It can be argued that the cryptocurrency industry has been around long enough that we are beginning to see the effects that varying degrees of Regulation have on the industry.

Unfortunately, the world has seen what happens when not enough regulation is applied, and in some places, we are beginning to see what happens when too much regulation is imposed on the crypto industry.

The question is, when does ‘thorough’ regulation become too much regulation? And can a healthy balance be achieved?

A Light Touch Can Have Heavy Consequences

It’s not exactly a far stretch of the imagination to imagine the kinds of things that happen when the cryptocurrency regulation is under-regulated. Actually, we don’t have to imagine at all--there are countless examples of the disastrous consequences of the lack of regulations in the crypto space.

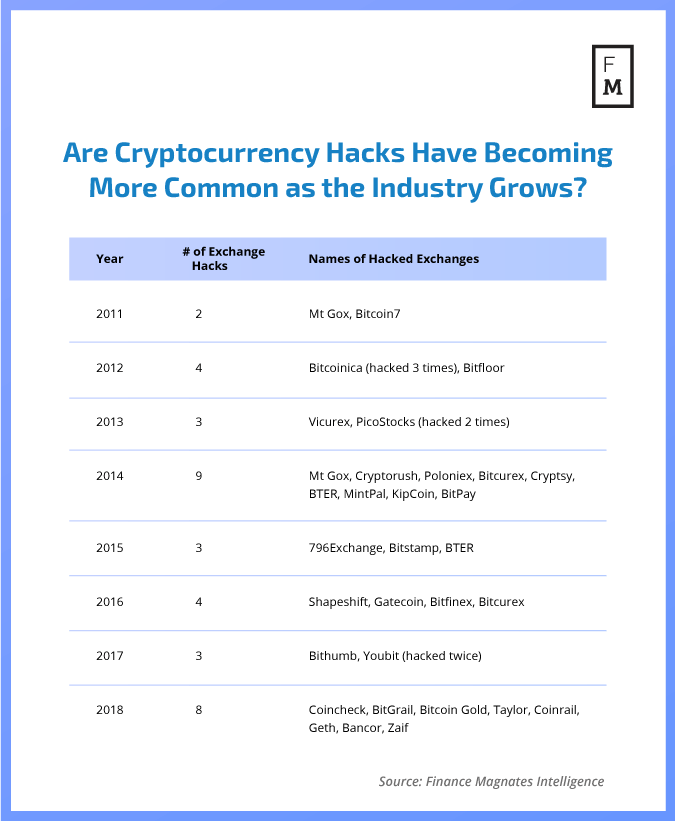

Let’s start with hacks. Of course, there aren’t always things that can be done to prevent cybercrime. Criminals work tirelessly to find their way in through the ‘back doors’ of exchanges and other cryptocurrency platforms. However, there are certain security standards that exchanges can be legally required to meet to prevent hacks from happening.

Here's how countries around the world are cracking down on Cryptocurrencies ? https://t.co/ieH7EKlNlU [THREAD ⬇️] pic.twitter.com/JD8TquSYc6

— Bloomberg Crypto (@crypto) March 21, 2018

Regulations that were put into place last year in Japan are a perfect example of this. Following the $540 million hack of Japanese cryptocurrency exchange Coincheck, the Japanese Financial Services Agency doubled down on the enforcement of security standards for exchanges, even going so far as to deny licenses to cryptocurrency exchanges who were not able to meet the requirements.

Since enforcement has increased, there have not been any major instances of security breaches of any Japanese cryptocurrency exchanges. This could just be a fluke, but it could also be a result of the improved regulatory standards.

Investors in the cryptocurrency space also must take great caution when participating in ICOs. The fact that a platform’s project may or may not be worth its salt aside, there have been more instances of exit scams and copycat frauds than we can count.

Indeed, there are plenty of other kinds of opportunities for fraud in the crypto space. Fake wallets, fake wallet seed generators, fake cryptocurrency exchanges--the list goes on and on.

A Light Regulatory Touch Brings in Capital

On the other hand, regulations that are too heavy can choke out the cryptocurrency industry and the capital and innovation that it might bring to a particular jurisdiction. For this reason, some jurisdictions may intentionally choose not to regulate the cryptocurrency industry too closely.

“Malta is a jurisdiction over in the Mediterranean that is offering licenses to cryptocurrency companies around the world…but I think it’s sort of like a tax haven,” said cryptocurrency regulation expert Patrick Burke in an interview with Finance Magnates last month.

“It’s pretty clear why they do it the way they do it,” he said. “They don’t really have that many people to protect, and they are glad to get any bit of revenue. If someone opens an office there, it’s a big deal. It opens up a new generation of technology-oriented citizens there.”

“So there’s a lot to gain from having a light touch and attracting that kind of business.”

And Malta has indeed quickly risen the ranks as one of the cryptocurrency industry’s global hubs, becoming the new headquarters of a number of major crypto companies, including Binance and OKEx.

Thus far, the country hasn’t had any major disasters in relation to its own regulatory policies on cryptocurrency. Therefore, the Maltese government hasn’t really had the opportunity to demonstrate how it would proceed in the wake of a large-scale hack.

Additionally, the country itself is so small that (as Patrick Burke said), it doesn’t have so many citizens to protect from a disaster. But what is the country’s responsibility to Europe and to the global cryptocurrency community in terms of the ways that it regulates the companies it houses?

This question remains largely unanswered. The level of globalization in the cryptocurrency industry is essentially unprecedented. But international regulatory solutions must be found - hopefully before another large-scale disaster strikes the industry.

Heavy Regulation Can Cripple Innovation

Reischer explained to Finance Magnates that “heavy regulation of the crypto industry would stymie technological development or completely derail technological development in the crypto space.”

For Reischer, a perfect example of this is India. “Cryptocurrency exchange regulations in India are extremely harsh. While technically legal, in April 2018 the Reserve Bank of India (RBI) banned banks and any regulated financial institutions from ‘dealing with or settling virtual currencies.’ The harshness of this regulation has all but stopped the development of crypto technologies in India.”

He’s correct. Just last week, Indian cryptocurrency exchange Coindelta made the decision to terminate its operations because of severe restrictions on banking services for crypto-related firms.

“It has been really difficult for us to operate Coindelta exchange for the last 6 months,” an official blog post by the exchange read. “The curb on the bank accounts by RBI has made us handicapped in order to provide seamless deposit and withdrawal services. There has not been any significant progress in the Supreme Court case which makes it difficult to predict when we will see the regulation.”

New York’s BitLicense program has also been heavily criticized for being too expensive and too logistically difficult for young companies to obtain, making it difficult for startups to establish themselves in the state.

Regulation needs to be well-written to promote growth. We need to learn from #BitLicense's many failings.

— Amber D. Scott (@OutlierCanada) February 21, 2017

Finding a Balance

While regulators can’t completely eliminate fraud from the ICO space, they can provide opportunities for legitimate ICOs to be verified and registered with a government body--this seems to be the happiest medium.

“A perfection regulatory balance would entail the 'licensing' of crypto exchanges and other crypto related entities similar to how most financial institutions worldwide are already required to register and maintain proper accounting and be responsive to regulatory oversight,” said David Reischer, Esq., Attorney & CEO of LegalAdvice.com, to Finance Magnates.

David Reischer.

Additionally, regulations should be scalable. Larger, more established companies should have a list of requirements they need to meet, and smaller, newer companies should have a set of requirements that is more attainable. “Limited regulatory oversight does not need to be burdensome or cumbersome but should be directly proportionate to the size of the financial transactions of any given financial entity,” Reischer explained.

Have any jurisdictions successfully managed to create a regulatory environment that manages to simultaneously protect users and promote growth? Reischer said that if any place has done things right, it’s Switzerland.

“Switzerland has put in place mechanisms for companies that accumulated around $1 million in third-party funds to test out their innovative financial technology ideas without the usual regulation surrounding finance and digital currency,” he told FM.

“Switzerland requires some degree of banking licenses for companies earning less than $1 million but these licenses are very expansive in scope. There has been a big uptick in innovative projects in Switzerland since 2017 when these new laws started.”

However, not even Switzerland has managed to eliminate all danger from its cryptocurrency industry. Last month, the country’s financial watchdog (FINMA) found that cryptocurrency mining firm Envion AG had ‘seriously violated’ a number of regulations and held its token sale illegally.

Swiss Watchdog Rules #Crypto Miner’s #ICO ‘Seriously Violated’ Laws https://t.co/tgzVaM7Tbq #cryptocurrency #regulation pic.twitter.com/TyGLg3yLqF

— Fintech Switzerland (@FintechCH) March 30, 2019

At this point, it’s unclear whether or not participants in Envion’s token sale will be able to recover their funds. But as serious as the situation is, it could have been so much worse two years (or even one year) ago. Many of the legal situations surrounding illegal ICOs did not offer any kind of recourse for their participants.

Is it Better to Have Too Much or Too Little?

Therefore, it can be argued that some regulation is better than none--and that erring on the side of heavier regulations is better than under-regulating. “Heavier regulation is the better balance to ensure that retail investors do not get sucked into crypto related scams,” Reischer told FM. “The crypto industry needs some regulation so as to ensure that crypto scams do not give crypto a bad reputation.”

Jonathan Bertrand.

But of course, perspective is everything. Jonathan Bertrand, President of Quebec-based crypto mining company D-Central, said that overbearing regulators have quashed the crypto mining industry within Quebec.

Due to the high demand for electricity that cryptocurrency mining requires, Bertrand explained that “a moratorium was put in place in June 2018 and it is still on at the time of writing. The consequence is that local businesses are penalized and cannot develop their activities.”

Combined with falling Bitcoin prices, Bertrand said that this “killed more than half of Quebec's mining SMEs in a matter of weeks... It has also delayed many foreign investments in the province.”

Do you believe that it’s better to err on the side of lighter or heavier regulation in the cryptocurrency industry? Leave a comment below--we’d love to hear from you.