When Bitcoin encouraged many startups to create distributed ledger-based digital currency, Ripple saw the potential in the underlying technology and created a decentralized Payments network controlled by centralized nodes.

Ripple aims to approach banks and financial institutions and use Blockchain technology to make the sluggish cross-border payments infrastructure efficient, promising instant transfers. Its competitor is SWIFT and not the banking system.

Indeed, the company partnered with hundreds of banks and financial institutions over the years across the globe, onboarding them into its network. It even formed a joint venture with Japan’s prominent financial conglomerate, SBI Holdings, to promote its products in the region.

Similar to any other decentralized ecosystem, Ripple’s products are fueled by its native XRP token, a “digital asset built for payments.”

“Ripple’s ODL relies on XRP as an intermediate currency for cross-border remittances,” Apifiny’s CEO Haohan Xu explained.

Criticisms and the Final Push

Though XRP was marketed as a cryptocurrency, a major section of the crypto community believes that the token is too centralized to be a crypto. Ripple even controls the supply of XRP.

Another heated debate was alleging that XRP is a security, not a currency. This claim oozed the US financial market regulator as on December 23rd it officially filed a lawsuit against Ripple for selling unregistered securities. The complaint also named Ripple Labs CEO, Brad Garlinghouse and Executive Chairman, Chris Larsen.

“From at least 2013 through the present, Defendants sold over 14.6 billion units of a digital asset security called 'XRP', in return for cash or other considerations worth over $1.38 billion...to fund Ripple’s operations and enrich Larsen and Garlinghouse,” the summary of the lawsuit read.

Ripple hit back at the regulator outside the court, saying it is harming “countless innocent XRP retail holders with no connection to Ripple.”

A very important reminder!

Thus far the world has heard the SEC's version of reality. The legal process will unfold from here and the world will have a much more robust and complete picture of the facts soon. https://t.co/dcXQkNHZnK — Brad Garlinghouse (@bgarlinghouse) December 24, 2020

Delisting and Price Drop

The statement came as Ripple started to experience the impact of the lawsuit within hours after the confirmation announcement by the SEC. Crypto exchanges started to delist XRP, which is potential security.

“The most important complication the exchanges that are available in the US will face, if XRP, a digital currency associated with Ripple, will be seen as a security token,” Maria Stankevich, Chief Business Development Officer at EXMO UK, told Finance Magnates. “So, if SEC sees it as a share of stock, it must be registered with the commission from the beginning more than seven years ago.”

Many crypto exchanges, including Coinbase, OKCoin, Bittrex and Bitstamp decided to suspend XRP trading. CrossTower, a small crypto exchange, even delisted the token after a warning by Garlinghouse on a possible lawsuit against Ripple.

Interestingly Hong Kong-based OSL became the first to delist the token after the SEC’s confirmation on the lawsuit.

Please note: In light of US Securities & Exchange Commission’s enforcement action against Ripple Labs & 2 of its executives, we have suspended all #XRP payment in and trading services on the OSL platform, effective immediately and until further notice.https://t.co/EXJJEHMawn

— OSL (@osldotcom) December 23, 2020

“The exchanges that operate in the US are compliant with SEC laws, and if XRP really turned out to be a security, it will be illegal for them to have it on the platform,” Stankevich said.

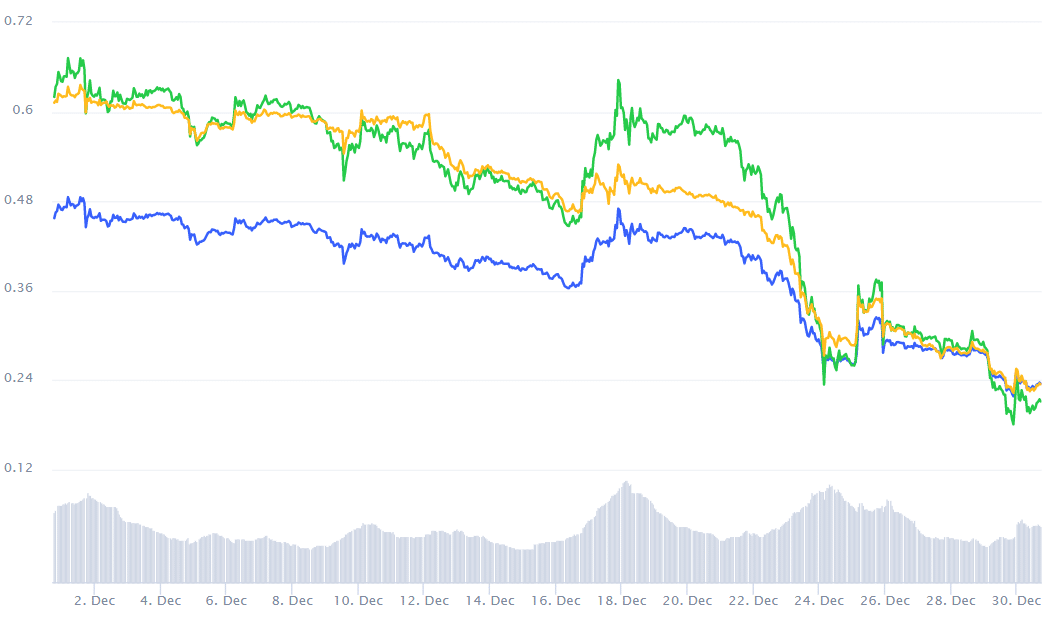

This delisting marathon severely impacted the price of the XRP token: it was trading at around $0.52 before the announcement of the lawsuit, and it is trading at $0.20 apiece, as of press time, shedding over 60 percent of its value.

XRP price chart, Coinmarketcap.com

However, many global exchanges like Binance and Huobi are still offering XRP trading.

“Non-US exchanges may still choose to trade it. But, if Ripple is unable to continue to make listing fee payments to these exchanges, there aren't many incentives to trade the coins,” Arca’s Chief Legal Officer, Phil Liu, said.

He further pointed out the influence of the SEC on other international regulators. “The SEC is a globally-influential regulator and to the extent, the SEC makes allegations of impropriety against an issuer, that always increases the risks that an exchange will be liable for not doing more to protect its customers' interests.”

XRP Is Ripple’s Core

Though the lawsuit itself is a demoralizing factor for Ripple, the company’s dependence on the token for its business and fundraising is upsetting.

“XRP has essentially accounted for the majority of Ripple’s revenues,” Prometheum Co-founder and Co-CEO, Aaron Kaplan said. “Without the XRP treasury, Ripple will have to pair down operations to be more in line with non-XRP related business activities.”

Indeed, Ripple’s on-demand liquidity (ODL), one of its flagship services, depends on XRP as an intermediate currency for cross-border remittances.

“Inadequate liquidity will increase the volatility of XRP and bring unpleasant experiences like large slippage to Ripple’s partners,” Xu warns.

Additionally, Ripple is heavily dependent on XRP for funding. The SEC lawsuit specifically pointed out the $1.38 billion raised by the company over the years.

It burnt XRP’s at a rate of around $275M per year in 2018, and its products are still unprofitable.

“Ripple, the company, maybe insolvent by the end of 2021 if it can't raise money by selling XRP, and its other products aren't profitable,” Liu said.

“I don’t see a viable alternative to replace XRP sales except to move out of the US and exclude US investors from buying XRP. They would have to start from scratch because all XRP profits would be disgorged since they all occurred when Ripple was a U.S.-based company.”