Various divisions of the United States federal government have been cracking down on Cryptocurrencies over the last several months. Near the end of 2017, the SEC halted one ICO and filed charges against another for failing to correctly register their coins as securities.

Discover credible partners and premium clients at China’s leading finance event!

Now, a US regulator on the state level has taken action against a cryptocurrency that has long been regarded as a 'scamcoin' by much of the crypto community.

On January 4, Texas Securities Commissioner Travis J. Iles served the UK-based BitConnect with an Emergency Cease and Desist Order. The charges? Selling unlicensed securities in the state of Texas, failing to register as a dealer or agent of securities in the state of Texas, and recruiting Affiliates who are also not properly registered as dealers or agents.

Additionally, the order points out that BitConnect makes rather outrageous promises to its investors--users are invited to participate in “programs that the company claims will deliver annualized returns of 100% or more”.

Because BitConnect is based in the UK, Texas can do little other than ban the company from dealing directly with residents of Texas; the rest of the United States will be unaffected unless states decide to take individual action.

Red Flags: Anonymity and (a Lack of) Accountability

BitConnect has drawn a lot of negative attention from the cryptocurrency community at large. The company has some rather significant similarities with textbook-case multi-level marketing and Ponzi schemes.

For one thing, there are no names or faces anywhere on the BitConnect website. This is a red flag--the operators of an above-ground operation in the crypto space should have no issue revealing their identities. A lack of personal information in this regard could be evidence of illegitimate activity.

Additionally, there is no BitConnect whitepaper explaining how any aspect of BitConnect works. That being said, there does appear to be an actual BitConnect cryptocurrency. Often, crypto MLM schemes do not really even have a blockchain or any cryptocurrency to begin with.

BitConnect Asks Holders to Lock Currency into Its Ecosystem for Months at a Time

Besides the BitConnect token (BCC) that can be traded on at least five different exchanges, BitConnect offers a 'lending program'.

In this program, users deposit their Bitcoins onto the native BitConnect platform and trade them for BitConnect’s native token, BCC. The BCC tokens are then whisked away by 'tradebots' and who have allegedly been equipped with 'volatility software' to buy low and sell high. Participants in the lending program are promised high profits in exchange for the loan.

Additionally, BitConnect recruits affiliates to recruit users into buying BitConnect tokens and lending them to the system. Every time a recruited user lends their cryptocurrency to the BitConnect, the affiliate gets a commission.

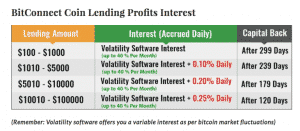

BitConnect claims that the lending program can earn you up to 40% interest in a single month, or 600% a year. The catch, of course, is that once your money is in the system, you won’t see it again for at least 120 days. Loans ranging anywhere from the equivalent of $100 to $1000 stay locked into the BitConnect ecosystem for as long as 299 days.

What’s troubling is that there is no guarantee that BitConnect will return your tokens to you at all. The lack of names and faces means that any legal recourse for such a crime would be in short supply. Of course, we can operate on good faith and hope that BitConnect will do as it says that it will--however, good faith is not enough.

The old adage is just as true in the world of cryptocurrency as it is in the rest of the world: if something sounds too good to be true, it probably is.