With the world on the brink of one of the worst economic crises in history, no corner of the financial world has been left untouched. While most financial markets have been caught in weeks of doom and gloom, there are a few markets and asset classes that have managed to squeak by--or even grow--as a result of the crisis.

One of these asset classes is stablecoins: which, for those of you who don't know, are Blockchain -based crypto tokens that are collateralized to another asset, usually a fiat currency.

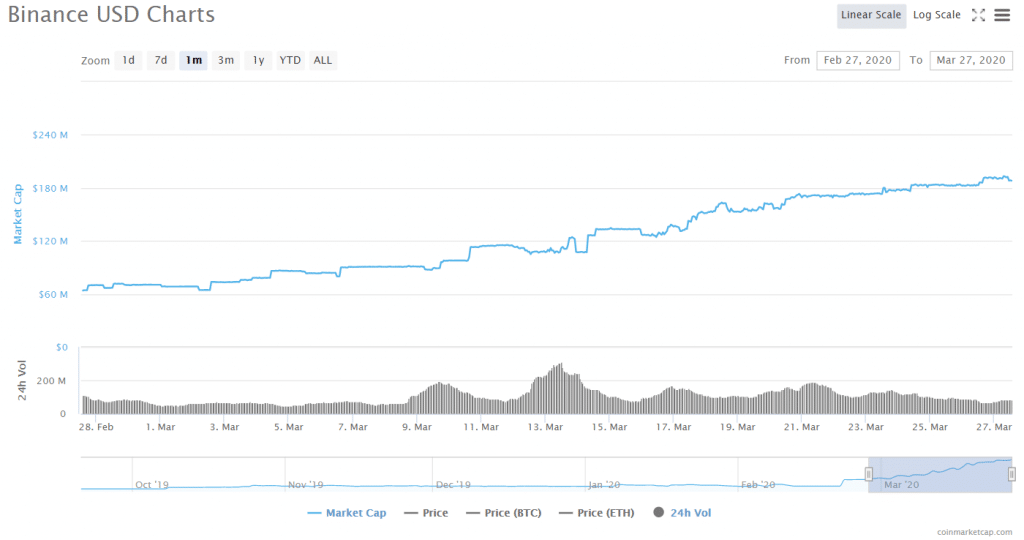

In particular, USD-backed stablecoins have suddenly seen a major boost: the market cap of Binance USD (BUSD), which was launched early in Q4 of 2019, has more than doubled, rising from $68 million to $188 million from March 1st to Friday, March 27th (a 176% increase).

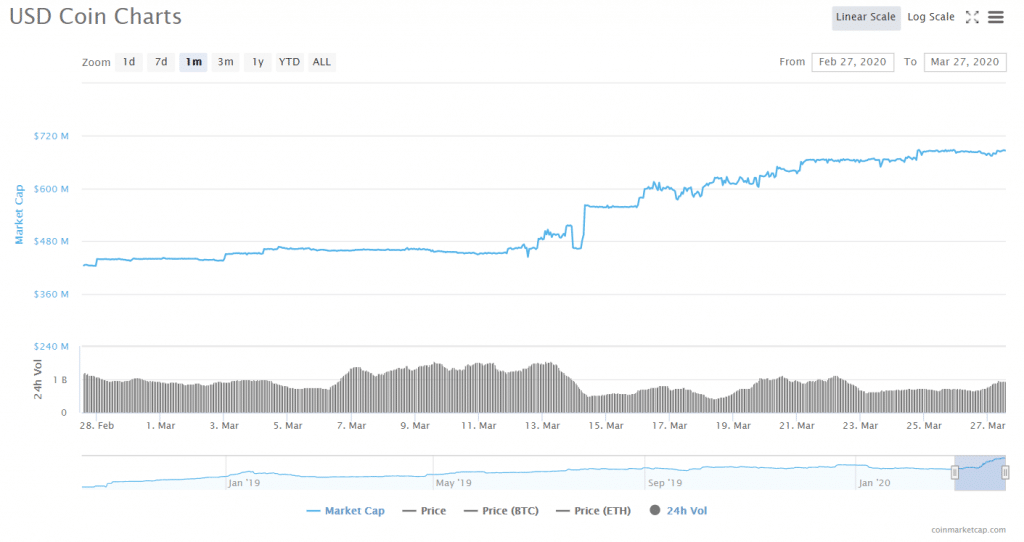

The market cap of USDC, Circle's USD stablecoin, jumped from roughly $440 million at the beginning of the month to $685 million (a 55% increase) over the same time period; Paxos Standard (PAX) grew from $200 million to $254 million (a 27% increase).

Meanwhile, Tether Dollars (USDT) haven't seen such a major increase in recent months, but the market cap has maintained its dominance as the world's largest stablecoin with a market cap of roughly $4.6 billion since early January.

In crypto, "many are using the 1:1 stable coin peg as a risk-protection tool."

Why are these USD-backed stablecoins jumping? Steve Ehrlich, chief executive of crypto trading platform Voyager Digital, told Finance Magnates that the movement into USD-backed stablecoins reflects a widespread movement out of more volatile assets into the USD in traditional markets.

"This unfortunate crisis has created extreme market volatility across global markets, both legacy and digital, causing many to move their assets into the U.S. dollar to de-risk," Ehrlich explained. "We've seen similar behavior in crypto, as many are using the 1:1 stable coin peg as a risk-protection tool."

Anna Tutova, chief executive of crypto news site CoinsTelegram.

Just as in more "traditional" asset markets, this movement into USD-backed stablecoins serves a very practical purpose: it "allows traders and investors to be on the sidelines awaiting their next move, as many are deciding how and where they will want to invest their stablecoins for maximum gain, and prepare for brighter days ahead."

Erlich said that he'd seen similar movements on his company's platform. "Since interest rates on certificates of deposit, savings accounts, and digital banks hit an all-time low at Voyager, we've seen our customers move their USD into USDC."

Anna Tutova, chief executive of crypto news site CoinsTelegram, echoed Ehrlich's sentiments: "investors prefer to hedge their risks, so stablecoins are the perfect tool to minimize the price volatility of their assets in times of economic downturns."

"Generally, periods of volatility have a positive impact on stablecoins."

Tutova also noted that de-risking into stablecoins might also be much less expensive than fully unloading into USD: "stablecoins are more liquid, [and] maintain all benefits of crypto: transparency of transactions, and [the possibility] of cheap and fast cross-border Payments ."

Steve Ehrlich, chief executive officer and co-founder of crypto trading platform Voyager Digital.

She also pointed out that the coronavirus crisis isn't the only instance in which stablecoins have benefited from chaos: "generally, periods of volatility have a positive impact on stablecoins," she said.

Indeed, Ehrlich also said that "Volatility is always good for emerging markets," as periods of volatility are "the litmus test for success."

"Crypto and stablecoins are thriving, proving their value both in how they're being utilized, adopted, and the necessary purpose they bring in a digital world as we're forced to digitally transact due to our current circumstances," he said.

However, not all networks survive this "litmus test"--Tutova added that "such volatility can be negative as well," pointing to an instance earlier this month in which an Ethereum token price crash caused the formation of a multi-million dollar hole in the collateral of DAI, the ETH-pegged stablecoin of the MakerDAO ecosystem.

"This is not how any of us would have liked adoption to happen, but this is forcing the issue."

I the past, capital tends to trickle back out of stablecoin markets after periods of volatility have subsided. However, the recent flood of capital into many USD-pegged stablecoin markets may hold even after the volatility has subsided because of the growing prevalence of interest-bearing crypto accounts.

Ehrlich said that on Voyager, and on a growing number of other crypto platforms, this movement is further incentivized with interest-bearing crypto accounts: "we offer 6% APR Interest and 2% interest on a wide variety of stable coins."

This has presented many of the platforms that offer these interest-bearing accounts with an opportunity: "now, crypto brokers like ourselves offer a real competitive advantage to banks as the places to store their assets for interest-bearing, while ensuring they maintain access and liquidity at all times," Ehrlich said.

Indeed, Ehrlich is optimistic about what the coronavirus crisis will ultimately bring to the cryptocurrency industry: "the cryptomarkets are successfully demonstrating why digital assets are the future, and mass adoption will become inevitable," he said.

"With potential cash bans due to contamination, banks putting cash withdrawal limits on their customers, the ability to transact and use stablecoins both for peer-to-peer payments and for institutional transactions, without requiring the involvement of a banking institution is exactly what these assets were designed for."

"This is not how any of us would have liked adoption to happen, but this is forcing the issue."

" Leverage in this space can ratchet up or down very quickly."

The flood of capital into stablecoins also has implications for leverage and lending in the cryptocurrency space.

Jean-Marie Mognetti, chief executive of crypto investment firm CoinShares.

For example, earlier this week, Jean-Marie Mognetti, chief executive of digital asset managementCoinShares, told Finance Magnates that given the 24/7 nature of the crypto markets, and the resulting "fluidity of collateral," Mognetti pointed out that "leverage in this space can ratchet up or down very quickly."

"We see this with a massive rotation from cryptocurrencies into stablecoins," he said, citing an influx of $140M into Circle's USD-backed stablecoin, USDC that resulted "as investors sold crypto for stability in the form of digital dollars."

"The flow out of stablecoins back into crypto can happen just as quickly, which tends to exacerbate swings in the crypto space. This fluidity is unique to crypto markets, their 24/7 nature, and the ability to exchange assets instantly on the same underlying settlement network (the blockchain), something we don't see in any other lending market," he said.