Cryptocurrencies have evolved from a fringe concept to a mainstream investment vehicle, attracting not just individual investors but also the attention of cybercriminals. A recent report by The Money Mongers sheds light on the staggering amount of money lost to crypto hacks over the past decade, highlighting the risks that come with the rewards of investing in digital assets. In 2023 alone, criminals are illicitly earning $289,000 every hour.

The Decade-Long Tide of Crypto Hacks

Since the inception of cryptocurrencies , they have been lauded as a revolutionary financial tool. However, this digital frontier has morphed into a hotspot for hackers, leading to widespread cyber vulnerabilities. According to the “Global Crypto Heist Report,” $1.89 billion was lost in 297 crypto hack attacks in 2023 alone. This translates to a loss of $289,000 every hour for the current year.

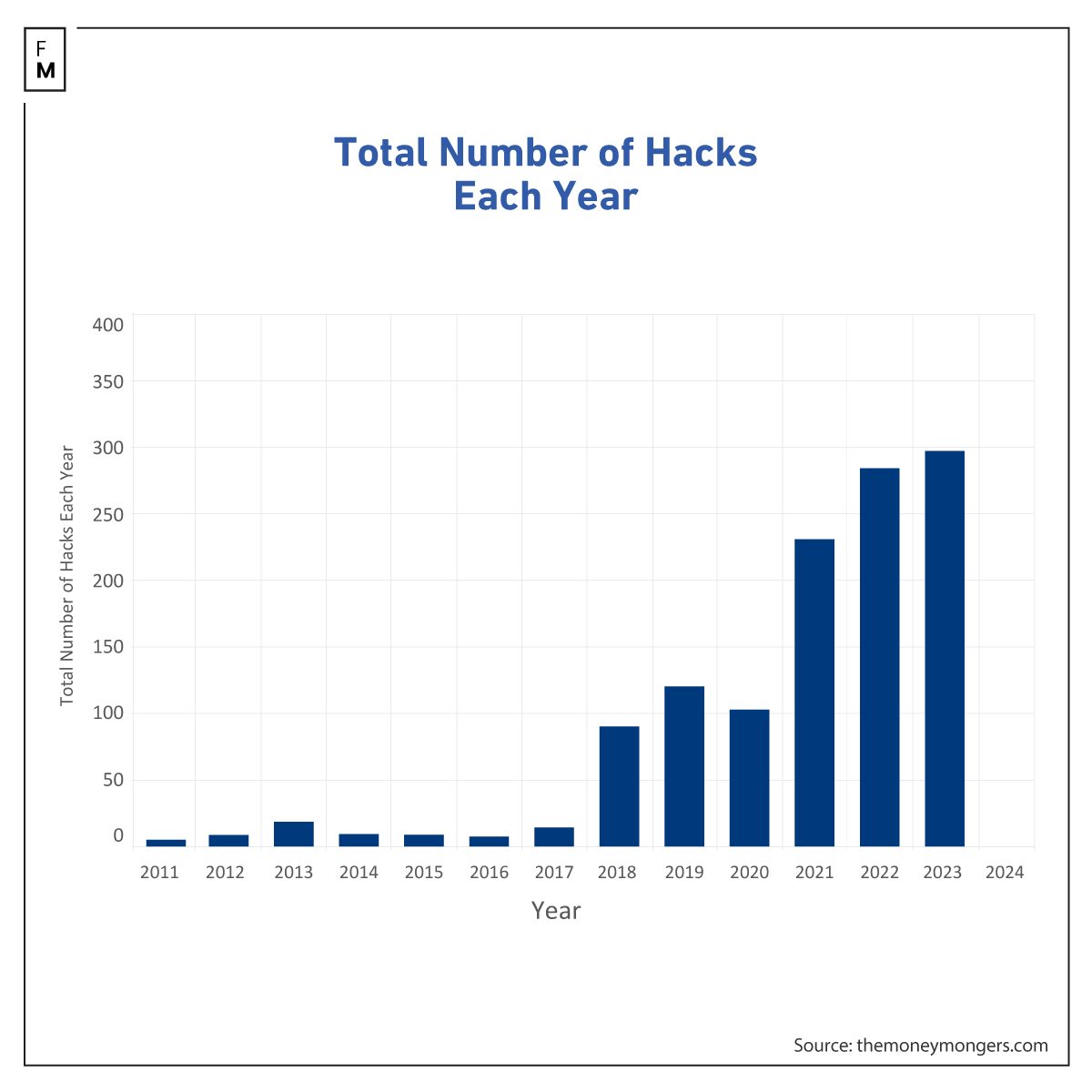

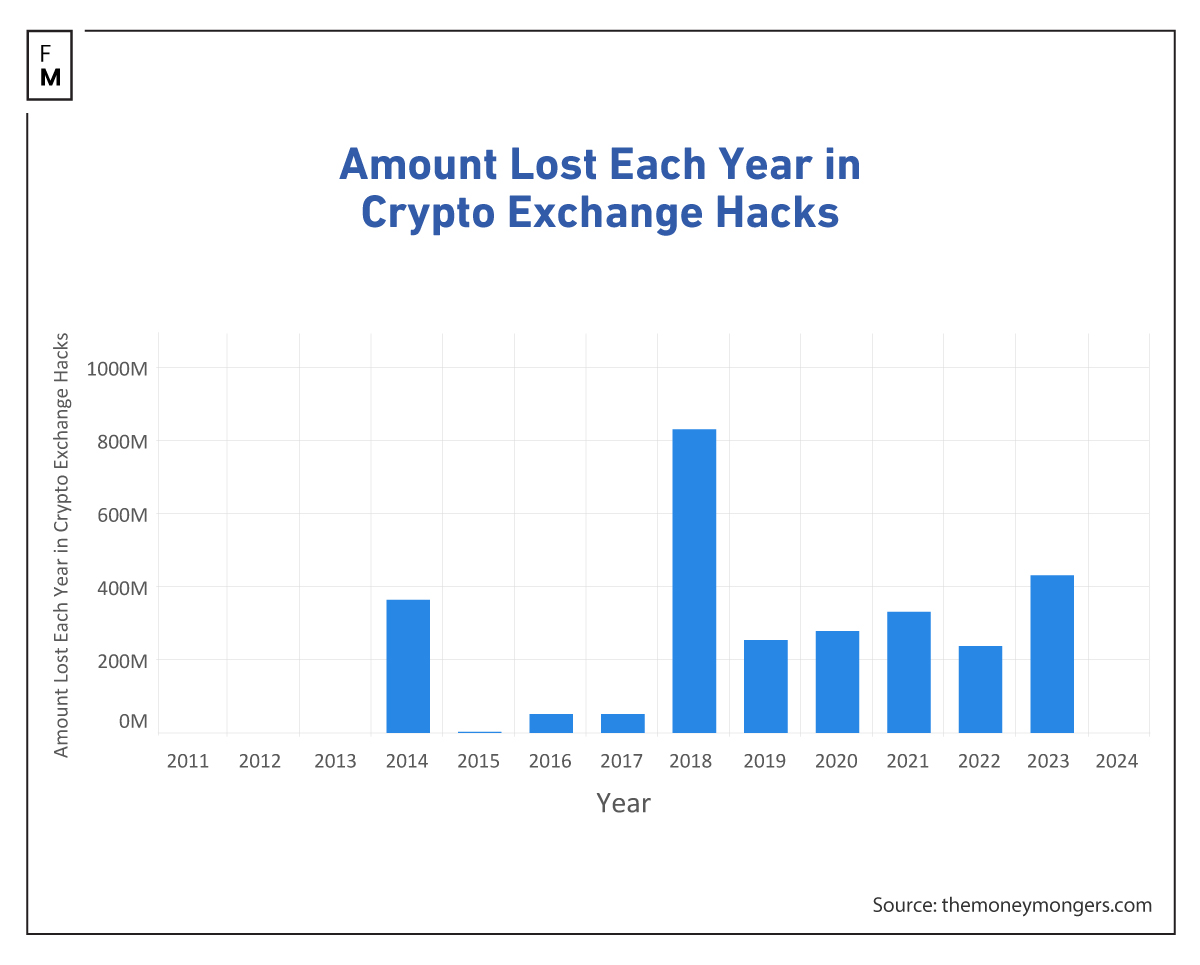

In 2022, the crypto world witnessed an unprecedented level of hacking activity. A record $3.5 billion was stolen in 284 separate incidents. This alarming trend has been on the rise since 2011, with a total of $12.36 billion lost in 1,207 incidents. The report also revealed that 192 crypto exchanges have been hacked since 2011, resulting in a total loss of $3.8 billion.

The year 2018 was particularly devastating for crypto exchanges, which lost a collective $1.1 billion to hacking and theft incidents. Decentralized finance (DeFi) platforms have not been spared either, with 93 and 76 hacks in 2022 and 2023 respectively, leading to a collective loss of $1.12 billion.

When it comes to the types of cryptocurrencies most affected, Bitcoin (BTC) and Ethereum (ETH) top the list. Since 2011, a total of 1,454,762 BTC and 1,175,082 ETH have been lost to hacks. These losses amount to $40.27 billion and $1.93 billion at current market prices, respectively.

"The research findings underscore the urgent need for fortified security in the crypto domain. As crypto matures as an asset class, its rising value has inevitably attracted more hacking attempts, especially targeting BTC & ETH,” said Sudhir Khatwani, the CEO of The Money Mongers.

The Top 10 High-Stakes Heists

Two common hacks have also been identified: contract vulnerability and flash loan attacks. These have led to a cumulative loss of $2.75 billion since 2011. The report also listed the top 10 biggest crypto hacks, which account for a cumulative loss of $4.26 billion. These range from gaming-focused blockchain networks like Ronin Network to major crypto exchanges like Coincheck and Mt Gox.

The report details the top 10 biggest crypto hacks, with Ronin Network leading the list with a loss of $625 million. Poly Network follows it at $610 million and Binance Smart Chain at $566 million. Interestingly, some hackers have returned some of the stolen funds, as was the case with Poly Network, which later offered the hacker a $500,000 bounty and a job offer for identifying the flaw in their system.

“While the potential of cryptocurrencies remains vast, these security breaches erode public trust. It's imperative for the industry to prioritize robust security measures to safeguard both investors' assets and the integrity of the crypto ecosystem,” added Khatwani.

The report additionally highlights the top 10 biggest crypto exchange hacks, which have resulted in a cumulative loss of $2.61 billion. Coincheck, Mt Gox, and FTX top this list, with losses of $534 million, $473 million, and $415 million, respectively.

“The Global Crypto Heist Report” compiled this data through multiple sources, including news articles, individual reports, and third-party security research firms. The report focuses solely on clear exploits by hackers and does not include rug pulls, exit scams, or employee theft of funds. The data only displays the total amount lost to hacks before any recovery attempts, so the actual lost amount for certain entries may vary.