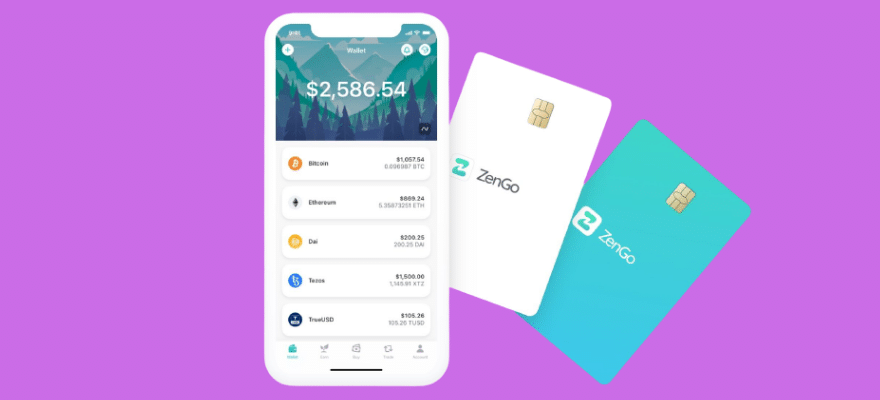

Israeli crypto wallet startup, ZenGo announced on Tuesday that it has joined Visa’s Fintech Fast Track program and is gearing towards the launch of a new payment card.

Though the company did not reveal much information about the upcoming crypto payment card, it will be first released in the United States. ZenGo has further plans to issue the card at other global locations.

Commenting on the development, ZenGo CEO, Ouriel Ohayon said: “This is an important step forward in our quest to make cryptocurrency useful and usable by everyone. Payments is one of the most important and underserved needs of our industry and we are excited to work with Visa on this.”

Will the Supply of Crypto Cards Hype the Demand?

ZenGo is one of many cryptocurrency wallet platforms, but the startup is trying to make the digital asset storage process simpler and safer. The company is using the so-called threshold signatures, which requires ZenGo’s servers and user smartphone to initiate any transaction. In case of loss of the device, the user can restore funds, but the startup will not have access to the Cryptocurrencies .

Similar to any other Visa card, the ZenGo card will be accepted by all Visa-enabled merchants for both online and offline transactions. It will be directly connected to the crypto wallet, allowing users to spend directly in crypto.

“As the preferred network for digital currency wallets, we are excited to help innovative fintechs like ZenGo harness the value of Visa's network,” Cuy Sheffield, Head of Crypto at Visa, added. “Through the Fast Track program, we can support ZenGo with access to Visa's experts, technology, and resources to scale with efficiency.”

Many other crypto companies, including Wirecard, Fold, and KiplePay, also partnered with Visa for issuing similar crypto cards.