Crypto prices have been getting a lot of air time so far this year and for good reason.

After all, Bitcoin has shown signs of stabilization above $30,000; at press time, BTC was pushing $35K. And, Bitcoin’s good fortune has long coattails as crypto prices are up across above the board.

This, of course, includes Ether (ETH).

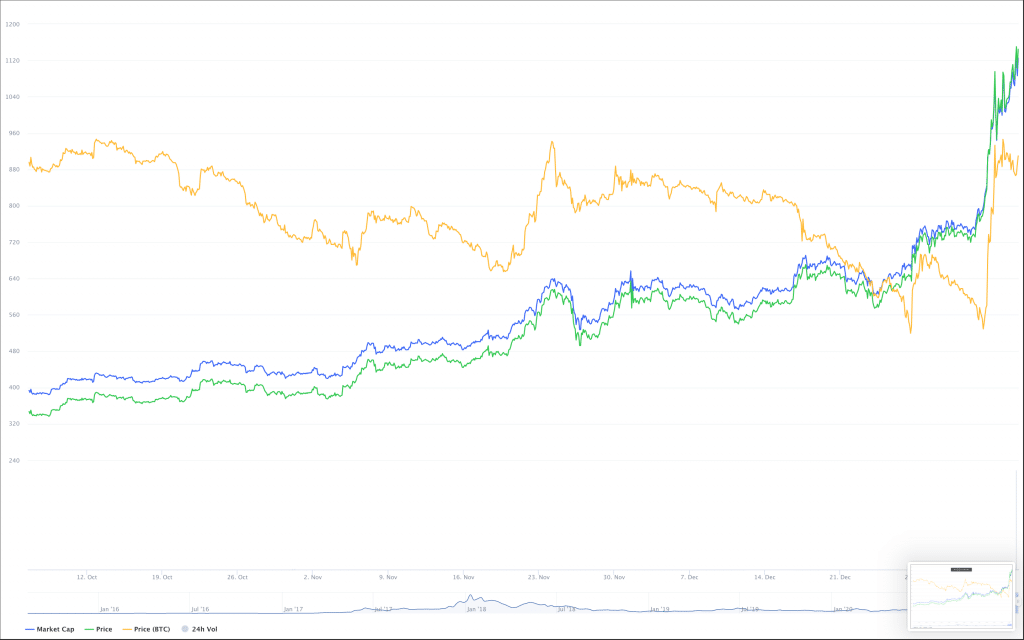

The price of Ethereum from October 6th, 2020, to January 6th, 2021 (via CoinMarketCap)

The Ethereum network has been the subject of some concern throughout the year. As the decentralized finance (DeFi) ecosystem has continued to grow, the strain on the Ethereum Blockchain has gotten more intense. Scalability issues and high gas fees have plagued the network, and while second-layer solutions are being developed to address these problems, none has taken hold.

Despite this, the Ethereum network has continued to grow, and the price of ETH along with it. At press time, ETH had spent the last 24 hours, or so around $1,100. While ETH has not yet managed to push past its previous all-time high of roughly $1,400. This price point was achieved in January of 2018.

As the DeFi ecosystem continues to grow, the viability of Eth2 draws nearer, and Layer 2 solutions move closer to launch than ever, Ethereum could be poised to grow even more.

What exactly is driving the price of ETH up? And will the rally last?

How Much of the ETH Price Rally Can Be Attributed to Bitcoin’s Price Increase?

A number of analysts have said that a large portion of ETH’s recent rise is due to Bitcoin’s recent price action which may or may not be sustainable for ETH in the long term.

“As bitcoin goes through a bull run, it drives more interest in crypto overall,” said William McCormick, Communications Lead at cryptocurrency exchange, OKCoin, to Finance Magnates.

“As bitcoin topped out around the $34k level, we saw rotation out of BTC during this period,” he said. In other words, traders exited their BTC holdings in favor of altcoins to try and gain higher returns.

Will McCormick, Director of Communications at global cryptocurrency exchange, OKCoin.

McCormick pointed out that Ethereum’s market share surpassed 14.3% on Monday, while Bitcoin dominance simultaneously fell to 67.66%. At press time, BTC dominance had risen to 68.5% while ETH’s market share was at 13.62%.

Of course, it has not all been about Bitcoin. Will McCormick pointed out that Ethereum’s current bull run seems to have begun with the mid-December announcement that ”the CME group (the world's leading derivatives marketplace) announcing that it will release ETH futures in February of 2021,” three years after releasing their bitcoin futures products.

Maria Stankevich, Chief Business Development Officer at EXMO UK, explained to Finance Magnates that additionally, “a large number of Grayscale's ETH investors via private placements received their shares the other day. So as, Joshua Frank stated, ‘ETH's run the last few days might be in large part due to those institutions buying ETH to cover their loans.’”

Maria Stankevich, Chief Business Development Officer at EXMO UK.

High Gas Fees on the Ethereum Network Are a “Liability”

Beyond possible speculation and institutional activity related to ETH, there is evidence to suggest that ETH’s price has been growing because people are actually using it, particularly within the DeFi world.

“Ethereum is certainly being utilized more as a network,” Will McCormick told Finance Magnates. “Total value locked (TVL) up in Defi protocols built on Ethereum has jumped $4B to more than $18B in 2021 alone.”

Of course, a 350% increase in TVL in the DeFi ecosystem does not necessarily correlate to a 350% increase in the number of users within the DeFi ecosystem. Still, many analysts agree that the figures are promising.

However, without a full transition to Eth 2.0 or a viable Layer 2 solution, increased usage on the Ethereum network could spell trouble.

“In this period of investment and speculation, gas fees are very high,” said Will McCormick, adding that fees were as high as “between $25 and 75 per swap” as of Monday.

Gas fees are the price paid to miners on the Ethereum network to execute transactions. As it currently stands, gas fees are not fixed; they fluctuate depending on network traffic.

In a piece for CoinDesk in October 2020, Education Ecosystem Co-founder, Michael Garbade explained that “under the current conditions, [high fees are] economically impossible. In the end, there is no incentive for using the Ethereum network. At worst, it becomes a liability.”

Are Transactions on ETH Getting Too Expensive

Still, as long as the token price is as high as it is now, high swap fees may not be such a big problem: “the upside in price movement is still so high that is a cost investors are willing to bear for the returns in price increases,” McCormick said.

However, this too shall pass: “to realize the vision of a ‘web 3’ decentralized web, the gas fees are entirely unsustainable and will be difficult to move beyond financial dApps,” he explained.

Jamie Finn, President & Co-Founder of Securitize, also told Finance Magnates that while the network is getting more usage, “you will have many developers search for another chain since it's getting too expensive to process a transaction.”

Jamie Finn, President & Co-Founder of Securitize.

For example, “right now it costs $17.00 to process a transaction,” he said on Tuesday. “This is untenable for most people unless you are using it for large transactions. For example, if you want to generate yield, you would need to spend $17 to get into the ‘deal.’”

If this is the case, you are “basically starting out at -$17,” which “is fine if you are deploying $100,000,” Finn explained.

However, “most people are only deploying $100-$1000, which means the yield is negative for a long time,” he said. “As an example, if you were to invest 1 ETH into a UniSwap pool, you would be paying $75 in fees right now.”

Ethereum Trudges toward Eth 2.0

Therefore, it could be a while before Ethereum is really ready to act as the 'rails' of a truly decentralized financial industry: “Eth 2.0 just started a three-year journey,” Will McCormick.

For the time being, “it has by far the largest developer community of the smart contract chains,” and is, arguably, therefore, the most viable of the existing smart contract chains to act as the backbone of the future of the DeFi ecosystem.

Still, Ethereum’s position in the future is not guaranteed: “should [Ethereum developers] struggle to address the scalability issues, then Polkadot, Avalanche and other [smart contract-enable chains] could gain more traction.”

Indeed, “Ethereum has a long way to go to improve the network and scale, while DeFi is just getting started so it has clearly been seen as a strong speculative asset into the future.”

“The Inventive Model of the Ethereum Network Is Broken and Needs to Evolve.”

However, Securitize’s Jamie Finn pointed out that even if Ethereum’s scalability issues are adequately addressed, high fees on the network may still be an issue.

“The current issues are more related to costs as opposed to scalability,” he explained. “That said, if the network scaled further, perhaps the costs would drop further, but that remains to be seen.”

In fact, Finn believes that Ethereum may be due for a fundamental change before it can be truly viable as the backbone of the future DeFi world: “fee-based networks such as Ethereum have the wrong economic model when you compare it to the more traditional economic models,” he said.

Transactions on Ethereum “currently get more expensive to use the more the network is used, which is the opposite of what would be expected with an economy of scale where transactions get cheaper as things scale up,” he explained. “The inventive model of the Ethereum network is broken and needs to evolve.”

Eth to the Future...

Still, Ethereum is making progress towards transformation, and, as a result, toward price stabilization.

Tim Sabanov, the Lead Technical Architect at Zumo, told Finance Magnates that the “first stage of Eth 2.0 went live in December, attracting validators wanting to participate in staking.”

Each of these validators needs “to deposit a minimum of 32 ETH to participate,” he explained. “That ETH is then locked until the release of Phase 2,” which will happen in 2022 at the earliest.

“Currently, there are already over two million of all available ETH locked” in the network, a figure that Sabanov said he expects “to steadily increase in the upcoming months.”

This seems to indicate that the price of Ethereum could be more stable over the next several years. However, Securitize’s Jamie Finn said that in his mind, the best-case scenario involves a lower price point for ETH tokens.

Tim Sabanov, the Lead Technical Architect at Zumo.

“In our best case we would like to see ETH drop to $200-$300 per coin and get more capacity into the network so that developers and users can use the network in a way where the fees don’t exceed the benefits,” he told Finance Magnates.

What do you think about the future of ETH and the Ethereum network? Let us know in the comments below.