After months of fairly stable gains, the price of Bitcoin slipped toward oblivion last week. After news that China would be cracking down on crypto and Tesla would no longer be accepting BTC payments, the price of Bitcoin fell from around $50,000 to $32,000 on Sunday, May 23rd.

Throughout the week, BTC has slowly been gaining stability. Yesterday, BTC briefly crossed the $40,000 mark; at press time, it was hovering around $38,400. Additionally, Bitcoin’s seven-day chart is turning green: at press time, BTC’s seven-day price adjustment chart was fluctuating between +5% and -5%.

Additionally, the Bitcoin Fear and Greed Index, which tracks how likely investors are to sell (fear) or buy Bitcoin (greed) has eased away from 'extreme fear' and to simply 'fear', an indication that Bitcoin hodlers are less likely to sell their coins.

While things are looking up for Bitcoin, BTC may not be totally safe from further drops, and its next moves could determine much about where Bitcoin is headed over the next several months.

Can Bitcoin Maintain Levels above $37K This Weekend?

For example, earlier this week, crypto market analyst TraderKoz tweeted that if Bitcoin can manage to sustain levels above $37,000 over the coming weekend, its chances of regaining the $42,000 resistance level will grow. If BTC recaptures $42K, its chances of starting a new rally will also grow. On the other hand, stagnation or downward movement below the $37K support level could see BTC stuck between $30,000 and $35,000.

Part of Bitcoin’s recovery may be due to the fact that Tesla Founder, Elon Musk appeared to voice some interest in the future of Bitcoin. After Tesla ditched BTC Payments , citing environmental concerns, Musk said that his company would be exploring “other cryptocurrencies” with lower carbon footprints as possible payment options.

However, Musk tweeted on Monday that he had “Spoken with North American Bitcoin miners.”

“They committed to publish current & planned renewable usage & to ask miners WW to do so,” he wrote, adding that the meeting was “potentially promising.”

Michael Saylor, the Chief Executive of Bitcoin champion investment firm, Microstrategy, revealed that it was he who had organized and hosted the meeting between Elon and Bitcoin mining firms in North America, which included representatives of Argo, Core Scientific, Galaxy Digital, Hive Blockchain , Riot Blockchain, Hut 8 Mining, BlockCap and Marathon Digital Holdings.

“The miners have agreed to form the Bitcoin Mining Council to promote energy usage transparency & accelerate sustainability initiatives worldwide,” Saylor wrote.

The formation of the Bitcoin Mining Council could help to address concerns about Bitcoin’s energy usage that span far beyond Elon Musk and Tesla. BTC’s reputation as a weapon of carbon-heavy capitalist machinery has been brewing for years, but seemed to come to a head in 2021 as the price of BTC, and Bitcoin’s media presence, grew to unprecedented highs.

“With the Huge Moves Down in BTC and ETH, Very Little Was Spared in Alts.”

However, as Bitcoin’s price is continuing to gain a stable footing, altcoin prices are soaring.

Jeffrey Wang, Head of America's for the Amber Group.

As has become somewhat typical for the cryptosphere, the price movements of Bitcoin have been magnified across altcoin markets. When Bitcoin fell, altcoins fell even further; now that Bitcoin is regaining stability, altcoins are performing fantastically.

Why is this? Part of the reason is that altcoin markets are much shallower than BTC. Bitcoin is still the largest cryptocurrency by a long shot, Ether (ETH), the second-largest crypto, has a market cap of $318 billion. BTC’s market cap, on the other hand, is $718 billion, more than double that of Ethereum.

Even the largest altcoins have considerably smaller market caps, making them even more vulnerable to significant price volatility. Jeffrey Wang, Head of America's for the Amber Group, told Finance Magnates that: “With the huge moves down in BTC and ETH, very little was spared in alts.”

“The risk sentiment was too negative for anything to not get dragged down which is common in large washouts like we saw. We saw large trades where people liquidated large and small caps to go into stablecoins,” he said.

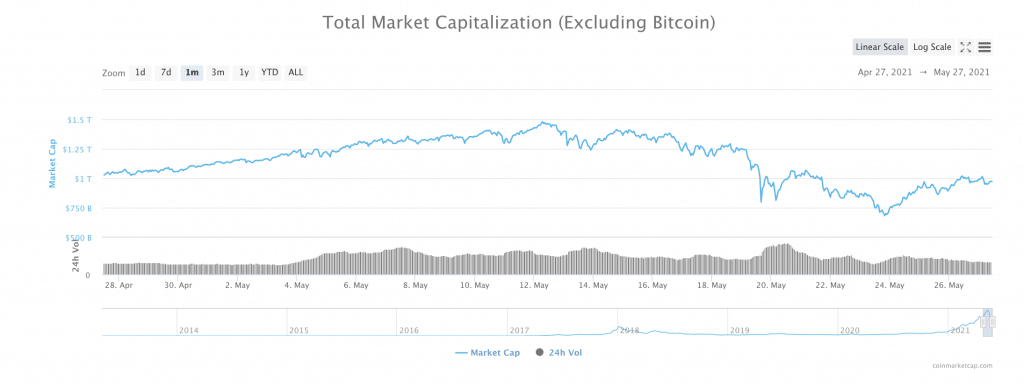

The rollercoaster performance of altcoin prices over the last week is easily visible in the chart tracking the total altcoin market cap. On Wednesday, May 12th, several days before news of China’s crackdown on crypto broke, the altcoin market cap was tracking at nearly $1.5 trillion. When markets bottomed out on Sunday, May 23rd, the total altcoin market cap had dropped to $680 billion, which is a loss of roughly 54 percent.

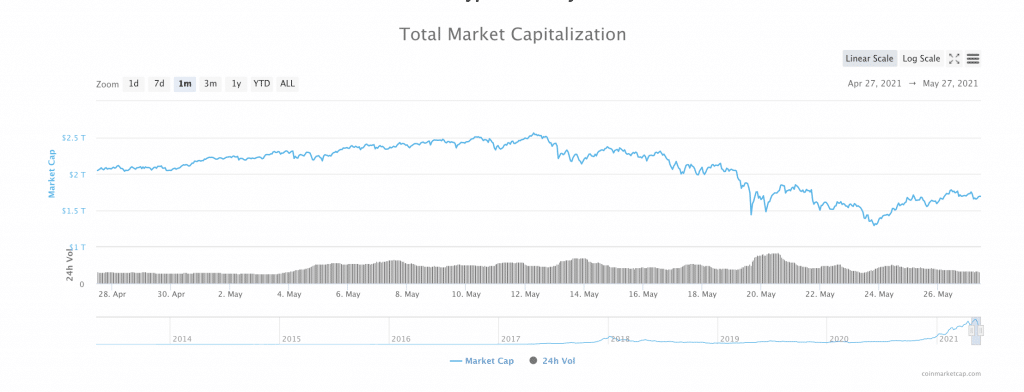

When you add BTC into the mix, the losses are still significant, but not quite as severe. Before the news of China’s crypto crackdown, the total market cap of all cryptocurrencies was roughly $2.5 trillion. At the bottom on May 23rd, that figure fell to $1.3 billion, capping the loss at approximately 48 percent. On its own, Bitcoin’s market cap fell from $57K to $32.7K, which is a loss of 42 percent.

“A Lot of Froth Was Taken Out of the Market on This Move.”

Now that markets are recovering, altcoins have surpassed Bitcoin in the other direction. From the bottom on Sunday, May 23rd, until press time, the total altcoin market cap is up from $680 billion to $975 billion, which is an increase of roughly 43 percent.

By the same turn, the total marketcap of all cryptocurrencies (including Bitcoin) is up from $1.3 trillion at the bottom to $1.7 trillion at press time, which is an increase of roughly 30 percent. Bitcoin on its own is up from $32.7K to $39K, which is an increase of just 20 percent.

Just like Bitcoin, altcoin prices are still vulnerable to negative news, Jeffrey Wang told Finance Magnates that: "The market has steadied for now but given a string of negative headlines for the space market is still very exposed to more negative news that will weigh on prices."

Additionally, while altcoins may be performing better than Bitcoin, the recent market crash may have weeded some projects out of the crop. Jeffrey Wang explained that: “the market now will be much more discerning.”

“Good projects with strong token fundamentals can still succeed, whereas, in early 2021, there was just a rush to buy everything without too much thought,” he said. “A lot of froth was taken out of the market on this move down but many large investors who are used to volatility are keen to buy certain tokens at a discount to precious valuations.”

Are “Healthy” Corrections Good for BTC and Crypto Markets?

Still, if last week’s events proved anything, it was that Bitcoin is still vulnerable to serious volatility, even with the depth that BTC markets have achieved over the past 18 months. However, some analysts believe that the correction was a necessary and healthy event for Bitcoin’s long-term trajectory.

Sagi Bakshi, Chief Executive of cryptocurrency exchange Coinmama, told Finance Magnates that: "Volatility both up and down is an integral part of the Bitcoin market.”

Sagi Bakshi, CEO of Coinmama.

“During sharp dips, the supply of coins tends to shift from weak hands to long-term hodlers. For example, of the 18.7 million bitcoins mined to date during May, about one million bitcoins were sold at prices ranging from $35K-30K. Those same coins were likely purchased much higher, at between $55,000-$60,000, which suggests that new buyers had trouble stomaching their first sharp correction.”

“At the same time, bitcoiners weren’t afraid to follow their beliefs and buy the latest dip,” Bakshi explained. “The fundamentals haven’t changed, on the contrary, the conditions today are better than ever. These coins are now with those of us that buy into the vision and execution of Bitcoin, and are less likely to be sold in a panic.”

Long-Term Trajectories

And the more times that Bitcoin is battle-tested, the more that it could see meaningful adoption. Monica Eaton-Cardone, the Co-Founder and COO of Chargebacks 911, told Finance Magnates that: “To a large degree, the future value of cryptocurrency will depend on its adoption rate. If cryptocurrency becomes pretty much interchangeable with traditional currencies, its value will almost certainly skyrocket. But, if countries like China successfully stop and stigmatize crypto, the currency will plummet in value.”

“The future of crypto is either as a niche curiosity of limited utility or as an internationally ubiquitous, mainstream alternative to traditional money. It's unclear which scenario is more likely, which is why it's such a compelling, high-risk investment right now: There's a chance you could lose your shirt, but there's also a chance you could make a fortune,” she said.

Monica Eaton-Cardone, Co-Founder & COO of Chargebacks 911.

“As long as governments mismanage financial policy and hamstring investors with onerous regulations, there'll be a demand for cryptocurrency. It's the incompetencies and inefficiencies of governments that drove investors to crypto in the first place! Well, it's highly unlikely that the politicians of 2021 and 2022 will suddenly be wiser, smarter or more competent than the politicians of the past. So, no matter what happens in the short-term, crypto won't be going away. The demand is just too great, because our politicians are just too incompetent.”