Etherdig, an Ethereum mining pool, is collecting mining fees without processing any transactions, according to Decrypt Media. And it is not the only one doing this.

Meet 'spy mining'.

What is Spy Mining?

In order to understand what spy mining is, you must first know that blocks in a Blockchain do not all hold the same amount of information. For example, Bitcoin blocks have a data limit of one megabyte, and Bitcoin Cash blocks have a limit of 32 megabytes. Blocks do not necessarily have to hold this much data to be verified and added to the chain.

Blocks are verified when someone closes them by working out their hash, which is a code made up of all the data in that block. This code is necessary to form the next block. Mining pools work by broadcasting each new hash to all the miners that are signed up, and they all begin working on it.

It is not possible to create a hash without seeing the data in a block. What is possible, however, is to use a created hash to create a new block before transactions have been performed. If there are no transactions, there are no invalid transactions to nullify the block.

Miners receive these hashes by signing up to a mining pool, receiving a hash, but mining it for themselves. Thus, spy mining.

Selfish Mining

This is related to a practice called selfish mining.

This is when a miner finds a new block and works on finding its successor without broadcasting its existence to the network, giving him a head start. The drawback is if someone else competes for work on a competing block and it is accepted first, which means that the selfish miner has simply wasted time. To minimise this risk, the selfish miner has to have significant resources.

This is why people are scared of a 51 percent attack; if a mining pool controls the majority of computing power in the network, it could completely monopolise mining of that blockchain by mining selfishly.

25. Re selfish-mining: "you actually have a negative gamma" ... "you actually help the honest miners by attacking the network"

My bulls*** meter appears to be showing a negative value.... oh wait that was an integer overflow. — Vitalik Non-giver of Ether (@VitalikButerin) April 3, 2018

Making Profit at the Expense of Others

Mining pools have access to these significant resources, and the results of these two practices are clear.

Decrypt Media found that Etherdig has produced 1,250 blocks in the last three months, and processed exactly zero transactions. Its blocks contain only the phrase “Interim Global Authority”, and it has made 3,750 ETH ($840,750 at the current price) in mining rewards over that period.

For reference, the Ethereum blockchain processes 5,800 blocks every day, holding approximately 540,000 transactions in total.

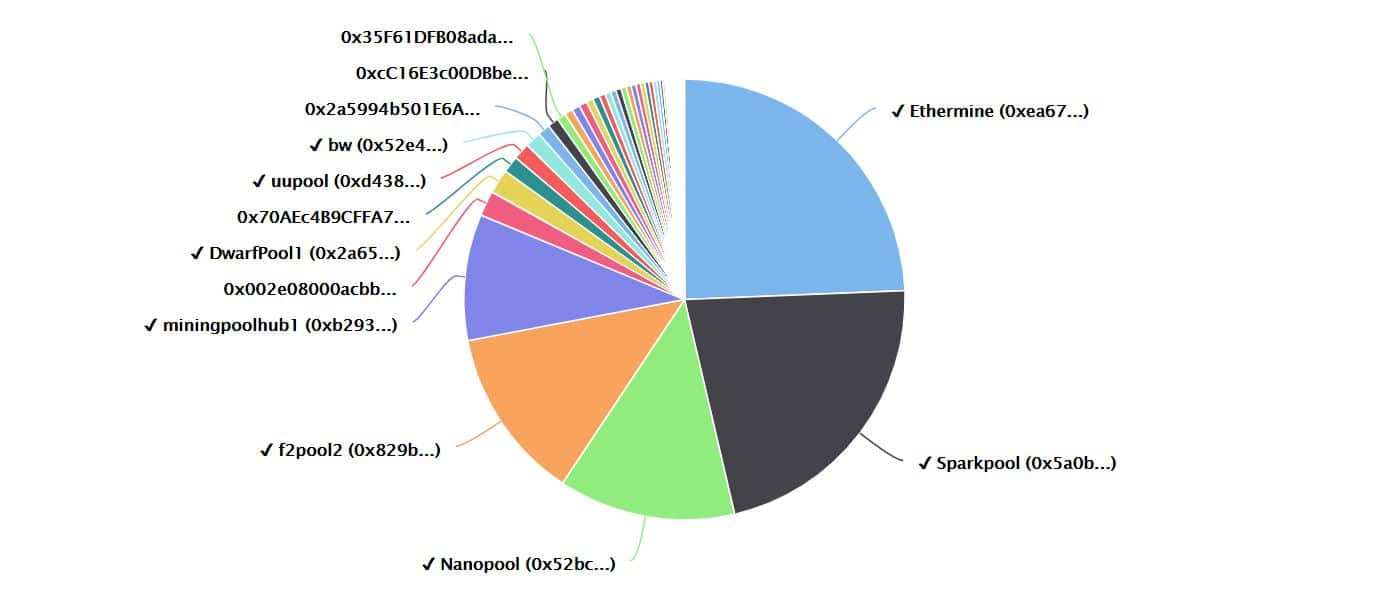

Etherdig is not the only pool engaging in this behaviour. Coinfi, a cryptocurrency market research company, found that F2Pool, the third-largest Ethereum mining pool, with 12.5 percent on the network Hash Rate , had mined 100 empty blocks in 24 hours, or 1.7 percent of all blocks on the network, as of the 2nd of October

Source: etherchain.org

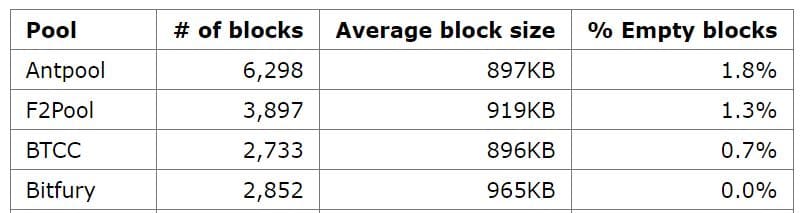

This also happens on the Bitcoin blockchain. BitMEX found in October 2017 that 1.8 percent of blocks created by Antpool - one of the world's biggest mining pools - were empty, because it permits this practice. Bitfury, in comparison, has the opposite policy and produced no empty blocks. And we can see below the result in terms of the number of blocks processed (which equals profit).

Source: BitMEX

In March 2018, Bitcoin Magazine also reported that apart from the empty blocks, Antpool was also mining blocks with significantly fewer transactions than those of other mining pools.

https://t.co/lc1qR71eIW pic.twitter.com/nalvdCuXbd

— Alex Petrov (@sysmannet) March 2, 2017

A Legitimate Activity?

Blocks mined in this way are not technically invalid, and some argue that it is a legitimate profit-maximising activity.

Others claim that empty blocks are harmful to the network because they still raise the mining difficulty, which gives power to monopolistic mining pools. It also causes miners to waste time on invalid blocks, thus reducing the transaction capacity of the network.

What is certain is that it gives entities with access to large amounts of computing power even more of an advantage than they already had.

Antpool, for example, is one of the mining pools owned by Bitmain, a Chinese company that dwarfs all other players in the cryptocurrency mining industry. Spy mining is giving it yet another advantage.

@sysmannet sorry, we will continue mining empty blocks. This is the freedom given by the Bitcoin protocol.

— Jihan Wu (@JihanWu) March 1, 2016