There’s been a lot of discussion about the role of women in the crypto industry.

In fact, it’s become somewhat trendy: increasingly, events companies, news platforms, and private companies are working to showcase the women who work in this industry--and yet, while there have been gains in the number of women who hold cryptocurrency and use crypto platforms, there is still a long way to go.

Why does this gap still exist? Why is welcoming more female users into the crypto world so important?

And--perhaps most importantly--how can companies do this successfully?

”Including women is critical to the success of crypto as an industry.”

At the core, the reason that crypto companies should be concerned about a lack of female participants in crypto is simply about numbers.

Binance UK Director Teana Baker-Taylor told Finance Magnates that “mainstreaming crypto depends on user and volume growth,” and that women represent a huge base of untapped users: “women literally make up 50% of the population.”

“This is an enormous cohort of potential customers,” Teana said. “Not targeting women and curating content and engagement opportunities for them to learn and get involved in the ecosystem is literally leaving money on the table and delaying the inflow of volume crypto needs to grow.”

Alex Mashinsky, chief executive and founder of crypto lending and earning company Celsius, also told Finance Magnates that on an ideological level, the participation of women is crucial for crypto: “you can not create a revolution while excluding half of the population,” he said.

Alex Mashinsky, founder and CEO of Celsius.

“It is hard enough to push change when you have everyone participating, so including women is critical to the success of crypto as an industry.”

Why aren’t women coming onto crypto platforms as customers?

Alex Mashinsky told Finance Magnates that the failures of the cryptocurrency industry are not linked to a lack of women users in fintech more generally.

“When you look at the broad fintech community you will see Venmo, Paypal and other apps counting over 50% women, as over 70% of spending on average is initiated by women,” Mashinsky told Finance Magnates.

However, “as far as I know, no crypto company has over 30% women as customers.”

Why is this?

For starters, it’s not because of a lack of interest: “the widely-assumed narrative that women aren't already participating in crypto is false,” Teana Baker-Taylor told Finance Magnates.“I often hear generalizations that women ‘don’t get crypto’ and ‘aren’t into it anyway.’”

This is categorically false. “I believe that previously, this was a widely accepted assumption and therefore, no one really bothered to take a look at the actual numbers,” she continued.

Women are increasingly participating in crypto--but there's still a long way to go

However, “we're now starting to see research delve into ‘women in crypto’ behaviors, and the data validates that women are in fact participating--and that their numbers are increasing--significantly."

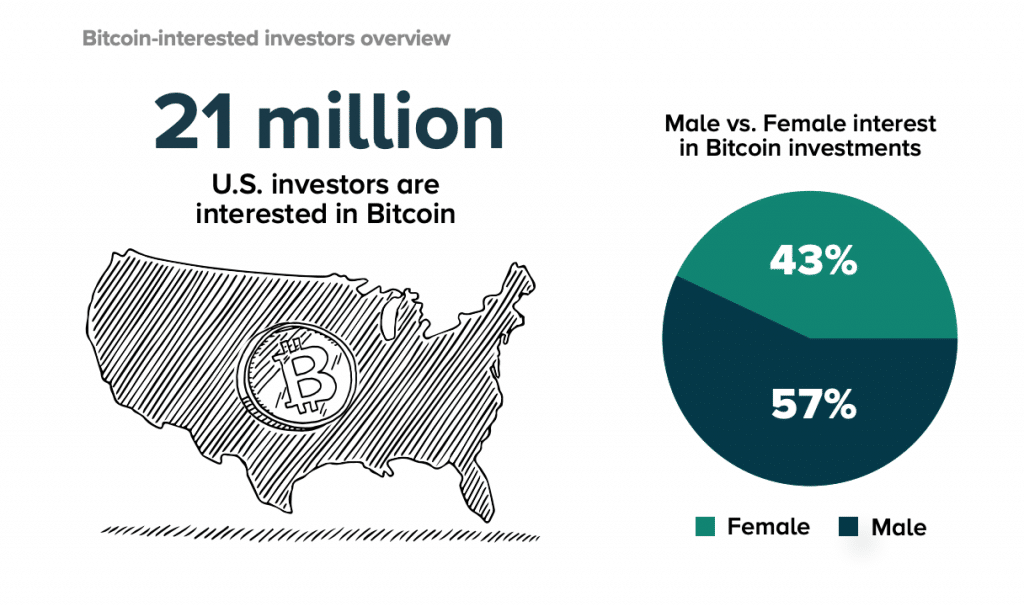

For example, “Grayscale published a report in December which showed that 43% of investors interested in Bitcoin are women--an increase of 13% from last year--and research trajectory shows this number continues to grow,” Teana said.

Source: Grayscale (Investing in Bitcoin: Perspectives from Female Investors)

Teana also pointed to a CoinMarketCap report that “recently revealed an unprecedented increase in the number of women involved in the crypto market,” which showed that the number of female crypto users increased by 43.24% during the first quarter of 2020; some exchanges saw surges as high as 160% surge amongst new female users.

Despite this progress, however, the gap in female versus male users of crypto persists. Why?

Crypto companies generally “haven't quite yet embraced tailored messaging, product development and interactive tools for women.”

Teana Baker-Taylor pointed out to Finance Magnates that part of the problem may be that cryptocurrency companies have not made enough specific efforts toward onboarding female users--that women’s’ specific needs have not been taken into account when it comes to both marketing and product design.

“Women do interact and engage differently than men,” she said, “in the same way that buyer personas aged 20-30 respond differently to those aged 30-40.”

“Crypto companies seem to appreciate the differentiation between age demographics, or between retail and institutional audiences, but haven't quite yet embraced tailored messaging, product development and interactive tools for women,” she continued to explain.

Tailoring products and marketing for women users needs to be research-driven: it’s not about ‘pink-washing’

However, in developing products and marketing efforts targeting women users, cryptocurrency platforms need to be conscious about which strategies actually work: simply making a glitzy, pink version of an existing trading app isn’t enough; in fact, it may actually drive women away.

“‘Pink-washing’ existing content or patronizing promotions, such as offering pink hoodies for users to give to their girlfriends only serve to push women further away from a brand,” Teana Baker-Taylor told Finance Magnates. Pink-washing is a term that is most often used to describe various forms of cause marketing--in this case, female financial empowerment.

Teana Baker-Taylor, U.K. Director at Binance.

Instead, crypto companies must do the due diligence required to understand what women are interested in: “to target and meaningfully engage any buyer, an understanding of their drivers is required,” Teana explained.

“Companies need to be willing to invest in testing different marketing channels and approaches which are tailored to women,” Teana Baker-Taylor said.

Indeed, “Targeted advertising and providing financial incentives will only be effective if the promotion delivers a resonant experience,” she continued. “This requires investment into curating community engagement and developing content designed to resonate with women. In some cases, product development could also be retooled to take women into consideration.”

“If a business, or indeed, an entire industry fundamentally believes that their prospective customers are predominantly men, they aren't going to develop buyer personas for women.”

The bottom line is that it’s not impossible to create events and marketing campaigns that are inclusive to women--it might just take a little bit of extra effort.

A parallel--and opposite--example of this can be found in the beauty and wellness industries: “smart marketing and targeted campaigns evolve from an understanding of market sizing and customer personas,” Teana explained. “Years ago, the beauty and wellness industries were seen as predominantly for women.”

However, “today, its widely understood that both women and men equally care about their health, appearance and wellbeing and these industries now approach the addressable market with a more balanced commercial uni-sex way.”

“However, if a business, or indeed, an entire industry fundamentally believes that their prospective customers are predominantly men, they aren't going to develop buyer personas for women," Teana continued. "This has created an imbalance in how crypto marketing and education has developed and where and to whom it is targeted towards. As a result, inclusive development of the wider crypto community overall has been stunted.”

Want more female crypto users? Add more women to the crypto workforce

Marketing research and product tailoring aside, however, one of the best things that companies can do to onboard more female users is to simply hire more women (and, ladies, if you’re reading this, now might be a good time to found that crypto company you’ve been thinking about.)

“Marketing 101 tells us that buyers gravitate towards brands who ‘look like them' and resemble their values, lifestyles and aspirations,” Teana Baker-Taylor explained; therefore, the fact that “historically, crypto companies have been founded by men, with men in the leadership positions, as well as the roles affecting product design, community development and marketing” may have contributed to the crypto user gender gap.

There are companies that have taken a proactive stance toward correcting this: Binance, for example, has a diversity ratio of 60% men and 40% women company-wide; roughly 50 percent of Celsius’ employees are women. Other companies have worked toward building similar ratios.

Lisa Tan, token economics designer at Economics Design, also told Finance Magnates that in her experience, women tend to be hired for roles that are stereotypically associated with ‘what women are good at’: “in my experience, most females in the space are doing PR, marketing, sales, biz dev, HR,” she said.

Lisa Tan, token economics designer at Economics Design

“They rarely expect a female to be doing the more math-y, economic-y, finance-y parts. Which is rather unfortunate. I have too many bad experiences of people having certain assumptions of what I do,” Lisa said. “[...] If there's anything that gets in the way, it's people assuming that I don't know what I am talking about just because of my gender or race. But I'm not too bothered by it.

Of course, there is a possibility that women may feel alienated by the crypto space, and may not go for certain roles to begin with: Lisa said that she believes “being a woman helped me more than anything.”

Still, “I definitely wish more women are in the space, because every meeting and conversation is almost always with [men],” she said. “I remember I had a week of meetings once (back to back, abroad), and the only time another woman was in the room was [when] the receptionist [came in],” she said. “Everyone I met was male.”

Women need to hold more visible roles in crypto companies

However, overall, things do seem to be changing when it comes to the gender hiring gap--women are increasingly holding high-powered the crypto work force, albeit slowly.

Still, though, the roles that women hold in crypto don’t seem to be as public as the roles that men do--even if companies have worked toward hiring women, the ‘loudest voices in the room’ seem to mostly belong to men.

“As a woman in crypto, I often hear criticism from other women that the women who are in crypto aren't made visible,” Teana Baker-Taylor told Finance Magnates.

“Industry event panels made up of mostly men is a classic example of this,” she continued, adding that “they pose two challenges: first, women don't identify as readily with male only panels, and second, it reaffirms the narrative that crypto isn't for them.”

“I've heard from event organizers that there just aren't women in crypto to put on these panels, which I personally try to remediate with my ever-growing spreadsheet of women speakers who are experts in their fields," she added.

Real inclusivity versus virtue-signaling

However, the Blockchain industry needs to be careful to walk the line between real inclusivity--taking the time and effort to include female voices in the crypto conversation in a meaningful way--and virtue-signaling: the “popular modern habit of indicating that one has virtue merely by expressing disgust or favour for certain political ideas or cultural happenings” (Cambridge).

For example, “I think crypto--and businesses in general--need to stop including women in the conversation within the confines of ‘Women in Crypto’ or ‘Women in Blockchain’,” Teana Baker-Taylor said.

These kinds of panels, while they may be well-intentioned, are often tokenizing, and tantamount to the ‘pink-washing’ they may be trying to counteract: “these events, initiatives and articles don't exist for men,” Teana said.

(After all, when was the last time you saw a panel or article entitled “Men in Crypto”?)

Instead, women’s voices must be included in the conversation in the same way that mens’ voices are: for example, “the Crypto Springs events, co-organized by Meltem Demirors, Elizabeth Stark and Jill Carlson are excellent examples of successfully curating content within an inclusive environment to bring together some of the leading entrepreneurs, technologist, investors, and thought leaders in cryptocurrency to discuss and debate the future," Teana pointed out.

The gender pay gap and ‘investment gap’ may also play a role

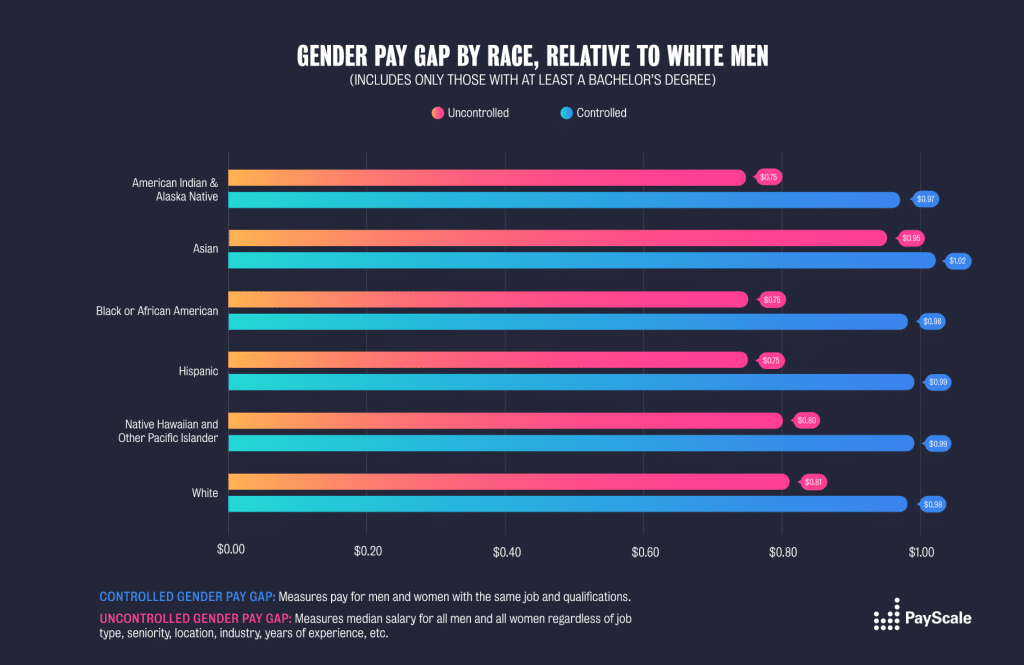

Of course, there are some aspects of the crypto user gender gap that go deeper than targeted marketing or hiring practices. The simple fact of the matter is that--while there are exceptions--on average, women still don’t earn as much as men do, even if they hold the same positions at the same companies.

Alex Axelrod, chief executive of pto-centric mobile finance service Aximetria, pointed out to Finance Magnates that “according to World Economic Forum data, the pay gap is 16% on a global average, and in some countries the gap is up to 35%.”

These pay gaps also vary greatly by race in each country (for example, according to data from Payscale, in the USA, American Indian and Alaskan Native women earn an average of $0.75 for every dollar a white man earns.)

Alex Axelrod also pointed out that, statistically speaking, “women [tend to] retire earlier, live longer (globally - on average by six to eight years), and they are more likely to take on the responsibility to care for children and elderly relatives.”

Alex Axelrod, chief executive of Aximetria.

Analysts at Merrill Lynch have also estimated that by the time women retire, the difference in the total income of American women and American men reaches $1 million, due to women spending a lot of time caring for their loved ones while men continue earning.

At an event in November, Wall Street veteran Sallie Krawcheck also pointed out that even when women do have access to extra money, they are less likely to invest.

“Women today invest less than men do. Women today leave the majority of their money in cash. Men today have the minority of their money in cash,” Ms. Krawcheck said, adding that “this ‘gender investing gap’ costs women hundreds of thousands, and some of your clients millions of dollars, over the course of their lifetimes — for some women, [it costs] more than the gender pay gap does.”

The reasons behind this ‘investing gap’ are various, but they do not include postulations like ‘women are bad at investing’ and ‘women don’t understand money’--additionally, they do not include the misconception that women are less likely to take risks than men: “at Ellevest, our research shows women are not risk-averse but risk-aware,” Ms. Krawcheck said. “The gender difference is that we want to understand risk before we take it.”

”A key foundation of the token economy is the democratization of finance.”

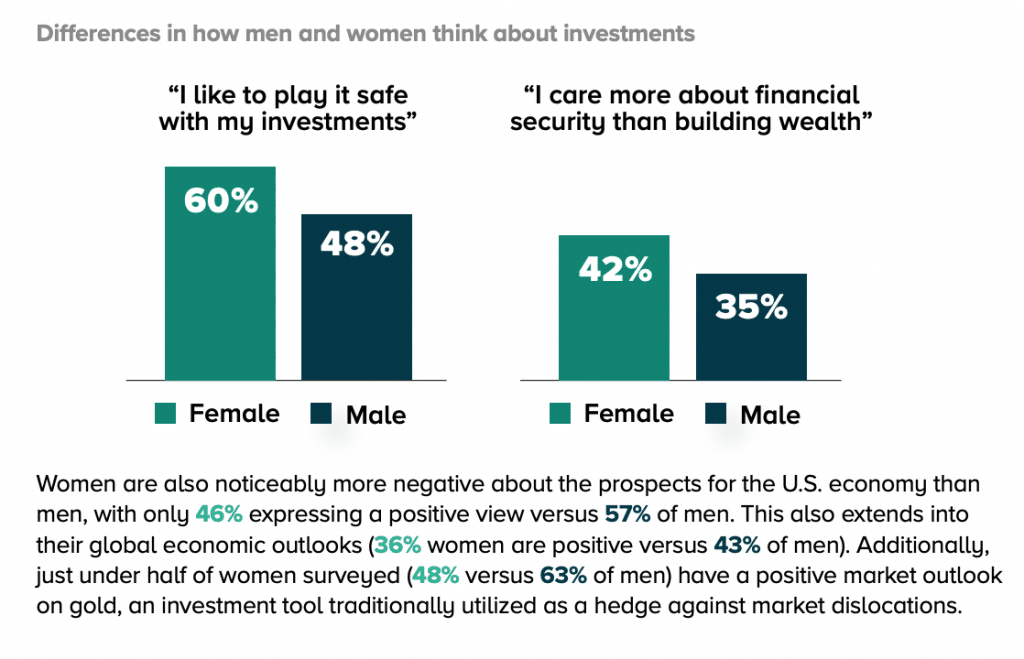

Teana Baker-Taylor said that the perception of women as wary of financial risk could come from the fact that “women are often responsible for managing their family finances.”

This could lead to the perception that women are “more risk-averse investors,” she said.

In a study published earlier this year, Grayscale found that women are increasingly likely to care more about preserving their financial security than building their wealth.

Source: Grayscale (Investing in Bitcoin: Perspectives from Female Investors)

Teana pointed out that “however, it’s a misnomer to assume that women aren’t looking for ways to grow their wealth, hedge risk, and earn yield to make their money work for them. They are.”

And indeed--just as crypto companies should have a vested interest in targeting more female users, they must also have a vested interest in increasing the wealth of those users.

“A key foundation of the token economy is the democratization of finance--through global access to capital creation and by creating fractional investment opportunities,” Teana said.

Is your company or a company that you know of doing this successfully? Let us know in the comments below.