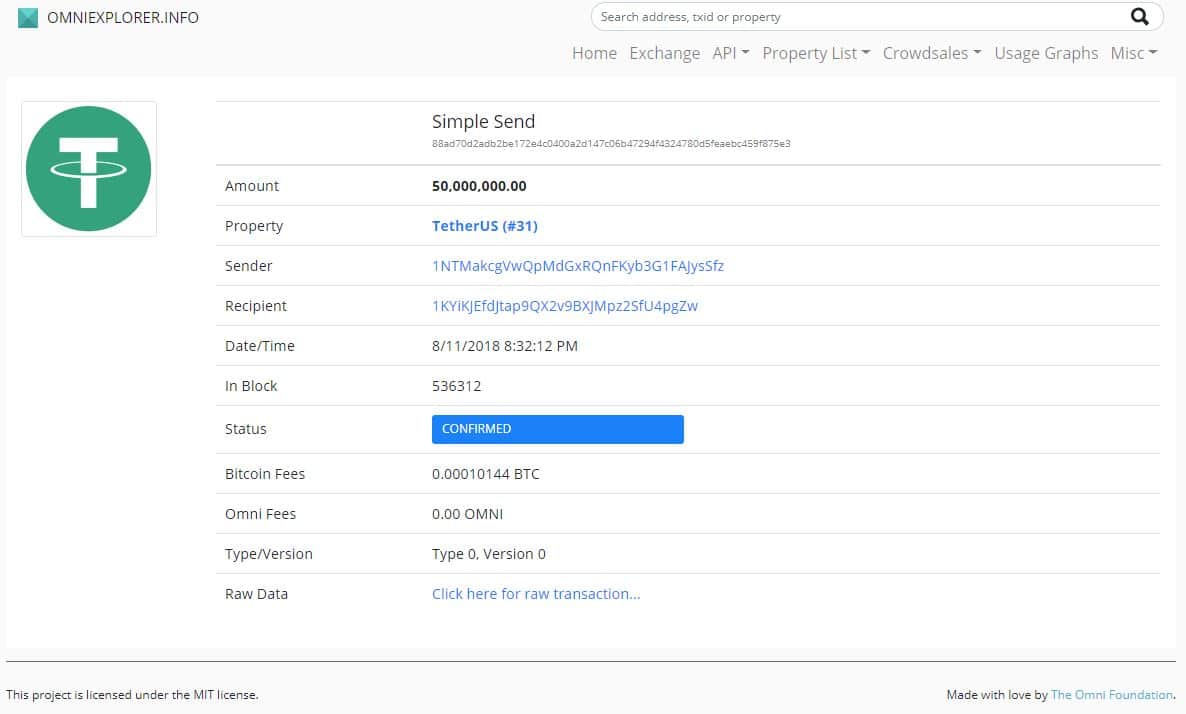

Tether has created another $50 million worth of tokens, according to OmniExplorer, which is the official record of Tether transactions.

Source: omniexplorer.info

Stable in its controversy

Tether (USDT) is what is known as a 'Stablecoin ', meaning that it purports to be pegged to the value of a fiat currency, in this case, the US dollar. According to coinmarketcap.com, one USDT is worth $1.01. There are currently 2.41 billion tokens in circulation, with a total market value of $2.43 billion.

The coins were released on the 11th of August. Looking at the charts, the price of Bitcoin jumped by $300 soon after the release:

coinmarketcap.com

The jump coincided with a sudden, brief drop of $50 million in Tether's market capitalisation. The injection follows Tether's creation of 300 million USDT at the end of March, after which the price of Bitcoin rose also.

A study by two Texas-based economists published in June 2018 claimed that the price of Bitcoin was being manipulated with Tether. They argued that periods of high activity by Tether coincides with jumps in the price of Bitcoin and that this activity tends to occur at times when the price of Bitcoin is down.

In response, Tether CEO JL van der Velde told Bloomberg: “Bitfinex nor Tether is, or has ever, engaged in any sort of market or price manipulation. Tether issuances cannot be used to prop up the price of Bitcoin or any other coin/token on Bitfinex.”

Stable in its controversy

Another interesting thing is that cryptocurrency exchange Bitfinex has lost approximately 34 percent of its trading volume over the last 24 hours. This is notable because Tether and Bitfinex are closely linked; the former is the creation of two executives of the latter, and USDT make their way into the world mainly via that exchange.

Tether is a controversial project for a number of reasons, the main one being that it has not submitted to a proper audit, despite claiming to hold what must be almost $2.5 billion.

Bloomberg reported in June 2018 that Tether's lawyer claimed that his firm had received access to two of Tether's bank accounts for two weeks and could confirm that it held enough US dollars to cover its tokens. This was not an accounting firm, however, and the bank account details were not revealed.

He added that "an audit cannot be obtained" because accounting firms would not take on cryptocurrency clients.

If that wasn't enough, Polish media sources reported in April that Bitfinex had apparently opened a bank account in Poland which was being used to launder money for cocaine smugglers, although the exchange denied the charges made by Polish Prosecutor General Zbigniew Ziobro and nothing was definitively proved. It had opened the accounts in that country in November 2017 in order to gain access to the EU market and offer euro trading.