The price of Bitcoin is dropping below $13,000 in Europe this early morning as Asian traders are running for the exits. Over the past 24 hours, BTC dropped over 23 percent and is now over 33 percent lower than the top marked at the beginning of the week.

For an asset that asserts to be a store of value, this is worrying, to say the least. But there might be a good reason behind the latest drop in prices. Transaction costs surpassed $33 this week and there is no good explanation for that except... it's almost Christmas!

With the growing popularity of bitcoin, you might have thought that it's a good idea to share some wealth with your loved ones. After all, this is why Bitcoin was invented, to give control of the financial system back to the people. Since not everyone has access to Bitcoin or knows about it, you might have taken the initiative and decided to share the goodies with your family, friends, and partners.

Transaction Costs Hurting the Network

Jokes aside, the slump in Bitcoin prices has completely irradiated the rest of the cryptocurrency world. Ripple was the last holdout as it briefly surpassed Bitcoin Cash’s market cap until minutes ago when it turned into the red, aligning with the broad market trend.

Christmas or not, the number of unconfirmed transactions on the Bitcoin network now stands above 285,000. The figure stabilized somewhat after surpassing the 280,000 mark, but there is no telling how far this figure can go if panic selling ensues (or if you prefer, continues).

The figure has been way higher in the past, however, the average price per transaction at the time wasn't remotely close to $33.

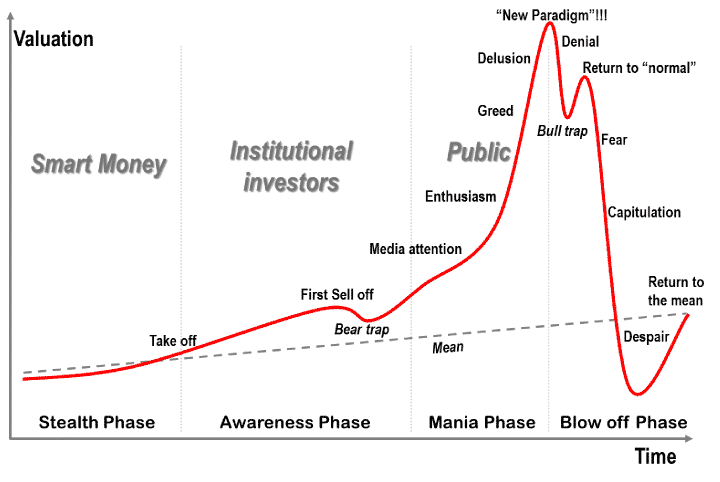

On that note, I don’t know what panic selling is in terms of Cryptocurrencies . Most of the people I know that are trading are excited that this is a big buying opportunity, and they might be right. But this is not how financial bubbles work, typically... and I know... here is where some of you will say "this is not a bubble."

The low print on Bitstamp is $12,560, but prices have rebounded to above $13,700 as of writing. In any case, the chart is starting to look more and more like the worrying one we outlined at the beginning of the week:

Classic Bubble Price Action, Source: Dr. Jean-Paul Rodrigue Dept. of Global Studies and Geography Hofstra University

The news that Goldman Sachs is mulling the opening of a cryptocurrency trading desk might have spooked investors. (As it probably should.)