Stablecoin issuer Tether has been the subject of much controversy over the last several years. Following accusations that Tether Dollars (USDT) were being printed without the reserves to back them, serious questions about the company’s integrity, and a court case with the New York Attorney General, the public seems to have a more varied (though perhaps more clear) picture of the stablecoin than it ever has before.

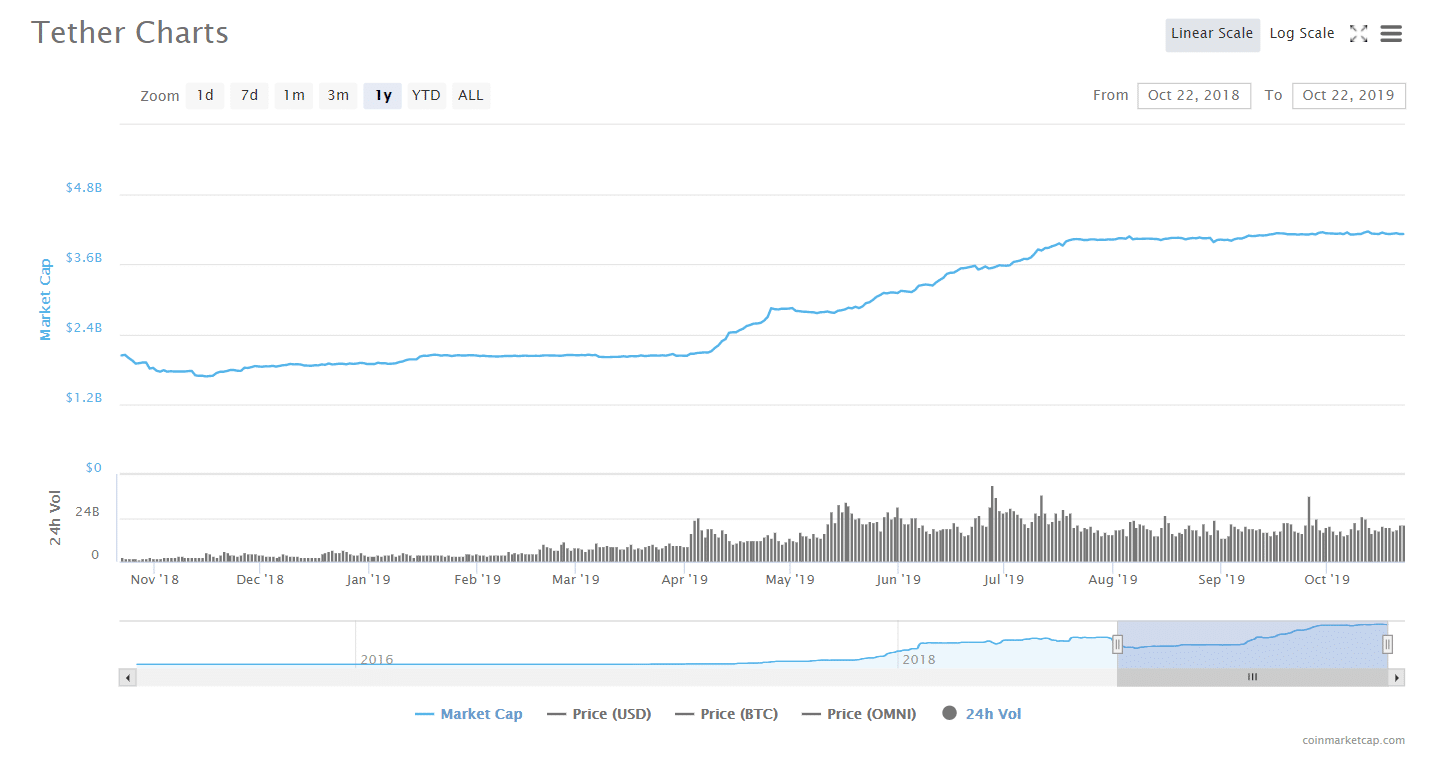

Despite the controversy, though, Tether is stronger than ever. USDT’s market cap has more than doubled since the beginning of the year.

While a wave of bullish activity in cryptocurrency markets can explain much of this, a great deal of new USDT trading volume can be traced back to a single location: China.

Why is this, and what does it mean for the industry?

The rise of USDT within Chinese cryptocurrency trading is a direct result of the cryptocurrency-related ban

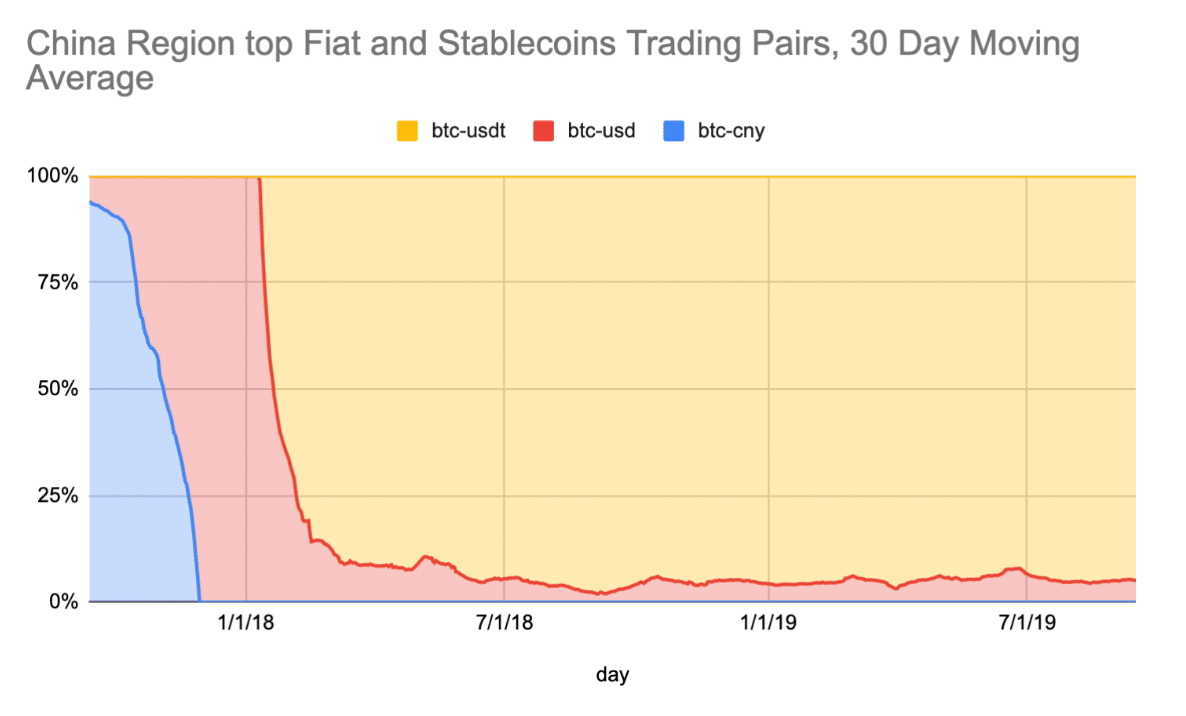

A recent report by Blockchain research firm Chainalysis found something rather interesting. While in Japan and Korea, almost 100 percent of the trades between Bitcoin and a fiat currency were compromised of trades with the corresponding fiat currency of each country--the yen in Japan and the Won in Korea--data from China painted a different picture.

Indeed, trading data gathered from exchanges that serve users in mainland China showed that nearly no one is exchanging BTC for Yuan (CNY). Instead, almost all of the trading volume from mainland China was between CNY and USDT. “In other words,” Chainalysis wrote in a report, “for Chinese exchange users, Tether has replaced the yuan as the go-to fiat currency.”

Why is USDT so popular in China when it isn’t used very much at all in similar circumstances in adjacent markets?

Chainalysis theorized that the rise of USDT within Chinese cryptocurrency trading is a direct result of the cryptocurrency-related bans that the country placed on the industry in 2017: in addition to banning Initial Coin Offerings and making domestic cryptocurrency exchanges illegal, China also blocked access to cryptocurrency trading websites. Finally--and perhaps, most relevantly, China banned its citizens from trading CNY for cryptocurrency.

And indeed, looking at how trading data has evolved over time is striking: Within the first several months of 2018, Chinese trading volume between BTC/CNY was first replaced by BTC/USD, and then by BTC/USDT.

Source: Chainalysis

CNY to BTC trades may still be taking place on OTC platforms, although data is difficult to gather

However, Chainalysis acknowledged that the data it gathered--which is publicly available information on trading volume from cryptocurrency exchanges--may not paint the whole picture.

Indeed, while cryptocurrency exchange trading data is perhaps the best metric for understanding cryptocurrency markets that is easily available, it doesn’t capture trading volume that results from over-the-counter (OTC) cryptocurrency trades--data that is notoriously difficult to collect.

In an article for CoinDesk published in August, Primitive Ventures co-founder Dovey Wan--who also occasionally acts as a liaison between crypto media in the eastern and western hemispheres--wrote that over-the-counter trading is “where most fiat to crypto volume in China has shifted to since the regulation.” In other words: while traders may no longer be allowed to trade crypto for CNY on exchanges, they still have the ability to do it on OTC platforms (out of sight, out of mind.)

From there, Wan says, the data becomes nearly impossible to track--using KYC identities purchased online, traders can “freely exchange” their newly obtained BTC or USDT, “even ones that try to block Chinese customers, by using the credentials of people from other countries.”

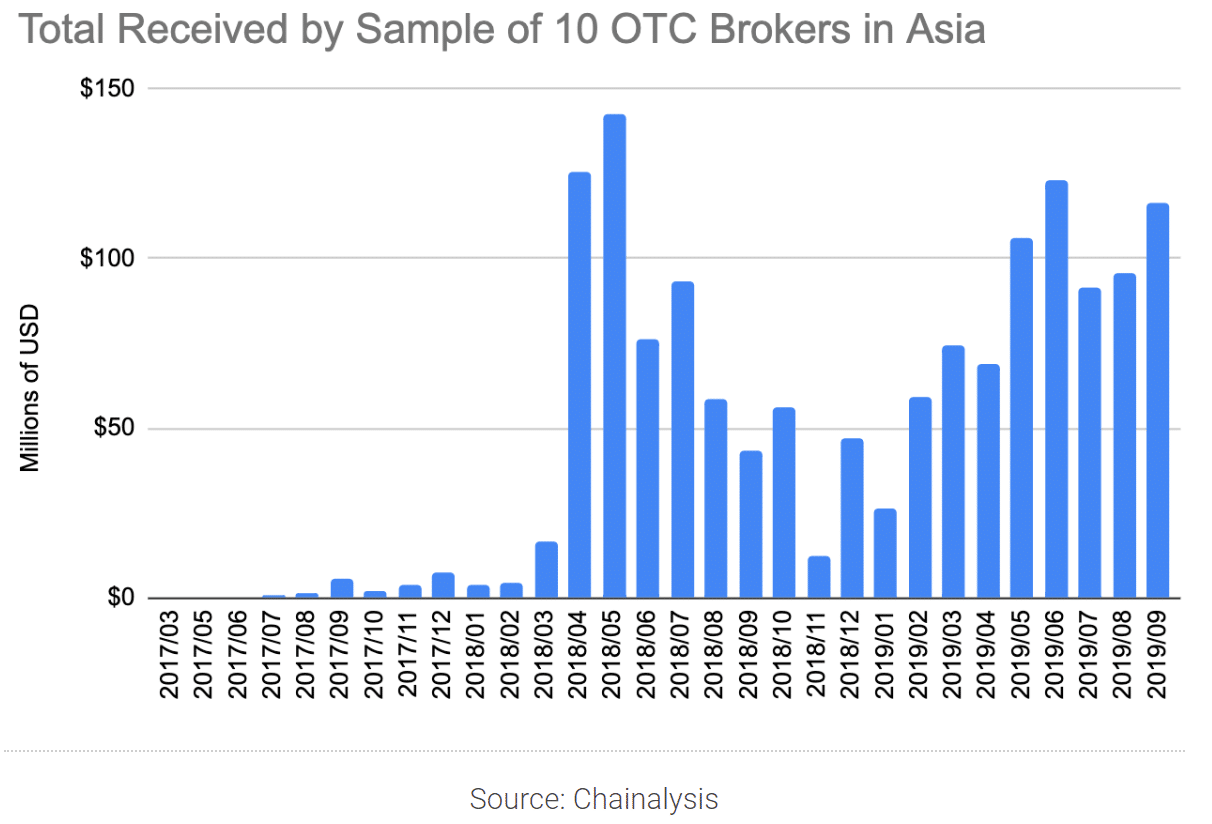

And indeed, data from Chainalysis shows a massive influx of cash onto ten OTC trading platforms that provided the firm with data.

Source: Chainalysis

Small OTC groups on WeChat may account for a significant portion of undocumented OTC trading action

Wan explained that these OTC platforms are often trading desks offered by cryptocurrency exchanges themselves (i.e., Huobi), but they can also be WeChat groups with strict sets of rules. While any of these groups may not process a high amount of trading in isolation, Wan writes that together, they “add up to a significant amount of crypto trading volume originating from China that is not accounted for by official figures.”

Perhaps aware of the fact that so much OTC trading was happening through its channels, WeChat updated its user policy in May so that cryptocurrency could no longer be used to pay merchants on the app. Dovey Wan tweeted that “this may impact local Liquidity to quite some extent.”

Urgh, Wechat just updated its payment policy .. merchant can’t serve any token issuance/fund raising or crypto trading activities, otherwise account will be terminated

Given most OTC transactions are happening in wechat, this may impact local liquidity to quite some extent pic.twitter.com/TdNIO6cggS — Dovey Wan ? ? (@DoveyWan) May 7, 2019