Tether has been facing a lot of criticism due to its opaque business model. Yet, without clarifying the present issues with its currency chest, the company is releasing new tokens pegged to the US dollar and the Euro. The freshly minted tokens accumulated in two Ethereum wallets and are supposedly intended to boost the trading services on the Ethfinix platform.

Discover credible partners and premium clients at China’s leading finance event!

https://twitter.com/IamNomad/status/961425012111659008?ref_src=twsrc%5Etfw&ref_url=https%3A%2F%2Fcryptovest.com%2Fnews%2Ftethers-abandon-Bitcoin -minting-moves-to-ethereum%2F

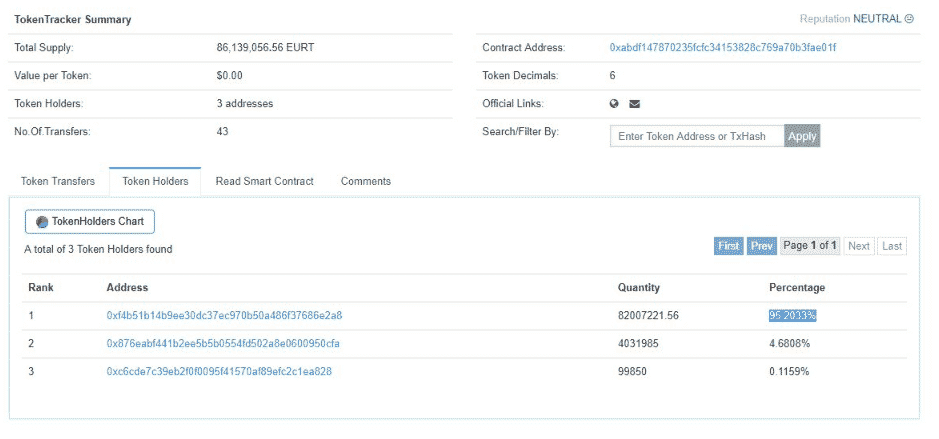

Compared to the currency supply of USDT and EURT, the number of newly issued tokens are significantly less at this stage as can be seen on the Ethereum block - around 60.1 million ETH-based USDT and 86.3 million EURT.

There is not much information available at this stage about the how many new tokens the company is planning to mint. Moreover, it is not clear how they exchange will introduce the new tokens or how they will form a trading pair. They are not even listed on coinmarketcap.com. All investors have to work off of is the firm's five-month-old promise to introduce of ERC20 Tether tokens, which are to be traded on Ethfinix.

“Tether have now collaborated with Ethfinex on the development of the first Ethereum-based Tether, compatible with the ERC20 standard. The ERC20 Tether allows for tokenized USD to be exchanged on the Ethereum network, enabling interoperability with Ethereum-based protocols and DApps whilst allowing users to transact with fiat currencies across the Ethereum Network,” an excerpt from the announcement noted.

With a bullish market, the new token might get a warm welcome from the optimistic investors, but considering trading limitations on Ethfinix, the exchange might not activate trading with the new tokens for a while.

Tether Surpasses Ethereum

Meanwhile, USDT has a significant influence on the market dynamics with more than 2.2 billion omni layer-based USDT in circulation. There is a significant demand for Tether in the market as well, as in last 24 hours, more than $3.4 billion Tether has been traded. The token is holding more than 13 percent of the present market. As per the trading volume, Tether is second only to Bitcoin, which is still leading the market with more than $8.8 billion.

After last year’s hack, Tether last month announced their intention to abandon Bitcoin Core and adopt Ethereum-based tokens. However, with all the questions floating around, Tether better put forth some disclosure about their business model rather than issuing new tokens.