The increasing difficulty of mining cryptocurrencies and a further 9% drop in its price has negatively impacted Wall Street Bitcoin (BTC) miners in August. The publicly listed CleanSpark (NASDAQ: CLSK) and Bitfarms (NASDAQ: BITF) have both reported a decline in their Bitcoin production compared to the previous month.

CleanSpark and Bitfarms Report Decreased Bitcoin Production in August 2024

CleanSpark, which describes itself as “America's Bitcoin Miner,” and is one of the biggest publicly listed BTC companies by market cap, mined 478 Bitcoin in August, down from 494 in July. This represents a 3.2% decrease in monthly production. The company's average daily Bitcoin production also fell slightly, from 15.94 in July to 15.43 in August.

Similarly, Bitfarms experienced a more significant drop in its Bitcoin production. The company mined 233 Bitcoin in August, compared to 253 in July, marking a 7.9% decrease. Bitfarms attributed this decline to higher network difficulty, which was partially offset by an increase in its operational hashrate.

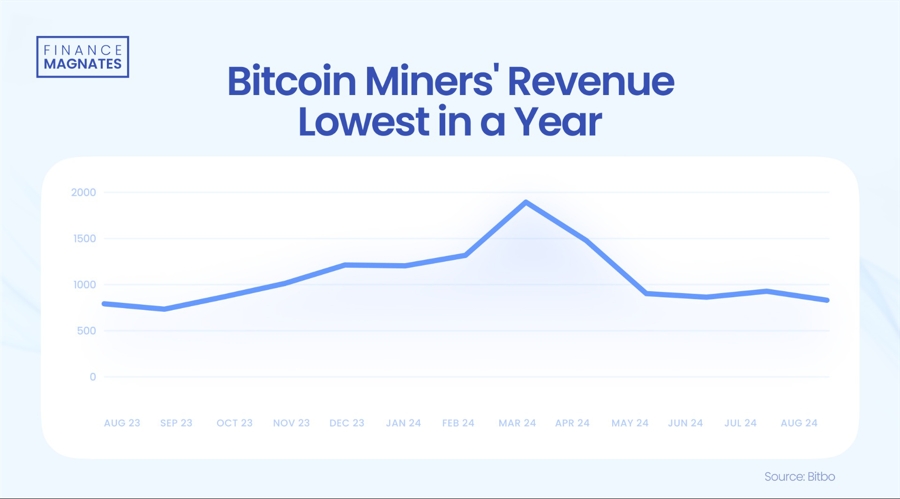

Lower mining outputs also correspond with decreased earnings. According to Bitbo data, cryptocurrency miners earned $828 million in August, marking the lowest earnings since September 2023. Moreover, this represents a 57% drop from the historical highs achieved in March of this year, when earnings nearly reached $2 billion.

Despite the decrease in production, both companies continued to expand their operations and improve their mining capabilities:

- CleanSpark increased its total operating hashrate by 1.4 EH/s during August, ending the month at 22.6 EH/s.

- Bitfarms reported an operational hashrate of 11.3 EH/s at the end of August, up 102% year-over-year and 2% month-over-month.

Battling the Adverse Trend

Both companies are pursuing aggressive expansion strategies. CleanSpark expects to bring 65 MW of additional data center capacity online in September.

“As we approach the end of our fiscal year, the team continues to work diligently to optimize fleet efficiency and increase hashrate,” said Zach Bradford, CEO. “Our fleet upgrade is well underway as we simultaneously prepare for 65 MW of capacity to be energized during the month of September. These efforts are expected to result in a meaningful increase in operating hashrate and bitcoin production as we close out our fiscal year.”

Bitfarms, on the other hand, has assumed control of its first mega-site in Sharon, PA, with access to up to 120 MW. Earlier in August, the company also acquired Stronghold.

“With this transaction, we have finalized the acquisition of 110 MW, with 30 MW expected to come online by the end of 2024,” commented Ben Gagnon, Chief Executive Officer of Bitfarms. “We have also signed a Letter of Intent for an additional 10 MW site, which will increase our total site capacity to 120 MW by 2025.”

The decrease in Bitcoin production for both companies highlights the challenges faced by miners as network difficulty increases and competition in the industry intensifies. According to the latest JPMorgan report, mining companies are still feeling April’s halving hangover.