The Australian Securities and Investments Commission (ASIC) has issued a warning about the rise in suspected investment scams propagated through social media advertisements. These scams lure individuals with investment opportunities and tips, often leading to their inclusion in WhatsApp groups.

Increasing Scams

In an announcement today (Tuesday), ASIC reported receiving complaints from several consumers who invested money and paid fees into suspected scams, only to find themselves unable to access their funds.

“ASIC is encouraging consumers to exercise caution when investing their money, particularly by avoiding clicking on investment ads on social platforms that offer share trading tips or promise very high returns. Consumers should also refrain from sharing personal information or identity documents,” the regulator said.

ASIC also mentioned that an “overseas regulator” has issued a similar warning, although the specific authority was not named.

In its statement, ASIC highlighted two unlicensed platforms, Juhbz and Ptounx, which are frequently linked to these scams. The regulator noted that while the names of the associated websites and brands often change, these two names commonly appear.

Neither of the platforms holds an Australian Financial Services (AFS) licence, which is a legal requirement for offering investment services in Australia.

How the Scams Operate

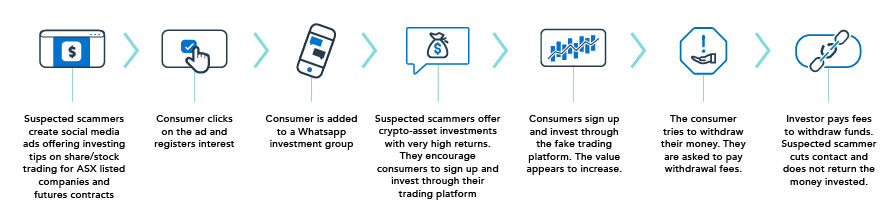

ASIC detailed the process used by scammers, starting with social media ads that promote investment tips. When individuals show interest by clicking on the ads, they are added to WhatsApp groups. Some victims are also invited to join “exclusive” chat groups.

The scammers in these groups promote risky crypto-asset investments, promising high returns. They push victims to participate in initial coin offerings (ICOs), initial decentralised exchange offerings (IDOs), or trade crypto-assets through specific platforms.

Although the ads initially appear to target regulated stocks, the actual offerings revolve around crypto assets. Fraudulent platforms often manipulate figures to show false profits, or show losses to pressure victims into making further investments.

When victims attempt to withdraw their funds, they are asked to pay fees or taxes, yet the funds remain inaccessible even after payment.

These scams are widespread and have led to warnings from regulators around the world. While ASIC issues such alerts occasionally, its counterparts in Europe and the United Kingdom frequently flag suspicious platforms. In some jurisdictions, authorities even block access to domains associated with these scams.