On the 29th of June, Bloomberg published an article entitled "Crypto Coin Tether Defies Logic on Kraken’s Market, Raising Red Flags".

Kraken responded with a pithily-titled blog post: "On Tether: Journalists Defy Logic, Raising Red Flags".

In this article I will look at the claims of both sides of the argument.

Bloomberg's accusation

Bloomberg claims that while other Cryptocurrencies fluctuate in price in accordance with buy and sell orders, Tether remains suspiciously horizontal.

Working off a tip, Bloomberg looked at 56,000 trades that were processed on the exchange between the 1st of May and 22nd of June, and consulted with New York University professor Rosa Abrantes-Metz and former Federal Reserve bank examiner Mark Williams. All concluded that the lack of movement was remarkable. None had seen a price fail to react to large transactions in this way.

Incidentally, Mark Williams infamously predicted in December 2013 that one bitcoin would be worth less than $10 by mid-2014. When in June 2014 the price got to around $600, he said that time would vindicate his prediction.

Mark Williams. Source: Bitcoinx

Abrantes-Metz said: “Large trades are not impacting prices. I’ve looked through lots and lots of data, and I don’t think this is real.”

The article lists some examples. One occurred on the 3rd of June: 37.5 Tether tokens purchased, price rose by x. Then another 37.5 Tether tokens were purchased, price did not move. Then 13,076.389 Tether tokens were purchased, and the price rose by x/2 - a smaller drop for a larger order.

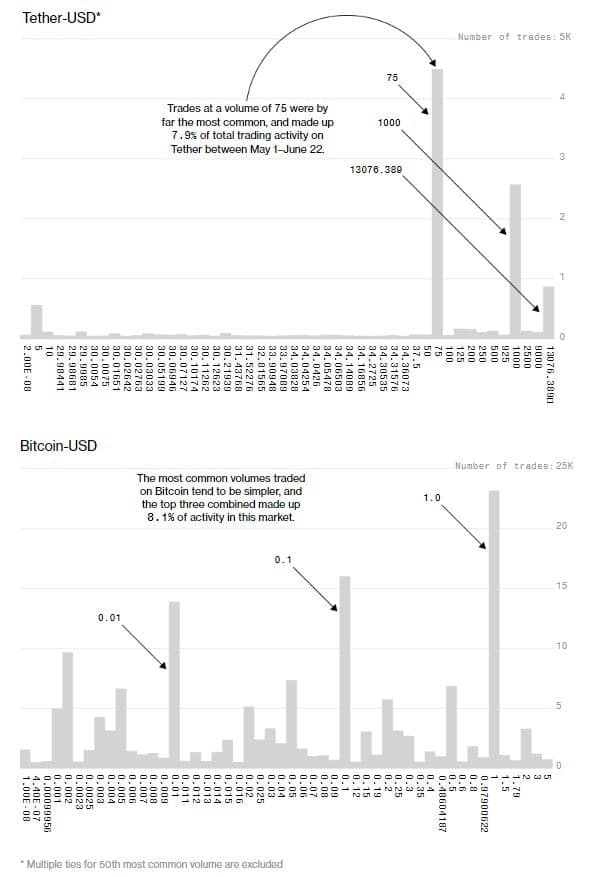

The Bloomberg team noticed another strange phenomenon; the three most popular amounts in terms of Tether during that period, in descending order, were:

1) 1,000

2) 75

3) 13,076.389

The two consultants suggested that the strangely specific recurring number with its many decimal places could be a signal to an automated trading system. For comparison, Bitcoin's top three most popular trades (1.0, 0.1, 0.01) together accounted for 8.1 percent of the market during the period examined, while trades of exactly 75 Tether accounted for 7.9 percent alone.

USDT/USD and BTC/USD trades on Kraken, 1.5.18 - 22.6.18

Source: Bloomberg

Williams said: “Many of the trade amounts are frequently occurring to the fifth decimal point, a unique identifier which increases the probability it is being generated by the same person or entity.” He suspects wash trading, an illegal practice (in the regulated realm) in which a business takes both sides of a trade to give the impression that the market is busier than it really is.

The article refers to a recent research paper by a Texas academic which claims that Tether is being used to manipulate the price of Bitcoin. However this paper focuses almost exclusively on a cryptocurrency exchange called Bitfinex; Kraken is barely mentioned.

Kraken CEO Jess Powell's immediate response to Bloomberg's request for comment was: “Nothing looks out of place to us in our publicly available data feed."

Kraken's defence

Writing in the company blog, the Kraken team dealt with the claims:

1. Tether does not experience Volatility as other cryptocurrencies do because it is asset-backed.

2. Resting buy and sell orders, that is, orders waiting to be filled, are typically equal to around $1 million. This explains why the price does not move much when an order is executed; there are more waiting ready to cancel it out. Asks the blog: "Why doesn’t the price on avocados change every time you put one in your basket?"

Source: Kraken

3. According to coinmarketcap.com, Tether has a daily trading volume of $3.6 billion, of which around $285,000 is traded on Kraken. "As much as we pride ourselves on the level of recognition we enjoy in the industry, we sadly cannot claim to be the arbiters of the price of USDT," says the blog.

4. Regarding wash trading, even if that tactic were being employed the volume is so small that the effect would be minimal. In addition to this, Tether only trades against the USD, its own peg. The blog says "it’s not clear what harm could come from wash trading of a pegged asset against its peg."

Kraken's accusation

Kraken expressed shock over what it claims to be a lack of basic understanding of market behaviour on the part of the people behind Bloomberg's article, so much so that it actually suspects foul play:

"It’s scary to think that our lawmakers are reading this stuff... If we are to take up our pitchforks against market manipulation, guide your torches toward this illumination: the Bloomberg News piece was published on June 29th, the last business day of trading for Q2, and expiration date of numerous futures contracts. It raises red flags."

Background

Tether is a cryptocurrency which claims to be backed by the dollar. It currently has a market capitalisation of $2.7 billion. It has been a source of suspicion because it claims to hold the same number of dollars as there are active tokens, but is reluctant to submit to an official audit. It also shares much of its management team with its major trading venue, Bitfinex.

Kraken is a popular cryptocurrency exchange launched in September 2013 by San Francisco native Jesse Powell. He was reportedly inspired to open an exchange after witnessing how badly-run Mt Gox was.

It was one of four cryptocurrency exchanges issued with a subpoena by the US Commodity Futures Trading Commission in June. The agency is investigating possible Bitcoin price manipulation because the exchanges were not eager to share trading data.

The Bitcoin futures contracts that Kraken mentions in its blog are one of the things that this trading data is supposed to be used for - specifically, ascertaining the future price of Bitcoin.