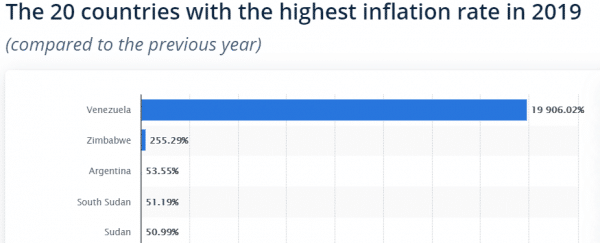

By simple definition, inflation is an increase in the price level of a selected basket of goods and services produced in an economy. The inflation rate is a concept that measures the percentage change in the prices over a certain period of time. This impacts the purchasing power of a nation’s currency, and higher inflation means a decrease in purchasing power, which leads to rising prices that affect the cost of living, the cost of financing, and the cost of doing business in a particular country. Some countries are battling with hyperinflation, like Venezuela, who were ranked number 1, with a skyrocketing inflation rate of 19,906% in 2019, according to the latest data released by Statista. Following that, Zimbabwe was placed second with an inflation rate of 255%. Then Argentina, ranked third, with a 53% inflation rate. These higher inflation rates had a negative impact on their respective currencies. Additionally, the Venezuelan Bolivar depreciated more than 1000% in less than a year against the US dollar. Not forgetting that the Argentinian Peso depreciated around 50% in the last year.

source: statista

Hyperinflation and a weak national currency opens the door for digital innovation, and what’s better than the Cryptocurrencies ? For all those people who don’t know what crypto is about. It all started with a research paper in 2008 when Satoshi Nakamoto published a paper with the title “Bitcoin: A Peer-to-Peer Electronic Cash System”. Nakamoto developed this cash system to allow Payments to be sent from one party to another without the involvement of a third party. Bitcoin, also known as “Digital Gold” gained popularity at the time and many cryptocurrencies emerged following Bitcoin with specific purpose and usability, such as Ethereum, Tether, XRP, and Bitcoin Cash to name a few. At this time, the overall market cap of cryptocurrencies stands at around $310 billion. One Bitcoin is currently worth more than $10,000 as the market cap of Bitcoin alone is around $200 billion.

So, the question here is what’s the relation between inflation and cryptocurrencies? Well, inflation is significantly helping crypto adoption. (John Boyd, Ross Levine & Bruce Smith 2001) published a research paper in 2001 with the title of “The Impact of Inflation on the Financial Sector” and discovered that the inflation rate of above 15% caused a significant drop in financial sector performance and pushed investors to find other investment alternatives. Back then, there were only two options for those investors, Gold and the US Dollar (also known as safe-haven assets), but now the popularity of Bitcoin and other crypto assets is causing a rapid adoption of cryptocurrencies in countries suffering from a high inflation rate.

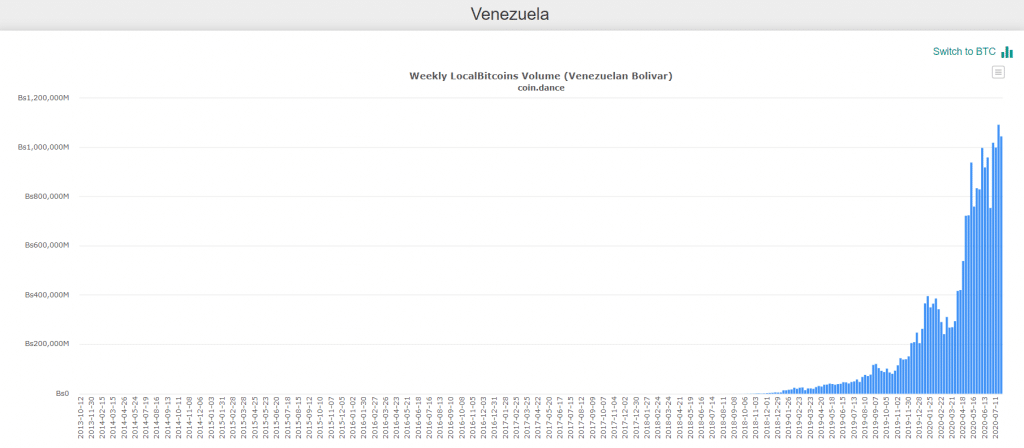

Venezuela

Venezuela’s national currency, the Venezuelan Bolivar, depreciated by more than 1000% against the US Dollar in less than a year. This inflation rate is skyrocketing and has helped non-traditional investment tools to take center stage. Presently, crypto adoption in Venezuela is booming, according to the latest report, and there are more than 20,000 businesses in Venezuela accepting crypto as a mode of payment, including a Burger King branch in the capital city of Caracas. Hyperinflation makes it difficult for local shops and merchants to store Venezuelan Bolivar, thus, making cryptocurrencies a much more stable medium of exchange. The data from LocalBitcoins, a peer-to-peer bitcoin marketplace, shows that the trading volume of Bitcoin in Venezuela reached an all-time high in July 2020.

source:coin.dance

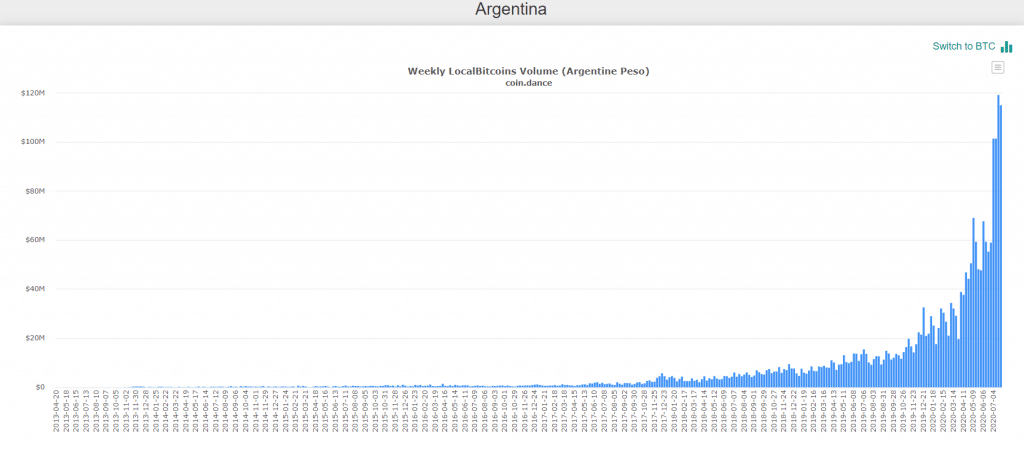

Argentina

Argentina suffered from a high inflation rate of 53%. Weak economic policies, political turmoil, and defaulted debts have accelerated currency depreciation. The Argentinian Peso, the national currency of this nation, lost more than 50% of its value in 1 year. This weak Peso is aiding crypto adoption within the country. Bueno Aires, the capital of Argentina and the most visited city in South America, is not just another tourist hotspot, it is gradually becoming the Bitcoin hotspot since more than 100 merchants in this city now accept Bitcoin. In fact, there are 11 Bitcoin ATMs in the city, and the Bitcoin trading volume in Argentina has reached a record high this month.

source: coin.dance

As stated, inflation has played a major role in crypto adoption, and most of the countries suffering from rapid inflation reported higher trading volumes in Bitcoin and other cryptocurrencies. Also, depreciation of the national currency has encouraged investors and even small businesses to store value in crypto assets in order to hedge against the devaluation of their local currency. The growing popularity of crypto assets during these difficult times shows a roadmap to an even greater adoption in the future.

Bilal Jafar is Co-Founder and Editor-in-Chief at Reefew