While we are less than one month into 2021, the year is already proving to be a historic one for cryptocurrency.

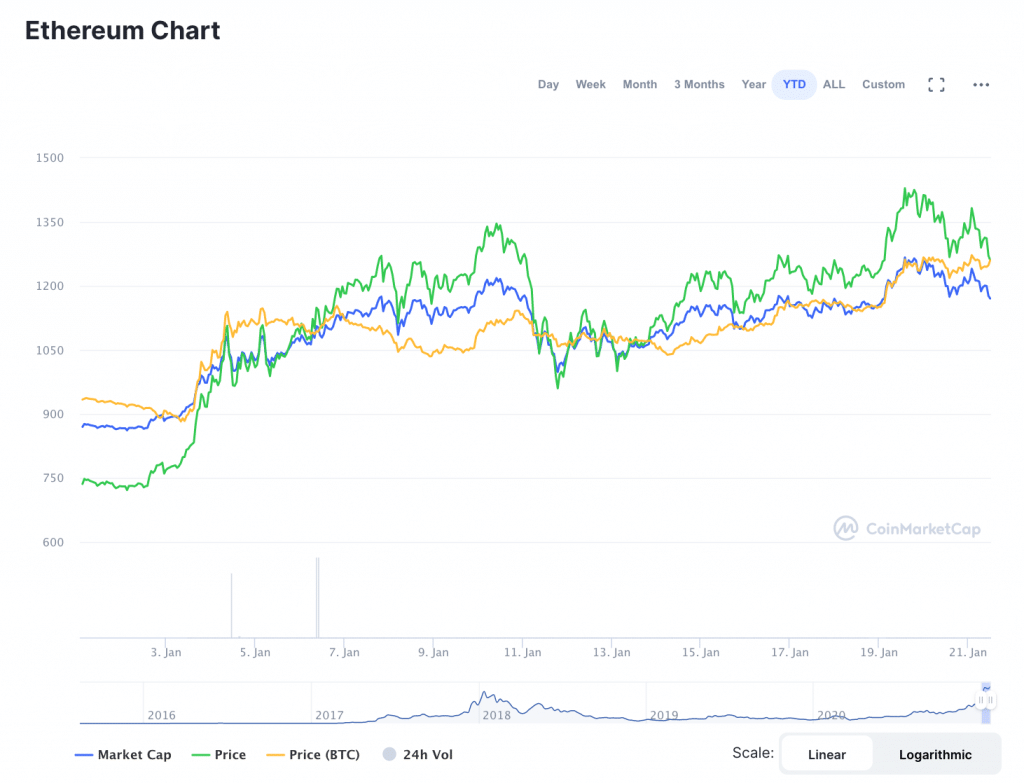

After Bitcoin reached a new all-time high over $40K earlier this year, ETH has made waves with a new all-time high of its own. Earlier this week, the price of ETH reached roughly $1450; at press time, the price had fallen to $1,243.43.

However, while ETH’s bull run may be over (for now), a number of analysts seem to believe that this is just the beginning for ETH and the Ethereum network. What caused the push to the new all-time high, and what is next?

Bitcoin’s 'Run-off' Effect

Simon Peters, Market Analyst at social trading platform, eToro, told Finance Magnates that ETH’s recent meteoric rise “parallels bitcoin’s push to its previous high at the end of 2020.”

And indeed, much of ETH’s recent push to a new all-time high seems to have been partially caused by runoff from Bitcoin’s recent push past $40K.

Ben Perrin, Host of crypto-themed Youtube Series BTC sessions, told Finance Magnates that this pattern can be observed when BTC has moved upward in the past: “over the past few bull runs, Bitcoin tends to take the lead, then some of that money filters out into other cryptocurrencies.”

Ben Perrin, Host of BTC Sessions.

While the exact reasons for this phenomenon are unknown, Perrin explained that the causes for the movement of capital to ETH and other altcoins is likely psychological.

“Individuals who bought Bitcoin and haven't come to truly understand what sets it apart in terms of decentralization, censorship resistance, immutability or its other qualities decide to pull some of their paper gains and speculate on other coins,” he said.

Additionally, “individuals who have seen the meteoric rise of Bitcoin may suffer from ‘sticker shock’, believing BTC is too expensive, and thus pile money into smaller, less liquid coins in hopes of capturing similar or greater gains.”

On Average, Ethereum Is Now Processing More Transactions Than Bitcoin per Day

But, of course, it is not all about Bitcoin.

Brian Norton, Chief Operating Officer of MyEtherWallet, pointed out that part of Ethereum’s rise can be attributed to the simple fact that the network is seeing higher rates of usage. And indeed, ETH seems to have been boosted in recent times by the 'network effect', which describes what happens when a product or service grows in value as more people use it.

Brian Norton, Chief Operations Officer at MEW (MyEtherWallet).

“The fact that more Ethereum processes more transactions per day than bitcoin and has for some time is a good indicator of the network effects at play,” Norton explained.

Indeed, Ryan Watkins, Senior Research Analyst at cryptic analytics firm Messari, recently tweeted that “Ethereum's daily transaction volume is going parabolic.”

“It now settles $12 billion in transactions daily - $3 billion more than Bitcoin,” he wrote.

The Multiplying Growth of the Network Effect

What is causing the boost in transactional activity on the ETH network?

“What I am watching is developer activity on Ethereum, as it serves as an indicator that new and better use cases are coming which will increase demand for the native asset,” Norton told Finance Magnates. “Ethereum has over five times the number of active developers as bitcoin, and is adding developers at a faster clip every day.”

In other words, Ethereum seems to be growing because it is increasingly being used as a platform for the development of decentralized applications. This is a positive sign for the network, which has struggled with scalability problems as more traffic has come to the network.

Peters told Finance Magnates that: “while Ethereum can fulfill the role of a currency, it is primarily a Blockchain platform, where developers can build decentralised applications (DApps) that run on the entire network rather than a group of servers controlled by a single authority or organisation.”

For example, “if a DApp were an App downloadable from the App Store, it would be run by its users rather than controlled by a central developer.”

Peters explained that because Ethereum is intended to act as the backbone of a DApp ecosystem, the power of the network effect could be particularly important for ETH’s future.

“As a result, the benefits of the Ethereum platform, and therefore the Ethereum token, are wide-ranging,” he explained. “It hosts a whole range of services, such as decentralised streaming applications, web browsers, video games, shared computing power services and digital art shops. In addition, it is host to many DeFi (Decentralised Finance) applications.”

“This plethora of uses has contributed to Ethereum’s price rise – as more DApps are built on the Ethereum blockchain its utility increases.”

Ethereum's Progress toward Scalability and Proof-of-Work

Peters explained that while scalability remains an obstacle for Ethereum’s growth, the organization that has helped to steer the Ethereum network toward a solution has met some important technological milestones in the recent past.

“The Ethereum Foundation, the non-profit organisation that oversees Ethereum’s development, has made positive moves to upgrade the platform to a more secure, decentralised, and efficient network, called Ethereum 2..0, which will use a proof-of-stake consensus mechanism,” he explained.

Simon Peters, Analyst at eToro.

“Proof-of-stake allows users to ‘stake’ their Ethereum, locking it away in the network for an extended period of time,” he said. “This makes the network operations more decentralised versus, say, a proof-of-work blockchain, because the network is not reliant on huge mining operations or mining pools.”

“It also enhances security; if a bad actor were to ‘attack’ the network they would have to stake tokens to be a participant or validator in the first instance, and would therefore be financially impacting themselves,” Peters explained.

Additionally, the Proof-of-Stake model promotes long-term price stability for ETH tokens: “a huge amount of Ethereum staked indicates the confidence that is placed in the new Ethereum 2.0 network,” Peters said. “Currently, around $3,738,000,000 of Ethereum is staked.”

“The Growth of Ethereum Has a Direct Impact on the Price of Tokens of Its Ecosystem.”

And, naturally, as the Ethereum network continues to grow, so too do the number of ERC20 DeFi tokens, many of which have been outperforming ETH in terms of returns.

“The number of users of DeFi-protocols is growing exponentially,” said Konstantin Boyko-Romanovsky, CEO and Founder of Allnodes, to Finance Magnates. “The number has reached 1.25 million. The growing popularity of DeFi tools and applications is built on Ethereum's smart contract, and it holds potentially new and profitable economic opportunities on a global scale.”

How will ETH’s push over $1,400 affect tokens in the DeFi market? “The growth of Ethereum has a direct impact on the price of tokens of its ecosystem,” Boyko-Romanovsky told Finance Magnates.

This is “partly due to the trade on decentralized exchanges such as Uniswap to pair with Ethereum and, in part, due to Ethereum's growth.”

Konstantin Boyko-Romanovsky, CEO and Founder of Allnodes.

”There Is a High Likelihood That Traders Will Rotate Their Ethereum Funds into ERC-20 Tokens Once Ethereum Begins to Consolidate and Flatten Out.”

Also, Matthew Goeckel, Chief Executive of LunaVulcan Cryptocurrency Signaling Service, told Finance Magnates that “it is very likely that ERC-20 tokens will begin to move higher if Ethereum continues to make higher all time highs.”

“Similarly to how Ethereum and Bitcoin interact during large uptrends, Ethereum and ERC-20 token, many of which involve DeFi, tend to lag behind,” he said. “There is a high likelihood that traders will rotate their Ethereum funds into ERC-20 tokens once Ethereum begins to consolidate and flatten out.”

Matthew Goeckel, Chief Executive of trading algorithm provider, LunaVulcan.

However, while DeFi is booming at the moment, the growth of the space could lead to some negative attention down the road.

“The DeFi ecosystem feels very reminiscent of the ICO craze of 2017,” Perrin told Finance Magnates.

“While the idea of ‘decentralized finance’ is a noble one, the majority of these projects are fully centralized with discernable leaders, kill switches, and from a regulatory perspective - people to crack down on,” he said. “If I were to venture a guess, we'll see a new round of fines from the United States Securities and Exchange Commission (SEC) a couple of years after the DeFi mania has made its rounds.”

Bitcoin’s Next Move Could Be Critical for ETH and Other Altcoins

However, while the growth of Ethereum and the DeFi ecosystem may be closely connected, Ulrik Lykke, Co-founder at cryptocurrency hedge fund, ARK36, told Finance Magnates that Bitcoin plays an important role in DeFi markets.

“The main correlation between Bitcoin, ETH, and other altcoins is that altcoins don’t move unless Bitcoin sets a direction for the whole crypto market,” Lykke said. “When Bitcoin moves fast in either direction, altcoins usually follow suit. The best thing that can happen for altcoins in terms of price development is when the Bitcoin market moves sideways.”

Therefore, Bitcoin’s future could play a significant role in the future of ETH and the rest of the DeFi world.

Ulrik Lykke of ARK36

But, where is Bitcoin headed? After pushing past $40K earlier this year, the price of BTC seems to have flatlined around the $34-36K range. While this is nothing to sniff at, some analysts are

“In the 2013 bull run, Bitcoin saw a 100-fold return,” Perrin said. “The 2017 bull run was a 20-fold return.”

If the pattern repeats itself, meaning that “this bull run is a 5X return,” Perrin explained that “this puts $100,000 BTC well within reach. It would not be outlandish to see multiples of that if history repeats itself.”

“The fact that institutions have begun buying and removing Bitcoin from exchange Liquidity seems to denote we could see a steeper spike than 2017 once supply dries up and retail fear of missing out (FOMO) truly kicks in.”

When Measured in BTC, “Ethereum Is Still down a Whopping 74% from Its Previous High”

However, moving forward, Perrin believes that “it's very important to zoom out and measure the price of ETH in Bitcoin terms instead of dollar terms.”

Measuring ETH by this metric tells a different story about ETH’s recent price progress. “In doing so, it becomes evident that despite hitting all-time highs in dollars, Ethereum is still down a whopping 74% from its previous high of 0.147 BTC in mid-2017.”

“In order to recapture its previous glory, ETH would need to reach around $5150,” he explained. This is more than 300% more than its current value, provided that Bitcoin would not move over $35k.”

“I would say this is extremely unlikely to happen,” Perrin said. “Like many coins before it, Ethereum will experience volatility but trend downwards in terms of its relationship to Bitcoin’s value over the long term.”