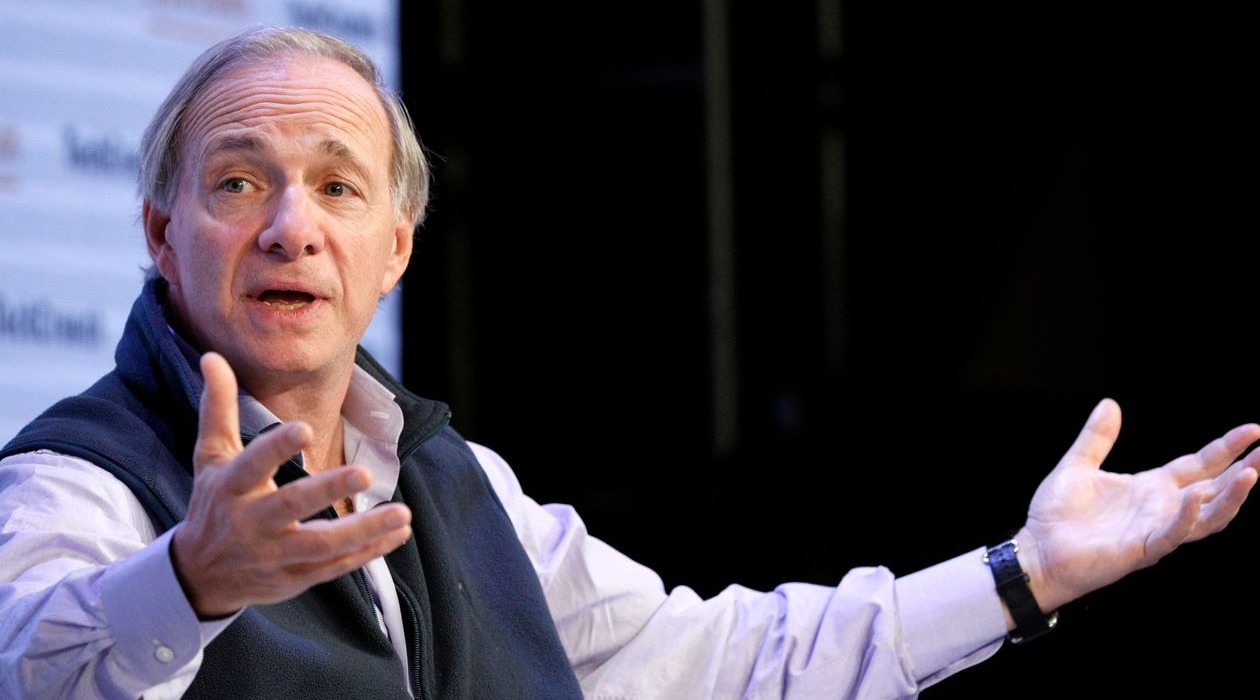

Ray Dalio, a US-based billionaire and hedge fund manager, recently commented about the price of Bitcoin and its comparison with gold. According to Dalio, there is a limitation on the price of the world’s largest cryptocurrency.

The Founder of Bridgewater Associates, one of the world’s biggest hedge funds, believes that the $1 million per Bitcoin scenario is not possible under current circumstances. He added that the total market capitalization of BTC is still far away from gold’s market value.

“The way I look at it is there’s a certain amount of it [bitcoin] and there is a certain amount of gold. I’ll use gold as a benchmark,” he explained during an interview with Lex Fridman, a leading technology researcher.

When asked about the possibility of BTC touching the price level of $1 million, Dalio said: “I don’t think that’s possible. Logically it seems to me that there’s a limitation on its price in relation to other things like it.”

Crypto Ecosystem

Dalio, who recently revealed that he is holding Ethereum and Bitcoin, talked about the monetary and crypto ecosystem in his discussion with Lex Fridman.

“When I look at it, I think we are in an environment of what is the alternative money. In my opinion, money has two purposes, a medium of exchange and a store hold of wealth. I look at Bitcoin as an alternative to gold. The total market cap of BTC is $1 trillion and the market cap of cryptocurrencies in total is $2.2 trillion. If you take the amount of money that is in gold that is not used for jewelry purposes and not used by central banks, and I assume bitcoin won’t be used for jewelry purposes or central bank purposes, that amount of gold is about $5 trillion,” Dalio explained.

In March 2021, the Founder of Bridgewater Associates called Bitcoin ‘Digital Cash’ during an interview with Andy Serwer.