South Korea's cryptocurrency industry is bracing for an impending shakeup as policymakers set their sights on regulation. The government's primary objective is to safeguard investors by stamping out any fraudulent activities that may be lurking within the industry's dark corners. While the specifics of these regulations remain unclear, one thing is certain: change is coming.

FIU Takes Action

South Korea has been actively engaged in the regulation of its digital asset market. In the latest development, the country's Financial Intelligence Unit (FIU) has taken stringent measures against five cryptocurrency exchanges, namely Bithumb Korea, Coinone, Dunamu, Korbit, and Streami, for their blatant disregard of regulations pertaining to the reporting of irregular crypto trading. The exchanges have been found negligent in their duty to monitor and report suspicious transactions diligently, resulting in the discovery of several instances of irregular trading practices. The detected irregularities include using borrowed-name bank accounts for transactions and grossly insufficient internal controls.

Notably, the FIU unearthed one case of a 95-year-old man engaged in late-night trading of over 30 different types of cryptocurrency, covertly splitting his money into smaller amounts to avoid detection. In another instance, a customer repeatedly withdrew money promptly after large virtual asset deposits had been made, raising suspicion of wrongdoing. On top of these, the FIU found that one of the board members of a cryptocurrency exchange was involved in transactions using their spouse's name, further underscoring the lackadaisical attitude towards internal controls.

As a result, the FIU has levied substantial fines and issued disciplinary warnings on the exchanges, with the potential to order further improvements if the corrective actions taken by the exchanges are deemed inadequate. The fines amount to a staggering 490 million won, and the exchanges have been given a strict deadline of three months to address the identified suspicious transactions. The neglect of duty by the cryptocurrency exchanges and the discovery of various irregular trading practices emphasize the urgent need for stricter regulations and improved monitoring mechanisms to thwart illegal activities such as money laundering in the crypto market.

Parliament Expected to Pass New Digital Asset Bills

The South Korean parliament is expected to pass a bill regulating the digital asset market in April 2023, which was proposed at the end of 2022. Currently, 18 digital asset bills are being debated in the Political Affairs Committee of the National Assembly of South Korea. These bills are part of the proposed Virtual Assets Act, which aims to regulate the digital asset market in South Korea. The bills cover a range of topics, including amendments to the Exchange Act and the Specific Financial Information Act, and the establishment of new regulations.

Out of the 18 bills, 11 are related to virtual assets, 4 are amendments to the Exchange Act for electronic financial services, 2 are amendments to the Specific Financial Information Act, and 1 is related to establishing financial institutions for digital assets. The parliament members have expressed their belief that the bill to regulate the digital asset market would likely be passed in April, owing to the intense debates that have been taking place in the Political Affairs Committee, with members narrowing their differences. Members of the first subcommittee have shown a keen interest in the bill and are expected to pass 18 digital asset bills by the end of the month.

The regulatory landscape for cryptocurrencies in South Korea is rapidly evolving, with new laws being proposed and enforced in response to the growing popularity of digital assets.

Actions Determine the Future

The government is willing to take legal action against crypto companies that engage in fraudulent activities. South Korean prosecutors also seek to extradite Do Kwon, a crypto entrepreneur accused of a multibillion-dollar fraud, to face charges in South Korea. Do Kwon was taken into custody in Montenegro, and South Korea and the US requested his extradition. There have also been attempts to arrest another Co-Founder of Terraform Labs, Shin Hyun-Seung, or Daniel Shin, in connection with the investigation into the collapse of the Terra-Luna cryptocurrency. Still, a South Korean court has twice dismissed the request for his arrest. This suggests that the government is willing to take legal action against crypto companies that engage in fraudulent activities.

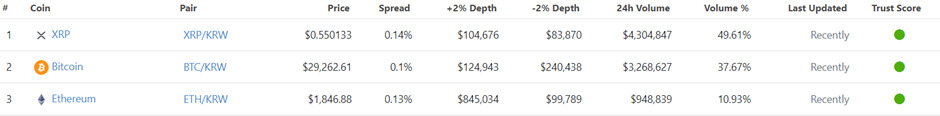

With protecting their investors in mind, the domestic market has picked up a lot of confidence. They have seen a resurgence of cryptocurrency trading, particularly in XRP tokens. The trading volume for XRP has spiked to billions of dollars on top Korean exchanges like UpBit, Bithumb, and Korbit. In fact, XRP has overtaken Bitcoin in volume on the top 4 Korean exchanges.

Source: CoinGecko

They are taking steps to regulate the cryptocurrency industry and protect investors. There are also rumours that regulators have started to take notice of foreign cryptocurrency exchanges operating in South Korea through various affiliate marketing programs, social trading, and decentralized wallets. It seems like they will block domestic access to foreign cryptocurrency exchanges that lack the proper registration to operate in the country in due course. Previously, FIU has notified authorities that 16 firms allegedly violated this rule. Violating the registration requirements carries a maximum sentence of five years in prison or a fine of up to 50 million South Korean won (US$38,000).

Ending Remarks

South Korea's efforts to regulate the rapidly evolving cryptocurrency landscape must be applauded for their aim to safeguard investors and combat fraud. However, the impact of these regulations could be more far-reaching and, dare I say, detrimental than initially anticipated. While well-intentioned, the imposition of rigorous regulations may deter reputable companies from entering the market and quash the spirit of innovation that has driven the cryptocurrency industry thus far. Companies may opt to relocate to jurisdictions with more lenient regulatory environments without a coherent global regulatory framework. This, in turn, could lead to a dangerous exodus of capital and talent from South Korea, leaving it in the dust.

Therefore, policymakers must take a nuanced approach that balances investors' protection with the encouragement of innovation. Perhaps, instead of going it alone, South Korea could spearhead a collaborative effort that brings together regulators from around the world to craft a regulatory framework that is both effective and equitable. By doing so, South Korea could become a beacon of progress in the cryptocurrency industry, fostering creativity and responsible business practices.

South Korea is still one of the biggest forces in the cryptocurrency space and will remain competitive for years to come if they strike a good balance.