The Securities and Exchange Commission of Nigeria recently announced that it will be regulating the trade of digital currencies in the country. “Issuers or sponsors of virtual digital assets shall be guided by the commission’s regulation,” the regulator said in a statement.

The move is intended to protect investors’ best interests and to promote transparency within the space: “the general objective of regulation is not to hinder technology or stifle innovation, but to create standards that encourage ethical practices,” the regulator said.

Regulations Could Bring More Legitimacy--and More Investors--to Crypto in Nigeria

While there are not too many specifics about what the regulation will look like, the agency said that the regulations will apply “when the character of the investments qualifies as securities transactions.” In other words, if the digital assets can be classified as securities, they will fall under the jurisdiction of the Nigerian SEC.

And even though the regulation has not hit the books yet, the fact that the Nigerian SEC is making moves toward regulating Cryptocurrencies seems to represent a shift in the country’s attitude toward cryptocurrencies. After all, the Central Bank of Nigeria did declare in 2018 that crypto-currencies including Bitcoin, Ripple, Monero, Litecoin, Dogecoin, and Onecoin, were not regarded as money.

A legal classification as a ‘security’ certainly will not make cryptocurrency into ‘money’ in the eyes of the law, either. However, the fact that the Nigerian SEC is recognizing that cryptocurrencies are, indeed, securities (and that as such, they need to be regulated) is a step forward.

This is because as more regulations have been applied to the cryptocurrency industry in other countries, more investors, particularly those of the institutional stripe, have tended to follow. It seems that investors may feel safer to enter the crypto space when regulators are present to abate the effects of fraud and other mishaps.

Open a Trading Account Today With These Recommended Brokers

And indeed, cryptocurrency regulations can have a stabilizing effect on the space. Ayodeji Ebo, managing director at Afrinvest securities in Lagos, told Bloomberg that “crypto transactions are already happening and the earlier it is regulated, the less havoc on the economy,” and that the emergence of crypto assets and relevant regulations “is another way to provide alternative assets to investors.”

“Nigeria is a crypto hotspot”

Even without the presence of regulations, it seems that investors in Nigeria have already been taking a dive into the world of cryptocurrencies.

Fernando Martinho, chief executive of fintech crowdfunding service, Nimbus Platform, told Finance Magnates that “Nigeria is a crypto-hotspot.”

“it is the biggest crypto market in Africa, especially regarding consumer adoption,” he said.

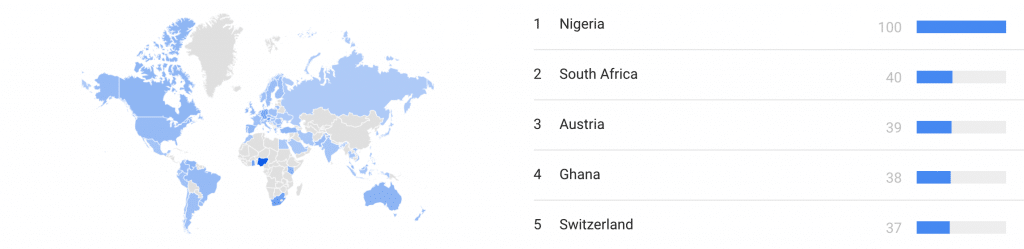

This is evidenced by several metrics: “according to Google Trends, Nigeria is ranked first worldwide in Google searches for terms like ‘Bitcoin’, ‘Ethereum’,” Martinho told Finance Magnates.

Nigeria is ranked #1 for the number of google searches for the word 'Bitcoin'.

Martinho also said that “the country is also one of the biggest sources of BTC trading volume in Africa.”

Citing a recent report from Chainalaysis, he explained that “Nigeria, South Africa, and Kenya lead the continent in monthly crypto transfers.”

The high amount of interest in cryptocurrencies seems to be the largest driver in the Nigerian SEC: “such big interests from the residents of Nigeria push regulators to adopt appropriate legislation,” Martinho commented.

More Regulations Tend to Bring in More Institutional Investors

While most of the interest in cryptocurrencies in Nigeria seems to be driven by retail investors, Martinho also stated that “institutional adoption will likely follow once there are more comprehensive regulations” in place.

A similar phenomenon has been observed in other countries that have adopted higher levels of regulation for the cryptocurrency industry.

Fernando Martinho, chief executive of fintech crowdfunding service Nimbus Platform.

Indeed, Ciara Sun, head of global markets at Huobi Group, said at a CoinTelegraph event in July that “larger institutions have higher compliance requirements, but regulatory agencies have not provided enough guidance on digital assets in the past.”

“This unclear regulatory landscape has made it riskier for larger institutions,” she said.

However, even without the immediate entrance of institutional investors into the Nigerian cryptocurrency industry, there is still huge potential for growth of the crypto industry.

Bitcoin and Other Cryptocurrencies Could Fill a Financial Services Gap in Nigeria and Beyond

Why is this?

For one thing, a lack of many of the traditional financial services that are often taken for granted in more developed countries are lacking in Nigeria.

This is because financial regulators in a number of African countries, including Nigeria, have imposed significant restrictions on how citizens can spend their money.

Ray Youssef, chief executive of cryptocurrency exchange Paxful explained this phenomenon in an interview with Finance Magnates earlier this year: “[African people] have a lot of money there. They just can’t use it,” he said.

This is because “the banking system there is disconnected from the rest of the world,” Ray explained; the problem even exists between countries within the African continent: “If you’re in western Africa and you want to send money out of the country, it’s nearly impossible. You have to go to three or four or five hops. You have to use your friends and family networks.”

Therefore, “there is a real, true need for Bitcoin [in Africa],” Youssef said, “not on a speculative basis, but on a real utility basis.”

Ray Youssef, CEO of Paxful.

Additionally, Nigerian financial news outlet Nairametrics reported in August that some Nigerian banks had reduced their customers’ dollar-spending limits to as low as $100, causing major problems for some citizens: “Nigerians rely on their debit cards to pay for online transactions that are billed in US dollars,” the report said.

This reduction in dollar spending limits, which were already quite low, has forced Nigerians to seek dollars elsewhere. In 2015, before Bitcoin truly 'took off' in Nigeria and elsewhere in the world, Quartz reported that “if you can’t access foreign currency through official channels, you are left with no choice but to use the black market at much higher rates.”

The ‘Leapfrog’ Effect

Therefore, it seems quite likely that part of Bitcoin’s apparent popularity in Nigeria has to do with the fact that it can be used to pay for some products that can be sold online; it can also be used to more easily access foreign currencies, including USD. In other words, the popularity of Bitcoin in Nigeria is linked to the fact that BTC is being used for practical purposes rather than speculative trading and investing.

As such, the regulation of cryptocurrencies in Nigeria, and the entrance of institutions that could follow, could make cryptocurrency adoption in the country truly explosive.

This adoption could continue to extend beyond Nigeria and into some of the more rural areas of the African continent. This is because of a phenomenon known as the ‘leapfrog effect.’

What is the leapfrog effect? Before the era of mobile phones, constructing the necessary infrastructure to create a continent-wide landline phone network in Africa was extremely inefficient in terms of time and expenses; it was also very impractical to install telephone poles and cables in rural areas that were not easily accessible by road.

However, the mobile phone industry brought a new era of accessibility to areas of rural Africa. While the landline phone industry struggled from start to end, and never really took off, the mobile phone industry flourished across the continent almost immediately.

Cryptocurrency adoption in African markets, including Nigeria’s, appears to be taking a similar course. The traditional, brick-and-mortar banks that are stalwart pillars of the developed financial world are impractical and inefficient for Africa in the same ways that the landline telephone industry was.

However, the crypto industry, which happens to be highly accessible through mobile phones, seems to be stepping in where traditional financial services failed. Through crypto platforms, millions of people who previously did not have access to financial services can now have them.

Watch This Space

In addition to the financial services gap that cryptocurrency and Blockchain can fill across Africa, the fact that the continent’s population is skewed toward younger generations means that Africa is likely to play an increasingly powerful role in the global economy.

“Demographically, African future generations will probably define a significant portion of global trends as a consumer group, driving further adoption for technologies suitable for consumer preferences,” Nimbus Platform’s Fernando Martinho told Finance Magnates. “Cryptocurrency is one such technology.”

Therefore, the introduction of regulation for the cryptocurrency industry in Nigeria could bolster a space that is already poised to boom.

However, it is still too soon to know exactly what the effects of the proposed regulation will be, after all, the details are still unknown.

Indeed, Paxful’s Ray Youssef said that “regarding the proposed rule by the Nigerian Securities and Exchange Commission (SEC) to regulate crypto-token or crypto-coin investments, we are at too early a stage to make any comment. We are analyzing the impact of the current information on the business and also on the community.

“That said, we are open to an opportunity to talk to the regulators and help showcase the various benefits that we’ve learned through the years that cryptocurrencies provide,” he added. “We envision building and helping communities to be financially independent. We see Africa as a leader in fulfilling this vision.”