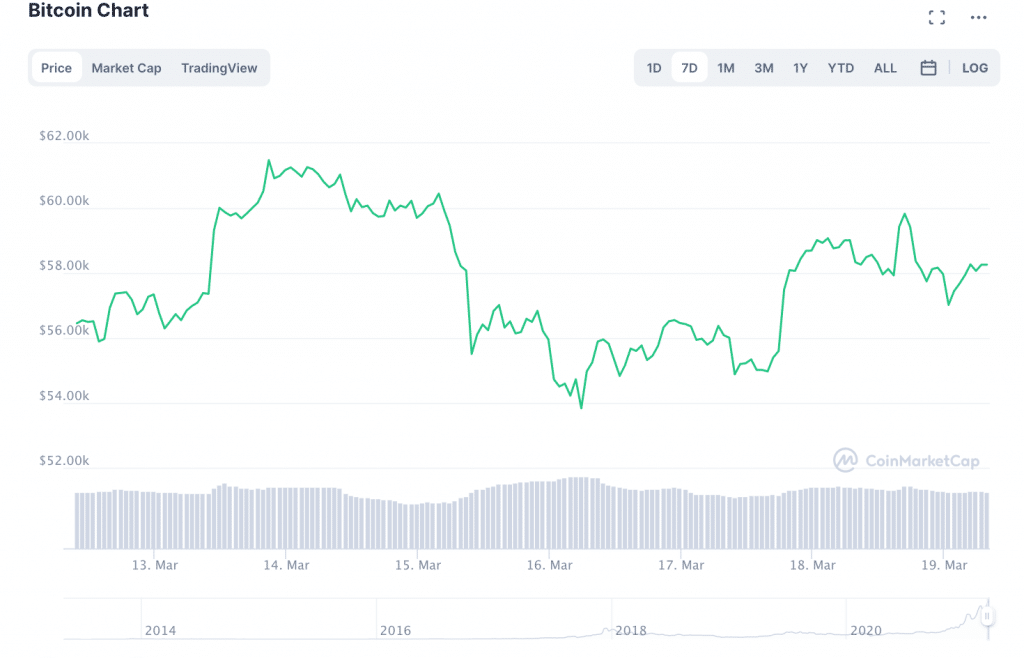

Bitcoin (BTC) reached another new all-time high last Saturday, March 13th, with its passage over $61,680. However, BTC was unable to maintain levels over $60K for the rest of the week. It slid briefly below $54K on Tuesday and has since recovered to nearly $58K at press time.

Treasury Yield Rates Are Rising, Interest Rates to Stay Low

A number of analysts attribute the short spike above $60K to the passage of the so-called 'American Rescue Plan' on March 10th. The bill included plans to distribute roughly $1.9 trillion in stimulus payments across the United States economy. Officials at the US Federal Reserve have expressed that they expect to keep interest rates close to zero until at least 2024. Both factors have caused concern that USD inflation is in the relatively near future.

According to Coindesk, concerns about inflation were ignited by a marked increase in the 10-year Treasury note yield. The figure surpassed 1.75% for the first time since January 2020, two months before the pandemic began. While higher yields on long-term U.S. Treasuries can signal an increase in investor confidence, they can also be a signal of concern over rising inflation.

Capital markets across the board seem to reflect such concerns. As the 10-year Treasury note yield hit its highest point in over a year, Bitcoin was not the only asset to lose steam.

The Financial Times reported yesterday that: “the tech-heavy Nasdaq Composite closed the day 3 per cent lower, its worst day in four weeks.” Bloomberg reported that as “stocks fell from record highs,” the price of oil “slumped” by 8 percent.

Additionally, Treasury bonds that mature in 30 years also showed signs of change on Thursday. Their yield rose to its highest level since January 2020 with an increase of 0.05 percentage points to a total of 2.47 per cent.

Following a meeting of the Federal Open Market Committee on Wednesday, Federal Reserve Chair Jerome Powell said that he believes that there is no need to push back against rising treasury yields.

“The stance of monetary policy [that] we have today we believe is appropriate,” Powell said. “We think our asset purchases in their current form, which is to say across the curve, $80 billion in Treasuries and $40 billion in mortgage-backed securities on net. We think that’s the right place for our asset purchases.”

Bitcoin as a "Hedge against Inflation"

Still, Powell’s words do not seem to have assuaged concerns over the rising tide of possible inflation.

While Bitcoin did spike past $60K last week, the expectations of what the American Rescue Act stimulus would do to the price of BTC appear to have fallen somewhat flat. After all, Bitcoin is increasingly described as a “hedge against inflation,” shouldn’t it be doing better than ever?

According to CoinDesk, Bitcoin is at the crux of two opposing forces.

On the one hand, there are investors that believe that Bitcoin is a vehicle of capital preservation in the face of USD inflation. On the other hand, there are investors who still view BTC as a risk-on investment. Because yields on Treasury bonds have been higher in recent weeks, some analysts believe that investors may be more likely to choose them over riskier assets, like Bitcoin.

“The Stimulus Bill ‘Drugged’ the Crypto Market.”

Still, a number of analysts believe that it is only a matter of time before the stimulus cash starts to make its way into Bitcoin, particularly if the world’s central banks continue to pump markets with stimulus cash.

Giacomo Arcaro, a renowned 'growth hacker', investor, and crypto entrepreneur, told Finance Magnates that “the stimulus bill ‘drugged’ the crypto market.”

Giacomo Arcaro, Growth Hacker, Investor & Crypto Entrepreneur.

“There was a spike, but it was momentary: it shortened the path to $60K, and I forecast that we'll arrive at $60K again very soon, and steadily,” Arcaro explained.

Arcaro is a firm believer in Bitcoin as a hedge against inflation. “we are speaking about $1.9 trillion,” he said. He believes that: “it's obvious that it has to be some kind of inflation, and when there is inflation, the only way not to lose money is to invest in gold or in ‘Crypto Gold,’ and this means Bitcoin or Ethereum .”

Aaron Rafferty, CEO of decentralized finance fund RF Capital, told Finance Magnates that the stimulus "has had a powerful effect on Bitcoin and crypto markets as a whole but it is not this large one-off event that some people are expecting."

"People are receiving their checks in staggered releases across various banks. The result of this that we are seeing is smaller pumps, such as the one on March 17th, where Bitcoin and various assets pumped 10% on the daily as 90 million Americans received their stimulus."

"The price of a $1200 stimulus check received on April 15, 2020, would now be worth $10,400 as of March 17, 2021, if it was invested in bitcoin. Given this, envision these gains to continue to push the market forward moving into summer as more people look to invest their checks in more speculative assets. However, it won’t be the overnight sensation that people are thinking."

"The Explosiveness of Institutional Interest in This Space Right Now Is Unprecedented."

Indeed, Bitcoin’s journey forward in the short-term could see a few more ups and downs before it sees meaningful momentum over $60K.

Matt Blom, Head of Sales and Trading for the cryptocurrency exchange firm, EQUOS, told CoinDesk that: “$57,400 remains our pivotal spot.”

Aaron Rafferty, CEO of decentralized finance fund RF Capital

“Should Bitcoin remain above this level, then the bulls will feel happy exploring and pushing prices to the upside, with $60,780 the target,” he wrote. However, failure to climb past this point could lead Bitcoin to as low as $53,360.

All things considered, $53K may not be such a bad thing, after all, $53K was Bitcoin’s all-time high less than one month ago. Additionally, some analysts believe that institutional buying of Bitcoin is about to hit an inflection point.

"The explosiveness of institutional interest in this space right now is unprecedented,” wrote market analyst and investor, Joseph Young on Twitter. Young was referencing news originally reported by Asiae in South Korea that was published on Naver News on Friday, March 19th, that Morgan Stanley is rumoured to be bidding for Bithumb. Bithumb is South Korea's largest crypto and bitcoin exchange, valued at roughly $2 billion.

"Strong-Handed" Investors Have Been Buying BTC from "Weak-Handed" Sellers

Additionally, Bitcoin analyst Willy Woo wrote on Twitter that since March 2020, there has been a “steep and continued” supply shock of Bitcoin “in sync [with] USD money printing” since March of 2020.

According to Woo, this is evidenced by an increase in “speculative inventory on exchanges.” Indeed, the amount of which has been depleted fairly consistently over the past 12 months. In other words, the amount of BTC being kept in exchange accounts has been relatively low, an indication that BTC hodlers are not planning on selling their coins anytime soon.

Woo also believes that as the amount of Bitcoin that is being held on exchanges has steadily lessened, the amount of Bitcoin “held by speculative ‘weak hands’” has depleted. In other words, investors who are more likely to sell their Bitcoin have, indeed, sold it. However, the “strong hand” investors who have bought the Bitcoin are much less likely to sell it in the future.

Woo believes that “what's happening is US institutions and high net-worth individuals (HNWI) are scooping up the available coins from weak hands and locking it up as strong HODLers in response to monetary inflation,” he said. He pointed to the “Coinbase BTC supply dropping off a cliff” as evidence of US institutional buying activity.

“This is insanely bullish of course,” he wrote. “Strong hands have been buying every dip which has been driving the price steeply upwards since Q4 2020.”

An Important Year Ahead

Some analysts agree that as Bitcoin has continued to grow, it is playing an increasingly important role on a global scale.

@DocumentingBTC, a Twitter account that posts important historical events in the lifecycle of Bitcoin, posted a tweet comparing two Reuters headlines with the caption “#Bitcoin has entered the geopolitical stage.”

The first two headlines in question “India to propose cryptocurrency ban, penalising miners, traders;” the other, “Pakistani province plans to build pilot cryptocurrency mining farms.”

Whether or not India’s upcoming set of cryptocurrency regulations will be enough to constitute a 'ban' remains to be seen. However, the tweet seemed to imply as though a new geopolitical divide could be forming between nations that embrace Bitcoin and the cryptocurrency economy, and those that do not.

Of course, digital currencies will likely play an important role in the future of the global economy, even if they only manifest as state-issued central bank digital currencies (CBDCs).

Indeed, in the United States, Powell has declared the exploration of a so-called 'digital dollar' as a 'high priority project'. Speaking before the House Financial Services Committee on February 24, Powell said that 2021 will be “an important year” in the creation of a U.S. central bank digital currency. Stay tuned.