The cryptocurrency market in Poland is set to face increased oversight as the government moves to implement the European Union's Markets in Crypto-Assets (MiCA) regulation into domestic legislation. The draft law, which aims to regulate and supervise the issuance, trading, and provision of cryptocurrency services, will grant the Komisja Nadzoru Finansowego (KNF) new powers, including the ability to block crypto accounts.

KNF to Gain Power to Block Cryptocurrency Accounts in Poland

Under the proposed legislation, the KNF will have the authority to independently block the accounts of cryptocurrency holders for 96 hours (4 days) if there is suspicion that a transaction may be linked to the commission of a crime. With the consent of the prosecutor's office, this initial blocking period can be extended for up to six months.

"In the event of a suspicion that a transaction may be linked to the commission of a crime, the KNF will be able to independently block the accounts of cryptocurrency holders,” Izabela Deryło, a tax expert associated with the Warsaw office of law firm Wolf Theiss, explained the implications of this new power to Business Insider.

The announcement of these new measures has caused concern among cryptocurrency investors in Poland, as the rationale for account blockades remains unclear. Experts point out that the lack of clarity surrounding the grounds for blocking accounts could lead to uncertainty and potential misuse of this power.

"This is another regulation that is causing considerable controversy, following an attempt a few years ago to push through very unfavorable rules for taxing cryptocurrencies," Arkadiusz Jóźwiak, a cryptocurrency trader, analyst, and Editor-in-Chief of the financial portal Comparic, tells Finance Magnates. "Given the aversion that the KNF has shown towards cryptocurrencies so far, the ability to preemptively block accounts based on mere suspicions may, unfortunately, be excessively used and abused."

Although the Polish government and the Financial Supervision Authority (KNF) claim they are implementing new regulations in accordance with the European MiCA requirements, the European legislation does not mention the preventative blocking of cryptocurrencies on user accounts. This "addition" was introduced locally, and Poland is known for such solutions. A similar situation occurred in 2018 when ESMA restricted FX/CFD trading. At that time, the KNF also introduced its modification to European rules.

Recently, the KNF awarded a Virtual Asset Service Provider license to Ouinex, a forthcoming cryptocurrency exchange.

New Authority in the Hands of the KNF by This Year

News that Poland is moving to regulate cryptocurrencies , which will be under the direct supervision of the KNF, started to emerge early this year. According to these reports, in the second quarter of 2024, the government plans to introduce regulations that will enable the regulator not only to block accounts but also to impose financial penalties on companies operating in the cryptocurrency market. This initiative follows the adoption of MiCA regulations introduced in the European Union.

The official statement highlighted that the introduction of this new legislation is driven by the necessity to establish a legal framework for the proper operation of cryptocurrency markets. It aims to ensure effective supervision and protection of investors by equipping the KNF with the necessary tools to achieve these objectives.

The initial efforts to regulate the cryptocurrency market in Poland began in 2020. In the years that followed, the digital asset market in the country has operated without a detailed legal structure, with only its taxation aspect being clearly defined. During this period, the KNF consistently cautioned investors about the high risks linked to investments in digital assets.

With the newest developments, Poland is set to become part of the expanding list of European nations where the local regulatory bodies govern the cryptocurrency market. This group includes the UK's Financial Conduct Authority, which issued new guidelines in November during a period of turmoil in crypto marketing .

Poland Crypto Market vs Europe

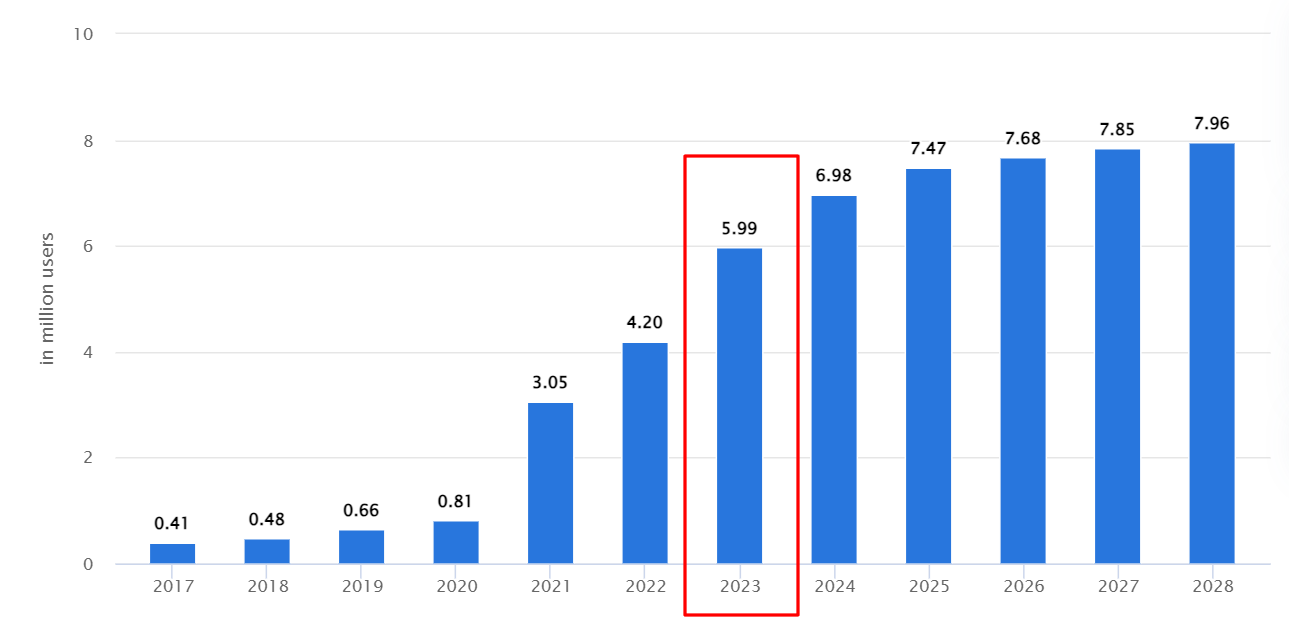

According to data from Statista, 6 million Polish citizens, representing 15% of the population, used cryptocurrencies last year. In 2024, the number is forecasted to increase by an additional million.

In comparison, the same source notes that Europe had 141 million cryptocurrency users in 2023, meaning 4% of them were from Poland. France saw 12.5 million people trading in cryptocurrencies, while Germany had 15 million users.

Cryptocurrencies are hugely popular in Poland, but due to an unfavorable regulatory climate, no major local cryptocurrency exchanges currently operate in the country. Just a decade ago, there were many of them, including the Polish BitBay, which was once among Europe's largest crypto exchanges. Eventually, it rebranded to Zonda and moved its operations outside of Poland. The Kanga Exchange, still active in the Polish market, is relatively small, and although it promotes itself as Polish, its headquarters are also located abroad.

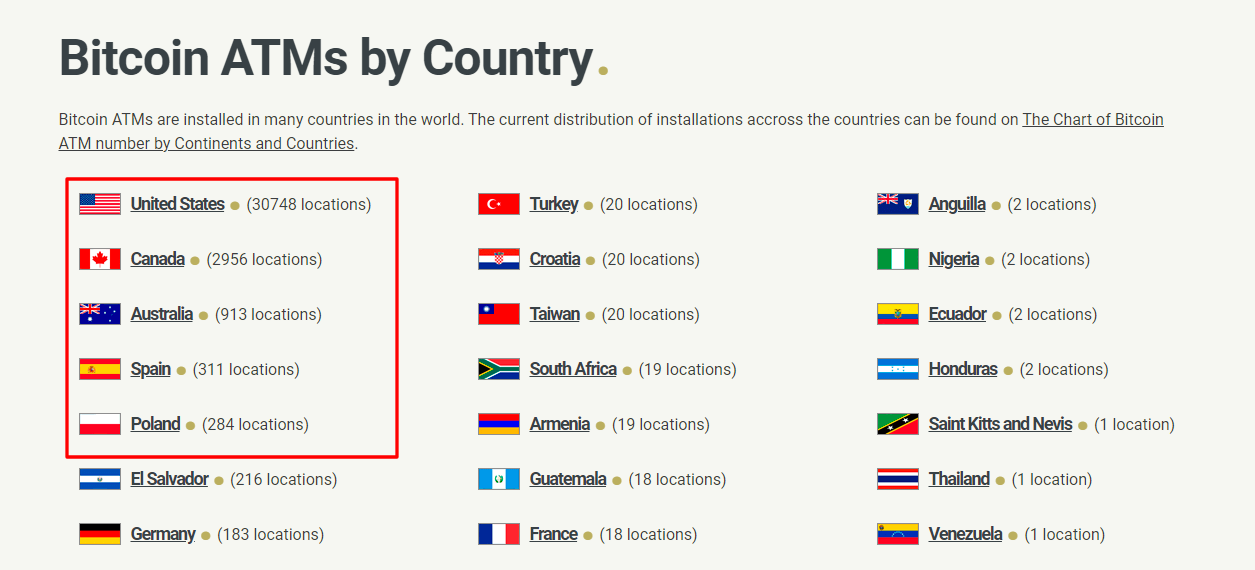

However, cryptocurrency ATMs and physical crypto exchange offices are booming in popularity. The country ranks fifth worldwide in the number of cryptocurrency ATMs, with just around 300 devices.

Clear regulations introduced by the MiCA and implemented in their local version by the KNF could clarify the regulatory situation and increase the chances of a new exchange emerging in the local market. This is particularly significant considering the millions of potential clients at stake.