With nuclear threats in Iran, the possibility of sanctions being placed on Turkey, and possibly major changes in US immigration, perhaps you may have thought that Cryptocurrencies would have been the last thing on President Donald Trump’s mind last week, but you would have been wrong.

On Thursday, July 11, President Trump let loose a string of Tweets that were heard ‘round the cryptosphere. In them, he asserted that cryptocurrencies were “not money,” that they were created out of “thin air,” and that if “Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations, just like other Banks, both National and International (sic).”

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity....

— Donald J. Trump (@realDonaldTrump) July 12, 2019

Many regulators around the world agree with the fact that Libra must seek some kind of certification and receive special permissions from governments if it wants to operate an international cryptocurrency.

However, Trump’s initial comments on crypto could be an indication that the American government is still largely uninformed about cryptocurrency and the possible implications that it may have for the future of the American economy, as well as the potential benefits that integrating cryptocurrency into the American monetary system could have for the future of the government.

The tweets also highlighted an ongoing trend among lawmakers and politicians who seem to be growing more staunch in their anti-Libra positions. Most recently, Treasury Secretary Steve Mnuchin called Libra "a national security issue,” adding that “we will not allow digital asset service providers to operate in the shadows.”

Interestingly, most of the policymakers that have come out against cryptocurrency and Libra have not been sitting on Trump's side of the aisle--the loudest critics of the projects, including Congresswoman Maxine Waters of California and Senator Sherrod Brown of Ohio, have been Democrats; a number of 2020 presidential hopefuls have also said their piece on crypto.

As for those that haven't--the silence is deafening.

Indeed, a time when the American government is more polarized than it has been in decades, cryptocurrency is one issue that isn't split clearly down party lines; the situation is either too complex or the lack of understanding too deep.

So, let's take a look at where the candidates stand. But before then, let's examine the legitimacy of the president's claims on crypto.

What is “money,” anyway?

Let’s start at the beginning of Trump’s tweets. “I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air,” he began. “Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity.”

It continues, but let’s stop there for a moment. Trump has already established that cryptocurrencies are “not money,” although what he probably meant was that they are not money that has been issued by a sovereign state--in other words, fiat currency. The word “money” is defined as “a current medium of exchange in the form of coins and banknotes; coins and banknotes collectively.”

Cryptocoins may not be physical in nature, but they are “coins” nonetheless, just as much as the dollars and cents which move digitally through the world’s banks are also technically still money, although there is no physical cash to back them up. In fact, it’s estimated that less than ten percent of the world’s money exists in physical form. But anyway.

Onto the next claim--that cryptocurrencies are based on “thin air.” What are state-issued currencies based on? It’s certainly no longer based on vaults of precious metals, as it once was. Indeed, there is no pound-for-pound physical backing of the USD--or most of the world’s other sovereign currencies--at all anymore.

The things that give value to the USD are not physical at all: supply and demand, certainly; but more than that, simple trust in the US government. Trust that if the country liquidated itself and paid off its debts, the combined value of everything would equal what the government says that it does.

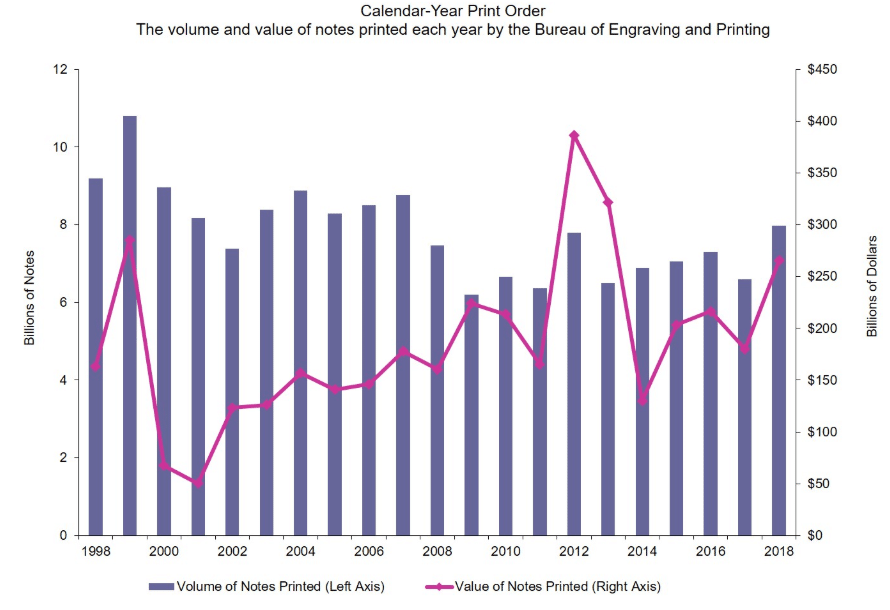

Perhaps the best demonstration of the power that this trust gives the US government is the fact that the federal treasury has added trillions of dollars into the national economy over the last ten years.

Calendar-Year Print Order: Volume and Value. Source: FederalReserve.gov.

Indeed, “usually when the term printing money is used, it is referring to one of two processes for increasing money supply. In one process, the Fed buys financial assets (don’t worry too much about what these are, just think of them as large chunks of money not in physical form) from commercial banks,” reads an article by American Bullion, Inc.

“The money the Fed uses to buy these financial assets is created out of nowhere; it is not existing money that the Fed possesses,” the article explains. ‘This gives commercial banks more money to lend to their customers, which pumps new money into the monetary supply. This is also referred to as quantitative easing (QE).”

The other method of money creation isn’t any more concrete: “the Fed simply extends a loan to a commercial bank, again using money that comes out of thin air.”

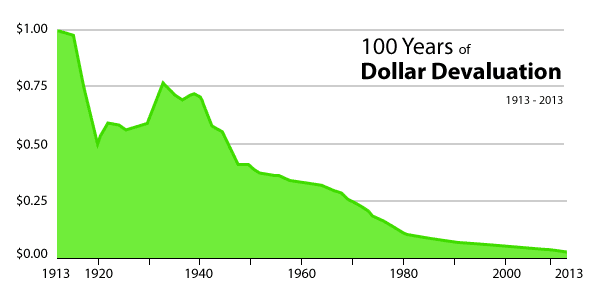

Source: Wikimedia Commons.

As the banks pay off these loans--as they theoretically should--the “extra” currency that the US government issued should disappear. However, if the government is issuing loans and creating new money at a higher rate than it can be paid back (or destroyed, really), inflation occurs.

And is inflation occurring? Well, since the Federal Reserve took over the US banking system in 1913, the dollar has lost over 96% of its value; in other words, today's dollar would be worth less than 4 cents back in 1913.

Source: Comparegoldandsilverprices.com.

The race to the bottom

And while the US government could theoretically “burn” some of these dollars to decrease the supply of these dollars (and thereby increase the demand), there is an incentive to continue to devalue the US dollar.

Currency wars, also known as competitive devaluations, occur when a country continues to try and decrease the value of its currency in order to compete with export prices from other countries.

As this happens, imports into the country become increasingly expensive; in theory, this benefits the domestic industry and boosts domestic employment.

However, as import prices continue to increase, the citizens’ corresponding decline purchasing power can ultimately hurt the economy. Additionally, if all countries adopt a similar strategy, a race to the bottom ensues, which hurts everyone.

Why are cryptocurrencies any different?

Bitcoin, and other cryptocurrencies, however, have a value that is fully determined by usage. The more people that buy into and use the network, the more that Bitcoin is worth; the less that it is used, the less it is worth.

There is a fixed supply--one can’t simply create more Bitcoins in order to give a boost to the cryptocurrency economy.

Of course, this is not to say that Bitcoin and other cryptocurrencies are not subject to their own problems, including market manipulation. This is a rather simple explanation--but it’s quite possible that the features of a cryptocurrency-based economy could eliminate some of the inflation issues that the US government has faced over the last 100 years.

But what is the likelihood of cryptocurrencies ever being adopted or created by the US government? If you go by Trump’s words, not very high--but the simple fact that Trump raised the issue in such a public way could have made the future of cryptocurrencies an issue in the 2020 election, which could, in turn, result in a larger ongoing political discussion about the future of crypto.

After all, Facebook’s Libra project has already caused quite a stir in the world’s regulatory circles. The US Senate is planning on holding a hearing on the project this week; France led the formation of a G7 task force dedicated to the project and to cryptocurrency regulations more generally.

The candidates’ views on crypto

And even before Libra and before Trump’s tweets, some of the United States presidential candidates had already started their own conversations on crypto.

The most crypto-focused candidate so far has been Andrew Yang, an American tech-entrepreneur turned presidential candidate who announced that he would be accepting campaign donations in the form of certain cryptocurrencies when his presidential bid was launched last year. In an interview with Finance Magnates last year, Yang also spoke about the formation of Digital Social Credits, a community-based cryptocurrency system in which individuals would be rewarded with digital coins for service to their communities.

Other candidates have been less vocal about cryptocurrencies, but not totally absent from the discussion. Democratic frontrunner Joe Biden has not spoken publicly about cryptocurrencies, but the Super PAC that was formed in 2016 to convince him to run has accepted donations in the form of Bitcoin.

Former Governor of Colorado John Hickenlooper, one of the lesser-known candidates in the race, created a 15-member Council for the Advancement of Blockchain Technology Use in May 2018 during his time in the governor’s office.

Senator Elizabeth Warren has had some mixed things to say about cryptocurrency in the past, although she appears to be better-informed than many of the other candidates on the issue. She has previously publicly stated that cryptocurrencies are easy to steal, and has expressed concerns over loose regulations that do not protect customers. However, her sentiments have not been entirely negative-- in October of 2018, she said that “the challenge is how to nurture the productive aspects of crypto with protecting consumers.”

Of course, the real test will come with time--whether or not crypto will remain a part of the national political conversation in the US remains to be seen. However, the ongoing regulatory hoopla--and Trump’s comment on the project, as well as other cryptocurrencies--could be a good indication that this conversation is far from over.