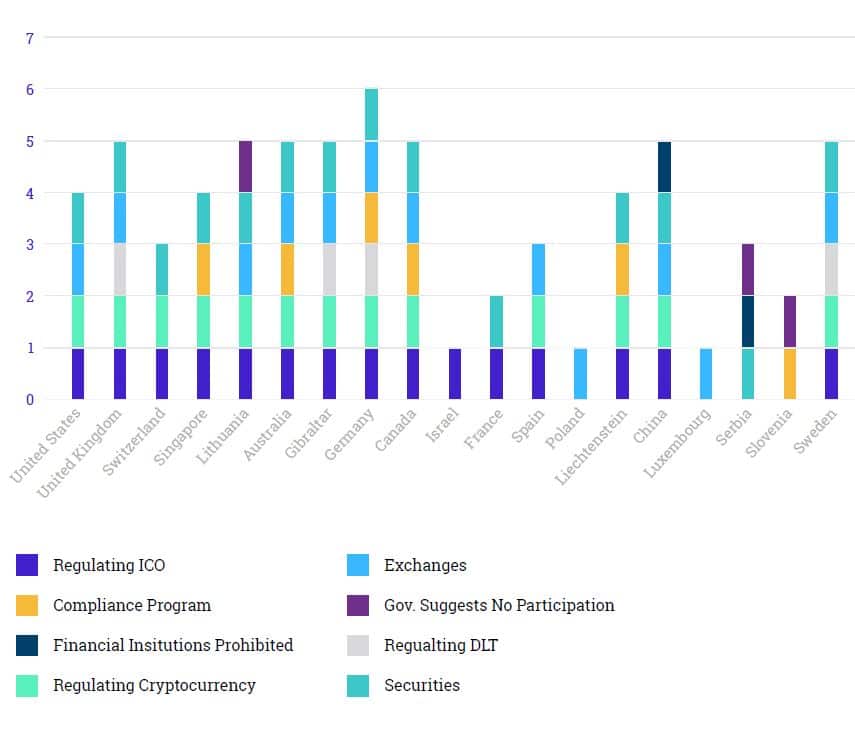

But even this doesn't paint the full picture, because there is no such thing as regulation is not binary - some countries have licensed different aspects of cryptocurrency, and usually in very different ways:

Source: Ibinex

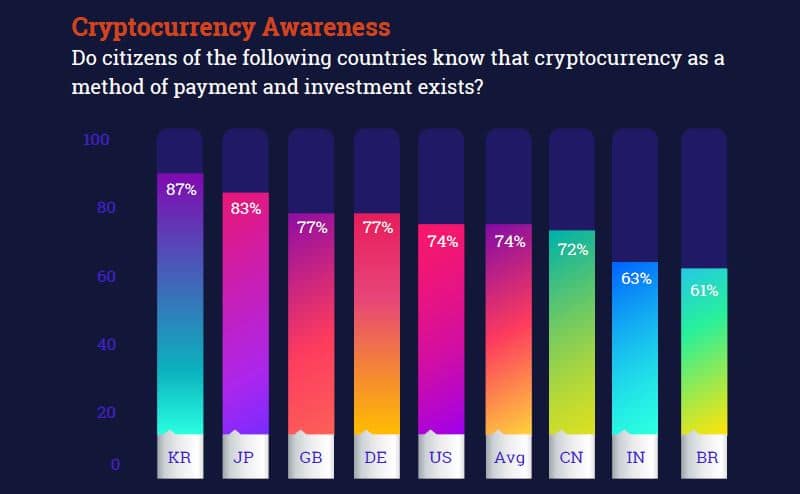

7. Cryptocurrency Awareness

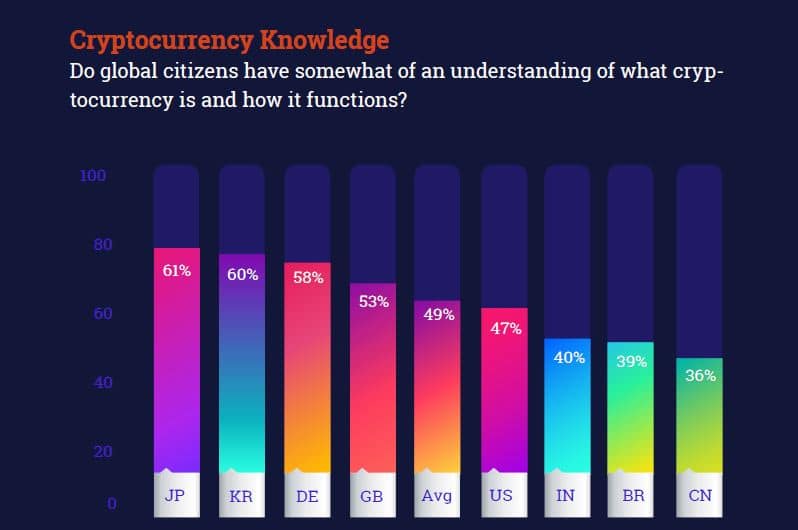

Citing Dalia Research, the report looks at cryptocurrency awareness - meaning what proportion of people are aware of the existence of cryptocurrency, and what proportion claim to have an understanding of how it works.

Source: Ibinex

As you can see, only a minority of people in the chosen selection of countries claimed to be unaware of cryptocurrency, and just under half said that they have "somewhat of an understanding" of how it works. The highest proportion of self-proclaimed crypto savvies was found in Japan.

Source: Ibinex

In the developed nations surveyed, an average of 7 percent own cryptocurrency, according to the survey. Of those that did not own any cryptocurrency, only 4 percent answered that they had such an intention.