MV Index Solutions (MVIS) has launched a series of digital assets indices, meant to track the performance of the cryptocurrency markets, in partnership with London-based digital asset data provider CryptoCompare.

The MVIS CryptoCompare Indices are designed to meet investment industry benchmarking standards by providing a public rulebook for fork treatments and other events, industry-wide data distribution, proper identifiers and further standard index governance requirements.

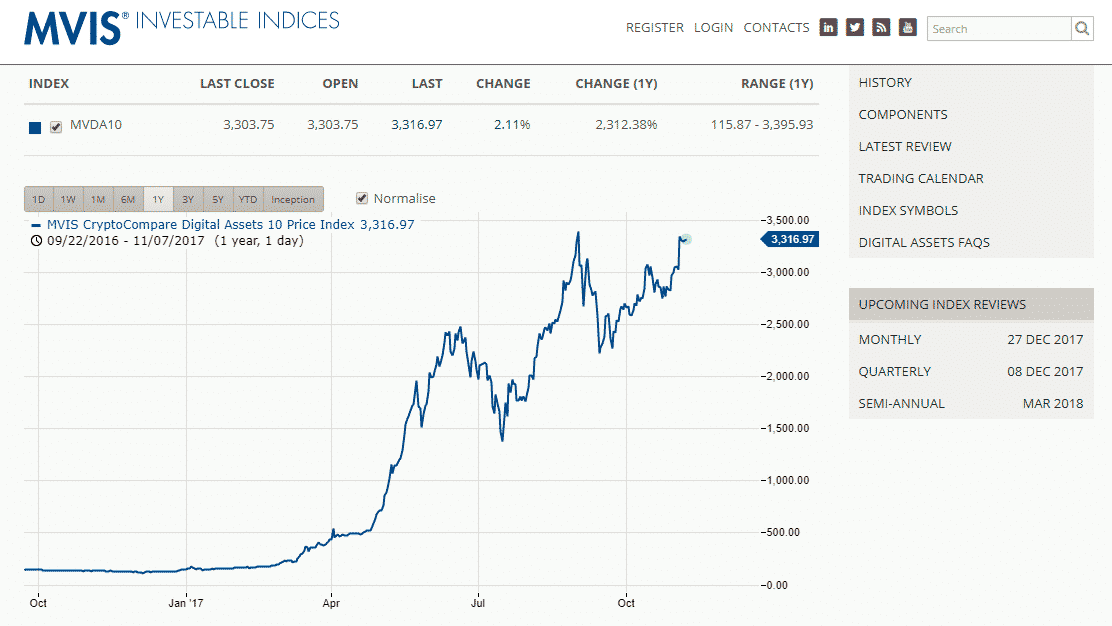

The indices utilise a digital asset pricing methodology incorporating pricing and trade data from 50+ major digital asset exchanges around the world. Prices are weighted by volume on 24/7 basis. The series includes twelve single digital asset indices and four multiple digital asset indices: MVDA25, MVDA10, MVDA5 and MVDA100.

The Digital Assets 10 Index components are: Bitcoin , Ethereum , Bitcoin Cash, Ripple, Litecoin, DASH, Monero, Ethereum Classic, NEO and IOTA.

“Digital assets are a dynamic area that merits attention, especially by professional investors,” states Thomas Kettner, Managing Director at MVIS. ”Although not without risks, digital assets have the potential to integrate into the broad economy and become an investable asset class in their own right. MVIS is at the forefront of these market developments.”

Charles Hayter

“We are excited to partner with MVIS in offering next-generation index strategies,” explains Charles Hayter, CEO and co-founder at CryptoCompare. “This alliance allows us to bring digital market innovation and expertise to the asset management industry.”

MVIS is the index business of VanEck, the US-based investment management firm and provider of the VanEck Vectors ETFs.

Gabor Gurbacs, Director of Digital Asset Strategy at VanEck, said: “VanEck (MVIS’ parent company) is committed to support long-term, structural innovation in the asset management industry. High quality digital asset indices are among the first building blocks in a series of market structure oriented digital asset initiatives.”