The approval of a regulated crypto derivative this year is now looking far less likely, as the US regulators have once again deferred its decision on whether to approve the Bitcoin ETF proposed by asset manager Bitwise.

Per an official document published by the Securities and Exchange Commission (SEC), the new deadline to review Bitwise proposal has been shifted to undisclosed date, as the agency needs more time to review the potential rule change further.

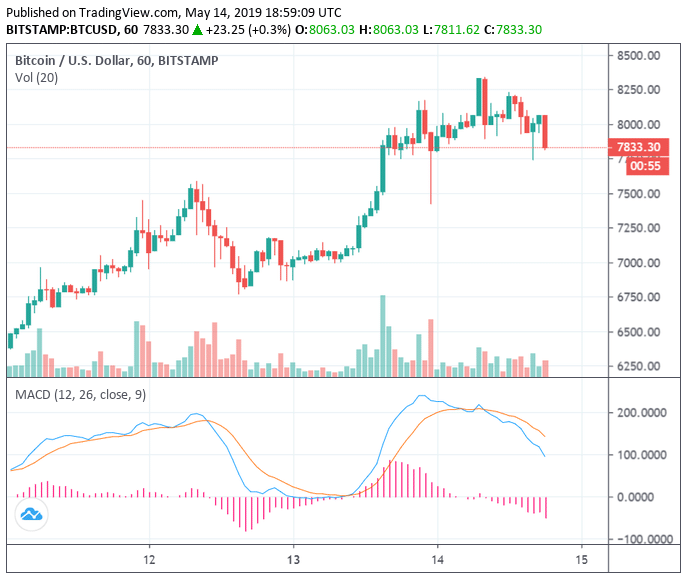

Cryptocurrency markets fell as a result. Bitcoin prices pushed lower in the last few hours from its one-year high it hit earlier in the session to trade around $7,900 at the time of the report. At this level, it had declined roughly five percent from its intra-day high of $8,335.

There are a number of applications underway to get a bitcoin ETF listed, but so far none have been approved by the SEC. The San Francisco-based firm has filed its initial registration earlier in January, joining the race to launch a physically-backed bitcoin exchange-traded fund (ETF).

Earlier in late March, the regulator pushed the deadline to make a decision on the proposed ETF to mid-May. Prior to this date, a decision was expected no earlier than April 1, 45 days from the time the application for the fund was published in the federal register.

The company filed with the US top watchdog for a regulated ETF that would track its Bitwise Bitcoin Total Return Index. Bitwise explains that the index aims to capture the total returns available to investors in the world’s largest crypto asset, including “any meaningful hard forks.”

The race to crypto ETF stumbles

Bitwise says its proposed ETF differs from previously-filed similar proposals in that it will safeguard holdings in 100% Cold Storage with an institutional, regulated third-party custodian and as the index draws prices from a large number of cryptocurrency exchanges.

If approved, NYSE Arca, the exchange owned and operated by the Intercontinental Exchange (ICE), will host the proposed listing while Bitwise Index Services will produce and manage the bitcoin ETF.

Bitwise is the second to apply for a physically-backed exchange-traded product. The first was Blockchain technology company SolidX, which filed with the SEC in collaboration with money management firm VanEck.

While some had argued that the proposal from New York-based VanEck, the ninth biggest ETF provider, was more likely to gain approval thanks to its plans for a high minimum share price, the US regulators have once again rescheduled its decision back in December. One month later, VanEck shelved its proposal for the coveted bitcoin license.