The r/WallStreetBets (WSB) saga that shook the world last week is far from over. In fact, it seems as though this may only be the beginning.

After a group of determined traders set out to send GameStop Inc (NYSE:GME) stock prices to the moon, squeezing Wall Street hedge funds in the process, it seems that the group of rogue traders is continually realizing the full extent of its potential power.

Melvin Capital Lost More Than 50% of Its AUM in January Alone

Indeed, since the GameStop pump began, spin-off groups of traders have used Reddit to organize their powers around a number of other assets: last week, the group pumped DogeCoin, and then XRP; Finance Magnates previously reported double- and triple-digit percentage increases in both assets, respectively. (Both assets have seen significant drops since their peaks.)

However, while these crypto pumps are certainly intended to earn money for some WSB traders, these latter targets do not carry the same anti-establishmentarian sentiment that WSB’s investment in GameStop and other 'meme stocks': to squeeze hedge funds so hard that they would fold, and, to that end, WSB has already done significant damage.

As the WSB Pump Continues, Hedge Funds Are White-Knuckling Their GME Holdings

Indeed, CNBC reported on Sunday that hedge fund, Melvin Capital lost more than 50 percent in January because of the WSB squeeze.

The fund was in such bad shape that Citadel and Point72, two other hedge funds, injected $3 billion into Melvin as an emergency effort, bringing the fund’s total AUM back to roughly $8 billion, still significantly down from the $12.5 billion it held before the squeeze began. Both Citadel and Point72 also sustained losses in January, though they were not nearly as serious as Melvin.

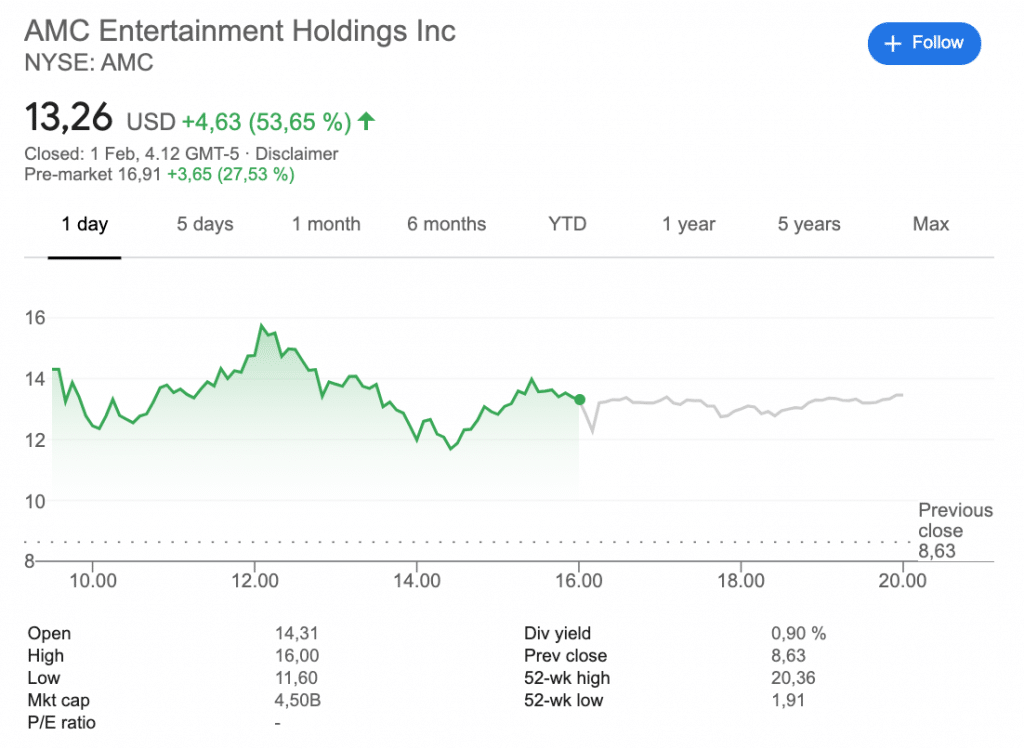

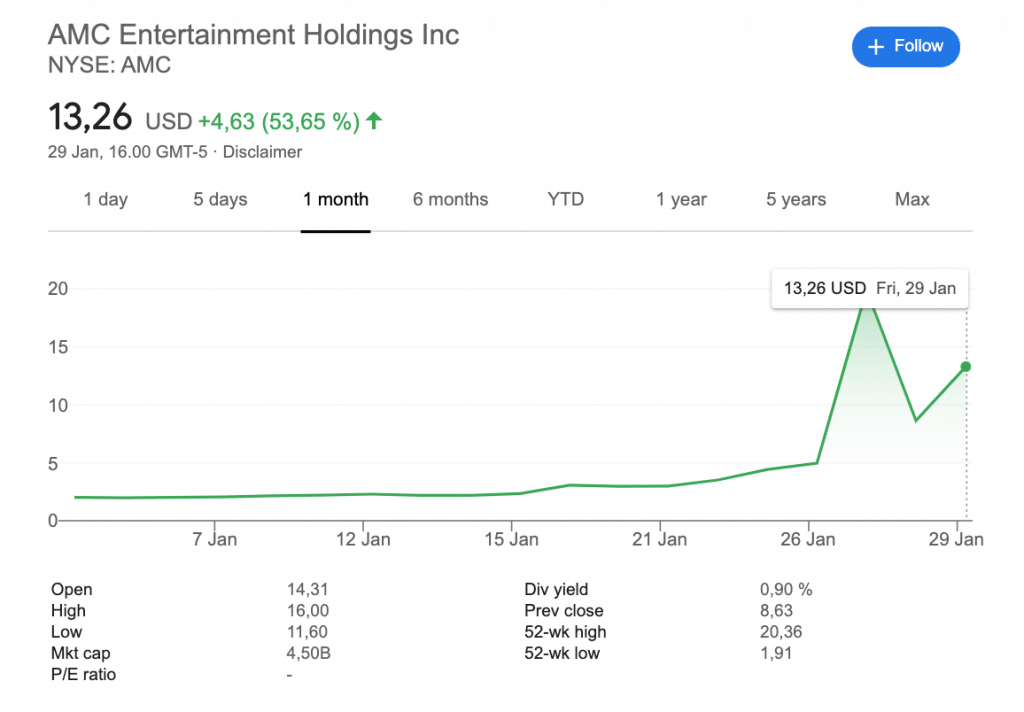

But, WSB investors are not done making their point: traders are still pumping money into GameStop, AMC (NYSE:AMC), and other companies that hedge funds bet against.

According to CNBC, a number of other hedge funds still have holdings in GME: “short-selling hedge funds have suffered a mark-to-market loss of $19.75 billion year to date in the brick-and-mortar video game retailer, GameStop,” CNBC reported, adding that the funds are either “holding onto their bearish positions” or “being replaced by new hedge funds willing to bet against the stock.”

At press time, GME was trading at $325; AMC was sitting comfortably at $13.26. Just one month ago, both stocks were trading for $17.25 and $2.06, respectively.

"Dumb Money" Ain’t So Stupid after All

So. What happens next?

Thomas Yeung, certified Financial Advisor and InvestorPlace Market Analyst wrote on Saturday that WSB’s retail reckoning is far from over: “as Wall Street picks up the remnants of Melvin Capital and the GME fallout, two things have become clear. 1) ‘Dumb money’ isn’t so dumb after all, and 2) ‘smart money’ is getting taken to the woodshed.”

('Dumb money' meaning retail investors and 'smart money' meaning the hedge funds that the 'dumb money' is currently KO’ing.)

Indeed, 'smart money' may have a lower IQ than we thought. Yeung pointed out that in fact, “Melvin Capital...lost 30% of its net worth in the first three weeks of January. But, it took another six days (after the stock had gained another 250%) for the hedge fund to finally relinquish its mammoth position.”

Thomas Yeung, certified Financial Advisor and InvestorPlace Market Analyst.

While other hedge funds are still holding death grips on their positions on NYSE:GME, the events of last week have left many 'big money' market managers shaking in their boots. Specifically, Yeung pointed out that short-sellers are proceeding with greater degrees of caution than ever before.

Many of them are taking steps toward preventing similar events in the future: for example, “Citron Research’s Andrew Left has already vowed never again to publish short-seller reports.”

The Us Government Is Considering Its Next Move

In the meantime, lawmakers in the United States and abroad are carefully considering what this all means for the regulatory world.

Last week, Representative Alexandra Ocasio-Cortez (D-NY) and Senator Ted Cruz (R-TX) made an odd couple when both of them called for action against Robinhood, the popular commission-free stock brokerage that pulled the plug on GME after the WSB pump went into full effect.

Additionally, Senator Elizabeth Warren (D-MA) told CNBC on Wednesday that “we need an SEC (Securities and Exchange Commission) that has clear rules about market manipulation and then has the backbone to get in and enforce those rules. To have a healthy stock market, you’ve got to have a cop on the beat.”

Meanwhile, Robinhood still has not restored trading of GME to its retail customers. Furthermore, the company is maintaining blockages on AMC Entertainment Holdings Inc and Blackberry Ltd, in addition to several others. However, as of yesterday, only eight companies remain on Robinhood’s blacklist; previously, Robinhood limited Retail Trading on 50 companies.