Cryptocurrency markets took an unexpected turn for the better last week with an unexpected surge in prices across the board.

Over the course of just a few hours on April 2, the price of Bitcoin leaped up from roughly $4110 to $4800; from there, it has continued to climb to its current price of approximately $5260. Over the same period, Litecoin has also gained about 50 percent of its value; Bitcoin Cash has increased by roughly 80 percent since the 1st of the month.

All in all, the cryptocurrency market as a whole has seen an increase from around $144 billion to over $181 billion. Bitcoin dominance has remained more or less the same since the beginning of the month, suggesting that investors are bullish on the market as a whole rather than just BTC.

So, what gives? Why--after months of downward pressure on crypto prices--are Cryptocurrencies recovering now? And what does this mean for the future?

The Big Trade that Started it All

A number of theories have emerged as to why cryptocurrency prices initially surged--some of them rather far-fetched. However, Gabriel Dusil, Co-Founder and General Manager at Blockchain technology incubator Adel, told Finance Magnates that there are some very logical reasons that Bitcoin is doing so well at the moment.

Gabriel Dusil.

“BTC spiked over 5k due to trading activity,” Dusil said, adding that “someone bought $100 million worth of BTC through several exchanges (Coinbase, Kraken and Bitstamp).”

Indeed, BCB Group’s Oliver von Landsberg-Sadie was quoted by Reuters on April 2, speaking on this mammoth order: “there has been a single order that has been algorithmically-managed across these three venues, of around 20,000 BTC. If you look at the volumes on each of those three exchanges – there were in-concert, synchronized, units of volume of around 7,000 BTC in an hour.”

Von Landsberg-Sadie also said that the trade was likely executed by an “automated software set” (an algorithmic trading bot.)

What may have caused this buyer to suddenly pump $100 million into BTC? Of course, it’s impossible to know the truth. However, Dusil believes that one catalyst may have been the revelations published in a presentation that Bitwise Asset Management made to the SEC. The presentation claimed that 95 percent of trading volume in the Bitcoin market is fake and that as such, BTC’s average daily trading volume is just $272 million.

With this revelation, “we are set back to 2017 volumes,” Dusil said. “This could be a reason why fresh capital is going into crypto”--investors may see a much more significant opportunity for growth in BTC than before.

A ‘Halving’ Rally

Another factor that may have caused Bitcoin’s upward movement has to do with the mining rewards ‘halving’ that will take place in May of 2020. “BTC rewards are soon halving,” Dusil explained. “The closer we get to May 2020, the more it will be discussed and spark interest to buy BTC and try to accumulate it for the future, when BTC will be harder to mine and, as with any scarce product, the price blooms.”

‘Halving’ literally means that mining rewards for Bitcoin holders will be cut in half. This has occurred twice so far in Bitcoin’s history - once in 2012 and once in 2016.

Bitcoin's price rally leading up to the 'halvening' in November 2012.

Indeed, a CoinDesk report entitled “Bitcoin’s Next Halving Rally: Coming Soon in 2019” that was published in December of last year explained that “historically, the halving starts getting priced in approximately one year before it happens, which would result in bitcoin bottoming out in early 2019 followed by a rally starting in May 2019.”

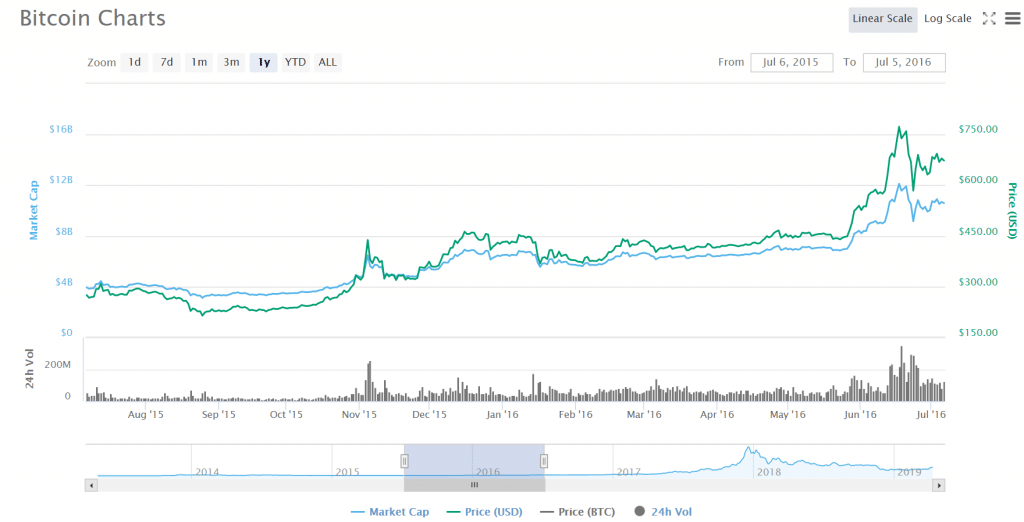

Bitcoin's price rally leading up to the 'halvening' in July 2016.

The report points out that in the year-long period preceding the other two ‘halvenings,’ price rallies drove the price of Bitcoin to unprecedented heights.

Speculation, Speculation

Dusil said that the third reason is simply hype. Because Bitcoin and other cryptocurrencies have made positive movement lately, speculators believe that they may be able to cash in on the bullish wave.

However, it’s still too soon to tell how long any meaningful new capital will stay in the space. The Bitcoin market is very different than it was in late 2017 when the last massive bull run happened. Practically no one had even heard of Bitcoin in those days; the upward spiral that closed out the year was primarily fueled by ignorance and blind optimism.

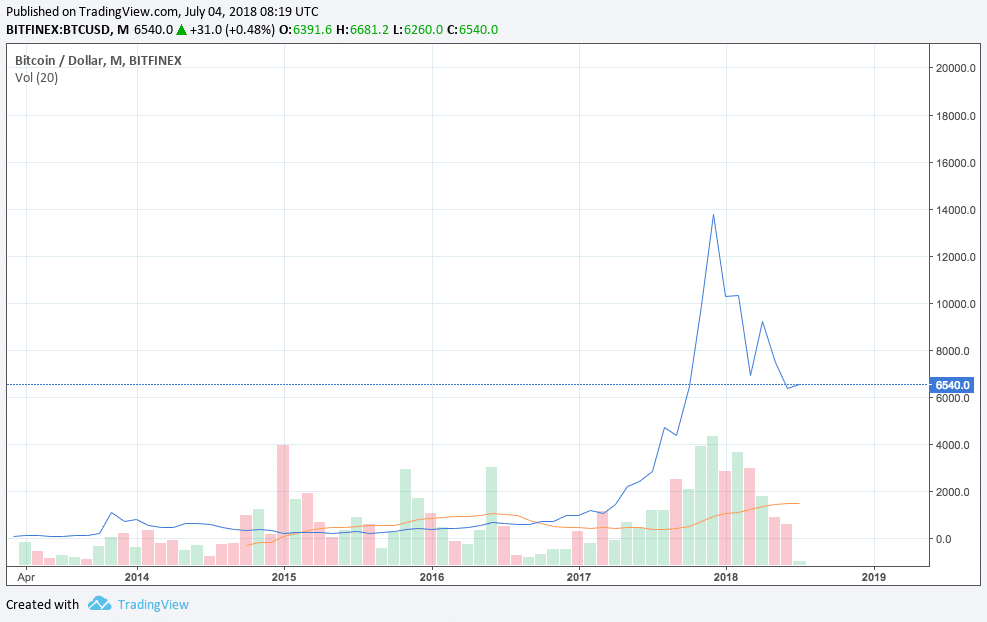

Bitcoin's price rally at the end of 2017 shocked the world.

Now, people have wised up. After seeing the spectacular market crash that took place at the beginning of 2018, most of the world is much more skeptical about pouring their cash into Bitcoin.

On the flip side, however, Bitcoin’s base-line price may have been made more stable by the influx of institutional capital and a new group of long-term ‘hodlers’ into the market. The risk that Bitcoin could go to ‘zero’ has been lessened by the industry that has been built around the asset.

Institutional Capital Could Be Part of the Upward Movement

The role of institutional capital in the Bitcoin market may also have seriously contributed to the recent rally. On April 5th, eToro analyst Mati Greenspan tweeted that “the CME bitcoin futures traded about $563 million yesterday.@MessariCrypto reports that the top 10 exchanges traded about $685 million.”

A report by Chepicap explained that “effectively this means that the CME alone cites a massive 82% of the trading volume of the top 10 crypto exchanges combine.”

The CME bitcoin futures traded about $563 million yesterday.@MessariCrypto reports that the top 10 exchanges traded about $685 million.

Even though Wall Street's contracts are only paper, and not settled in bitcoin, they are still a significant part of this market now. pic.twitter.com/5iUZlymdfe — Mati Greenspan (@MatiGreenspan) April 5, 2019

Therefore, although Greenspan acknowledged that “Wall Street's contracts are only paper, and not settled in bitcoin,” Wall Street still acts as an important influencing force for BTC: “they are still a significant part of this market now.”

Is China Back in the BTC Market?

According to a report by NewsBTC, another factor that may be driving up the price of Bitcoin and the crypto markets as a whole is the re-rentry of Chinese investors into the market.

“Don’t ask us how, but locals are ‘FOMOing’ in so hard that they’re skirting local regulations to get their hands on BTC,” the report said.

According to a tweet by local industry insider CnLedger, one of the in-roads that Chinese buyers may be using to get their hands on BTC is OTC (over the counter) trading venues.

1/ Chinese markets reveal strong buys. OTC (Over-The-Counter) trades, the almost only way to buy bitcoin with fiat in China, showing considerable $ premium (1 USDT = 7 CNY) over the official rate of 1 USD = 6.7 CNY. pic.twitter.com/bd0n0DGFVU

— cnLedger (@cnLedger) April 8, 2019

For example, both Huobi and OkEX are registering Yuan-to-Tether (USDT) trades at a rate of 7.0, a premium of 4.4 percent over the market rate of 6.7. At the same one, Yuan-pegged stablecoin bitCNY has seen 10-fold increases in its average daily trading volume since February.

Analyst and trader Light Crypto has also reported an increased demand for cryptocurrencies.

/1 We are witnessing a resurgence in Chinese demand for cryptocurrencies. This trend in the making comes after more than a year of relative quiet, a reminder of the time when Chinese volumes were king. pic.twitter.com/5ZOjD4dxbM

— Light (@LightCrypto) April 8, 2019

Effects of the Bull Run

Bitcoin’s bull run hasn’t only filled the wallets of hodlers. Several days after Bitcoin’s initial spike, Bloomberg reported that crypto stocks have also gotten a big boost.

According to the report, “crypto-linked stocks in Asia also extended gains, led by Remixpoint Inc. in Japan with a jump of as much as 16 percent during the day Thursday. It’s up 26 percent so far this week. Vidente Co. has climbed almost 20 percent since the weekend, while Omintel Inc. is on a 6.3 percent advance.”

The rally has also been felt in US stocks--Riot Blockchain Inc. saw a 24-percent boost last week, while DPW Holdings Inc. and Marathon Patent Group Inc. (two smaller crypto firms) saw gains of their own.

Usually, an increase in the price of Bitcoin is echoed in the price of other altcoins. But as the crypto ecosystem continues to grow outside of coin market caps, boosts in the price of Bitcoin are increasingly having a positive effect on these external entities--a sign of the times if there ever was one.

What Does This All Mean?

But is the rally here to stay? And do the price increases we've seen so far mean anything in the bigger picture?

For Dusil, the answer is 'not exactly.'

"This spike doesn't mean we are in a bullish trend, we need to look at longterm picture and that shows we are in a correction," he said. "Price can as easily drop down as it can go up. Those who were buying in 2/2 of 2017 are still in loss. We need to see prices at 8k area to say we are in recovery and a bullish trend has [truly] been established."

But still, the Bitcoin market isn't far from reaching some serious milestones. "If we break through 6k, it means bears are losing their power and bulls are entering."

However, investors must be wary of the speculation that this might bring. "This also means all who bought BTC at 3.2k will get a nice 100% return on their investment, which can spark debates in public areas, and we all know what can happen when people start saying they made 100% in just few months."

If the rally continues, legendary prices could eventually become a reality. "If we break 8k, we can say the bullish sentiment is back and we are on our way to all-time high. At the 12k area, we could see the start of FOMO (fear of missing out) that could bring new speculators in, and with fresh capital in crypto, we could see the prices surpassing the 2017 heights," Dusil explained.

But until then--don't hold your breath, kids.