It seems that tokenization is “eating the world,” much in the same way that Marc Andreessen said that software was “eating the world” in 2011. ICOs and Blockchain are everywhere, and a growing number of platforms are appearing to bring off-chain assets on-chain.

However, last week, Latvian startup Digipulse announced that it would be ‘de-tokenizing’ itself in a rare industry occurrence.

We definitely hear the outrage that our recent news has brought on. We expected nothing less from a community of dedicated, crypto oriented individuals. That being said, our ultimate goal is still unchanged. Our CEO explains: https://t.co/IOSz1hLLm1 #digital #inheritance

— Digipulse (@DigiPulseIO) August 3, 2018

”We Need to Create Value”, Not “Token Price Speculation”

Normund Kvilis, the company’s CEO, explained in a blog post that the decision was made because “we need to create value with our service, rather than token price speculation.”

“For all its advantages,” the post continued, “Digipulse token value fluctuates based solely on speculation, a process that doesn’t support a sustainable business development,” adding that “out of the 320 service sign-ups we’ve had until July 25th, only two people have actually allocated tokens to the service, meaning that only two people have actually used the DGPT token for its main purpose.”

In other words, Digipulse’s crypto tokens weren’t actually being used on the platform; they were being bought and held as speculative investments.

Kvilis didn’t see a future in that kind of community. Therefore, he ended the post by making an offer to “members who have supported our vision, rather than just token speculations” - the tokens can be exchanged for a share in the company. DGPT tokens will officially be unlisted from cryptocurrency exchanges on December 15 of this year.

Is a Trend Forming?

Digipulse isn’t the first company to drop its association with blockchain, and it won’t be the last. LL Bean canceled a blockchain project in March; Telegram scrapped its public ICO in May. Stripe called it quits with its Bitcoin payment option in April.

Could a trend be forming? It may be too soon to say--the words ‘blockchain’ and ‘cryptocurrency’ still add too much value to a company’s stock price for the global crypto craze to truly be over.

So why did these companies choose to ix-nay the lockchain-bay?

Stripe Cut Crypto Because it Was Impractical, Overhyped

Some say Stripe was ahead of its time when the Payments company developed an option to accept Bitcoin payments all the way back in 2015. Therefore, Stripe was more than prepared when cryptocurrency hit the mainstream in 2017. Suddenly, Bitcoin was everywhere.

But in April of this year, something surprising happened: Stripe cut BTC from its payment options entirely. Could this be another example of Stripe’s foresight?

Speaking coolly at the Fortune Brainstorm Tech conference in July, Stripe COO Claire Hughes Johnson said that the decision was nothing more than a practical measure: Bitcoin and other blockchain payment networks are too slow, too impractical, and way overhyped.

Here’s the thing: she was right.

Using a traditional debit card issued by Visa or Mastercard, a purchase can be cleared in a matter of seconds. Using the Bitcoin network, the same transaction could take an hour, or even more; other blockchain networks aren’t much better.

“I do think we’ve reached that jump the shark moment where you just say ‘da-da-da blockchain’,” she added, referencing the explosion in companies that have tacked the word “blockchain” onto themselves to attract funding. She also said that the SEC was right to take action against these companies.

Telegram May Have Cut its Public ICO to Avoid Scrutiny from Regulators

Messaging app giant Telegram shocked the world twice earlier this year: first, when it announced the success of its massive $1.7 trillion ICO, and second when it announced that the public portion of the ICO had been canceled and that the funds collected during this period would be returned.

According to Recode, the reasons for this were simple: “Telegram doesn’t need the money, and likely doesn’t want the scrutiny,” a May report reads. In fact, Telegram’s roadmap outlined only $400 million in spending over the next three years.

Therefore, “why risk more regulatory scrutiny by opening the ICO to the public?”, the report asks. The United States SEC still has not issued a clear set of guidelines on ICO legislation - a number of ICOs have been postponed or canceled due to general legal uncertainty.

It’s still unclear when the US SEC will manage to create guidelines that would make the business of holding an ICO simple and easy. Until then, many firms may see the process as more trouble than it’s worth.

Blockchain Experimentation is “Incredibly Expensive”

In an exclusive interview with Finance Magnates conducted earlier this year, cryptoGeeks CEO Malcolm Cauchi said that “blockchain is an amazing technology”, but “not everything needs to be built on it.”

Cauchi added that foraying into the blockchain sphere can come at a heavy cost: “blockchain experimentation can be extremely expensive.” Indeed, the Financial News reported that a lead developer on a blockchain project can cost a company $650,000 per year in salary.

It’s a simple matter of supply and demand. BlockchainDevelopers.net estimates that out of the 18.5 million software developers that exist on the planet today, less than 5,000 of them are experienced blockchain developers; the cost of hiring a team of developers to build a blockchain will eventually decrease - but when?

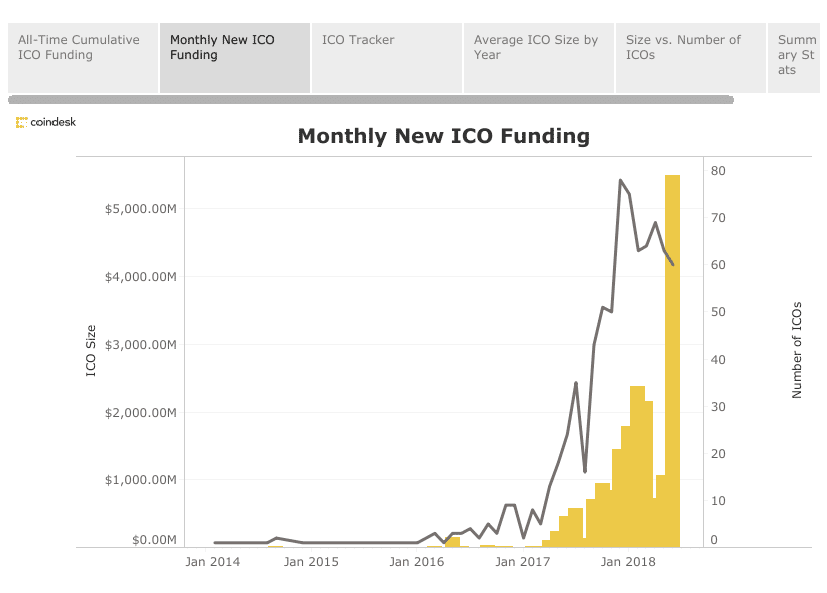

Of course, most companies who decide to build blockchain platforms assume that the funding that a blockchain will bring in will far outweigh the cost of building it. And indeed, the proof is in the pudding: ICOs continue to grow bigger and bigger. More funds had been raised through ICOs by April of this year than through all of 2017; $5.4 billion was raised in June alone.

Immutability is a Two-Edged Sword

While ‘immutable’ may not be the most common blockchain buzzword in the world, it’s definitely out there; one of those words that really does make its user sound more clever than they actually may be. (In case you’re looking to add it to your lexicon, it essentially means “unchangeable.”)

It’s true. Without an extreme amount of effort, a blockchain transaction is absolutely permanent and cannot be reversed. While this does protect users against certain kinds of false transactions (i.e., double-spending), it leaves them vulnerable to others.

Think about it: you accidentally hit the ‘submit’ button twice buying a pair of pajama pants online. You pay for two pairs of pajama pants. The seller won’t get back to you to reverse the transaction, but you can call your credit card company to cancel the duplicate transaction. Could you do this on a blockchain network? Absolutely not.

What if somebody gets ahold of your private keys? What if you permanently lose access to your hardware wallet? Sayonara!

There are some blockchain networks that have been created with a mechanism that (on some level) allow for hacked funds to be frozen and returned. However, these networks are often criticized for being too centralized.

Additionally, there are plenty of blockchain networks that have been (and are being) developed to eliminate - or at least alleviate - some of the risks associated with blockchain networks and cryptocurrencies. However, none of them has been adopted on a large enough scale to act as a practical solution.

Other trends in blockchain, like tokenization, may also not be as prolific as many believe they will be.

Blockchain May Still Have a Future, Although it May Not Resemble the Present so Closely

Not everyone is so down on the future of blockchain. In a Fortune report, Bridget Van Kralingen, SVP of Global Industries, Platforms, and Blockchain at IBM, said that blockchain has already disrupted supply chain, in addition to cross-border payments and identity verification.

Indeed, IBM seems to be very bullish on the future of blockchain. Its blockchain department boasts more than 1500 professionals; blockchain based IoT networks, stablecoins, and other products have been explored by the company.

Likewise, JPMorgan Chase, Goldman Sachs, and a growing number of other Wall Street firms have forayed into blockchain; virtually no industry has been untouched by blockchain.

And--even if financial networks in the first world find blockchain networks to be too clunky to compare with the electronic payment networks that are most widely available today, individuals in the developing world rely on cryptocurrencies to store their savings.

In any case, the blockchain industry is going through some major growing pains. Where will it be in ten years? Who knows. However, the blockchain industry of the future may be quite different from the one we know today.