Earlier this week, the Blockchain Transparency Institute (BTI) published a report alleging that wash trading in the cryptocurrency space has decreased by roughly 35 percent on the world’s 40 largest exchanges since the beginning of the year.

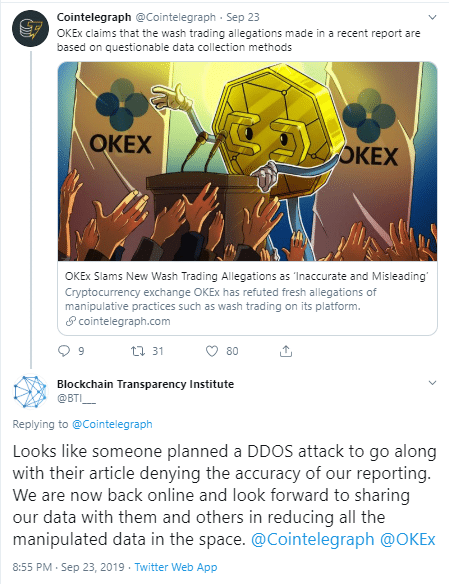

However, quite a bit of wash trading still remains within the space. Following the publishing of BTI’s report, the website began experiencing a Distributed Denial of Service attack, and has been inaccessible; it seems as though someone was not happy with the results of the report, and wants to hide it from the world.

In fact, BTI seemed to point the finger directly at news media outlet CoinTelegraph and cryptocurrency exchange OKEx, the latter of which was named as an exchange that persistently has (willingly or unwillingly) hosted wash trading.

“Sounds more like this was a timed attack to go along with the article,” BTI wrote. “We are not surprised either, but we are still open to working with the OKEx team and will be sending them over data reports shortly to beef up their surveillance systems. Many times we have found members of the upper management aren't even aware that one or some devs are allowing the wash trading to occur.”

Clearly, wash trading and false volume remain volatile and important issues. What is allowing the wash trading that remains in the space to persist? And what has been effective in reducing it?

Shedding a little light on the problem six months ago started a wave of action

The primary reason behind this decline can be traced back to a single event. In March of this year, Bitwise Asset Management published a presentation that it had delivered to the United States Securities and Exchange Commission as part of its application to create a Bitcoin-based exchange-traded fund (ETF).

In the report, Bitwise claimed (among other things) to have identified 95 percent of all trading volume in the Bitcoin market was artificially generated. For most industry participants, the claims came as a wake-up call; despite the fact that wash trading was recognized as a problem within the space, most of the industry did not recognize the extent of the problem.

The sudden wave of awareness around wash trading in cryptocurrency markets caused a wave of counter-activity: “I suspect that one of the primary reasons that wash trading has decreased in 2019 is due to the numerous organizations and reports that have put a spotlight on this form of market manipulation,” said Mitesh Shah, Founder & CEO of Omnia Markets, Inc., to Finance Magnates.

Mitesh Shah,

In addition to the Blockchain Transparency Institute’s market surveillance reports, which are published quarterly, the organization has created BTI Verified an opt-in program for exchanges to ensure that its trading volume is authentic. A number of platforms, websites, and organizations such as OpenMarketCap and Messari have sprung up to report “real” trading volume.

Additionally, the major exchanges that were named as having wash trading on them in the Bitwise report have taken their own steps to reduce the inauthentic volume on their platforms. After Huobi was identified as having wash trading on its platform, the exchange updated its policies and perhaps rethought its relationships with some of the market makers it was working with.

“We did identify a few of our market makers conducting what we suspect may have been wash trading for the sake of performance and marketing purposes,” Huobi Global CEO Livio Weng told CoinDesk through a spokesperson earlier this year. "We have already communicated with these market makers and they have discontinued the strategies in question.”

Changpeng Zhao: “It’s quite hard to fight and define this problem.”

However, Changpeng Zhao, CEO of cryptocurrency exchange Binance (which was also identified as an unwitting host for wash trading), told CryptoGlobe that although his exchange is “fight[ing wash trading] very aggressively,” the problem does not have an easy solution.

“It’s not an easy thing because it gets creative very quickly,” he said. “So, we actually have to go through a lot of very complex mechanisms to prevent it.”

Additionally, identifying exactly what constitutes wash trading and what does not is a difficult process: “if one trader buys from another trader and then sells back to that trader, from an exchange perspective, is that bad?” he asked.

“And up to what limit do you say it’s wash trading? If you define it as two accounts trading against each other for $100K and then we freeze the account, what are they going to do? They’re gonna to go to $99K, and stop. So, it’s quite hard to fight and define this problem.”

Markets have changed

Ram Krishna Rao, CEO of MarketOrders, a blockchain-based gold and jewelry industry platform, told Finance Magnates that wash trading may have decreased because, from a perpetrator’s perspective, it simply isn’t as effective as it used to be--crypto investors aren’t as susceptible to hype and quick price movements as they once were.

Ram Krishna Rao, CEO of MarketOrders.

“It’s a lot easier to wash trade small market cap tokens than large market caps,” he said. “However, with investor sentiment on a decline, these small caps have noticed it’s an illegal and temporary solution and ultimately unless there’s developer growth, the outcome of the project will dwindle and the price will move proportionally to BTC, almost all the time.”

CEO and Founder at Credits Blockchain Company Igor Chugunov said that the cryptocurrency community is much more active about informing each other of wash trading than in the past, and that reputation is more important than ever: “projects and exchanges on which fictitious trading was noticed are added to the blacklist among crypto traders,” he told Finance Magnates.

Igor Chugunov, CEO and Founder at Credits Blockchain Company.

“As a result, they lose their Liquidity and reputation. Therefore, projects and exchanges have realized that the short-term benefits of such speculation are much lower than organic growth. Reputation is a game-changer.”

Is regulation effective in stopping wash trading?

The BTI pointed out that regulation may have had some effect on the decline in wash trading, pointing to the fact that a number of the exchanges with the least amount of wash trading were based in the United States and Japan, two countries which have relatively more well-developed regulations on the financial and cryptocurrency industries.

However, the report also noted that more regulation doesn’t necessarily mean effective regulation: “stricter regulatory frameworks do not always produce the cleanest exchanges,” it said. South Korea was named specifically as an example of this.

CoinMarketCap is still part of the problem

The report also named crypto market data website CoinMarketCap as a part of the problem. The platform came under fire following the Bitwise report for not putting in enough effort to make its users aware that some of the volumes it was reporting may be false.

The platform promised to develop better methods of recording and reporting more accurate volume--or at least flagging volume that is expected to be artificial. Shortly after the Bitwise report was released, the platform tweeted that “We are listening to all our users’ feedback, and we are working hard to add a suite of new metrics so users can get a fuller picture of exchanges and crypto on the site. What are some new metrics you would like to see? Share with us. :)”s

We're working hard to build constructive solutions to address volume concerns. We look forward to more suggestions as we build out tools for our users. https://t.co/S9Z0m8ohgt

— CoinMarketCap (@CoinMarketCap) March 29, 2019

But in the time since Bitwise’ report was published, CoinMarketCap has continued to face criticism for what seems to be continual inaction.

CMC will never do anything. They are part of the problem encouraging projects to wash trade and forced into using monopoly exchanges.

— Adel de Meyer (@AdeldMeyer) September 25, 2019

One thing that CoinMarketCap did do was add a column for “adjusted volume” to its rankings, but Forbes reported that “the numbers are almost entirely the same as ‘reported volume’ provided by the exchanges themselves.”

Nic Carter, a partner at crypto investment fund Castle Island Ventures, told the publication that the platforms pithy response was “like trying to put out a fire, a blazing house fire, by pouring a small cup of water on it.” Finance Magnates reached out to CoinMarketcap for commentary but did not hear back before press time.

What is the motivation behind wash trading?

Wash trading is not unique to the cryptocurrency industry--the practice, which involves executing a high volume of artificial trades in order to drive up the perceived value of an asset--takes place in all kinds of financial marketplaces. For example, in July, the US Commodities and Futures Trading Commission fined the Illinois-based Eagle Market Makers, Inc. $350,000 for engaging in wash trading in the derivatives market.

In crypto, the motivation to participate wash trading is similar to the motivation to participate in wash trading in other markets: “the primary goal of wash trading is to artificially boost volumes either for a specific coin, token or exchange; the perceived effect of this being that the coin, token or exchange becomes more appealing for customers, traders and investors alike,” said Peter Wood, CEO of cryptocurrency trading platform CoinBurp, in an email to Finance Magnates.

However, the cryptocurrency industry seems to have been affected far more severely than other types of financial markets. This is largely due to the fact that the cryptocurrency industry is relatively far less regulated or policed than other kinds of financial markets, in addition to the fact that a high percentage of smaller cryptocurrency exchanges have not developed tools and methods necessary to properly detect wash trading and stop it from happening.

Peter Wood, CEO of cryptocurrency trading platform CoinBurp.

As such, coins with relatively smaller market caps are often targeted by scammers on these smaller exchanges. Whereas a larger exchange may have a mechanism in place to notify its operators if an individual user or a small group of users is executing a large amount of buy and sell orders on a single asset in rapid succession, such behavior on a smaller exchange may go more or less unnoticed.

When the price of the asset has been driven sky-high, and unwitting investors have been attracted accordingly, the entities that artificially pumped up the value of the asset will sell their holdings, leaving unsuspecting new buyers with a worthless asset--a classic pump-and-dump scheme.

Many smaller exchanges may even be doing some wash trading of their own, particularly in Bitcoin markets: “wash trading is used by certain exchanges, generally smaller ones, to try and attract new users as they can show an increase in trading volume from their exchange,” explained Shah in an email to Finance Magnates.

This can create a sort of vicious cycle that ultimately negatively affects users: “this leads potential traders to their exchange in the guise that other traders are also going there or are utilizing that exchange due to factors such as faster transactions or better coin prices,” Shah said. “It can also attract digital currency issuers to list on that exchange.”

Identifying wash trading

And why should it matter to users that exchanges try to pump themselves up with fake volume? It’s not just a matter of principal--Algoz CEO Nir Dovrat explained in an interview with Finance Magnates earlier this year that exchanges who appear to have high trading volumes fetch a high premium for listing new tokens.

Therefore, developers may get cheated out of millions of dollars to get their products listed on exchanges with low traffic.

Additionally, traders who may wish to execute large orders may find themselves left in the dust, with their funds locked up for days--or even weeks.

“If I’m an investor looking to invest in a crypto project…one of the most important things is that if I want to invest $1 million, I want to make sure that I can sell $1 million in the exchanges,” Dovrat said. “But if all this volume is fake–and I just bought $1 million and the real volume is $5,000 per day, now I have a huge problem.

So, if wash trading is occurring on an exchange unchecked, how can traders identify it?

Nir Dovrat, CEO of Algoz.

Shah said that there are several different methods: “one of the easiest ways to determine if an exchange is participating in wash trading is to compare the number of viewers on the exchange to the exchange’s trading volume. If there are large discrepancies, such as an extremely large trading volume per viewer, this indicates possible wash trading.”

“Another way is to compare the time it takes for an account/address to purchase and sell digital currency,” he added. “If the time is almost instantaneous, this could show the activity of a bot account which quickly buys and sells in order to increase the trading volume of an exchange – this can also be tied to a comparison of similar buy and sell orders from the same exchange as it is unusual for users of the same exchange to buy and sell the same amount of digital currencies at the same time, which is another indicator of bots.”

Finally, “several exchanges and groups have suggested potential mechanisms be put in place to prevent exchanges from participating in wash trading; although, it has yet to be seen if the smaller, unregulated exchanges will accept these suggestions and go the route of becoming a reputable exchange to compete with the larger ones.”