One of the characteristics of any new development market or exchange that attempts to attract Liquidity and develop price discovery processes, is that for certain newly structured instruments or thinly priced/thinly traded assets, a wide difference in available prices and fragmented liquidity from one market source to the next can exist.

The essence of this phenomenon has existed for a millennial since the ancient days of commodity trading in Mesopotamia (modern-day Iraq), and was brought to light in Forex trading over the past decade, as electronic access to markets enabled arbitrage to take place at the speed of light in markets such as online currency trading, when comparing rates across various providers for the purpose of exploiting even the smallest difference.

Such arbitrage, also known as scalping, appears to have already surfaced with Bitcoin trading, which has seen an influx of traders push prices of Bitcoin, relative to major currencies to new highs, and as the difficulty in mining Bitcoins continues to increase as well.

Normally this pricing challenge isn't as pronounced (or even existent) with certain exchange traded securities or assets that are priced under any applicable best-execution regulations, yet even for participants in the US stock markets - access to dark pools or proprietary trading firms that internalize broker-dealer customer order flow - can extract differences between bid/ask spreads, just as a market maker does. Such opportunities in more developed markets are not only rarer and infrequent, but even more fleeting.

Fees and Venue Restrictions Eat Away at Scalper's Profits

The key challenge for scalpers, even after finding arb opportunities and connectivity for trading, are fees, as the costs associated can more than eat away from any profits fetched from successful capturing of price disparities by purchase of lower asking prices and selling higher bid prices (or vice versa).

While the adjustment of fees from one Bitcoin venue to the next may provide a buffer against any successful scalping, over time, as the ease of transacting increases, the increased flow and speed of trading Bitcoins (i.e. compare to how fast/quick Forex trading can be performed today) can help to decrease the inefficiency.

This price disparity was made apparent recently, including early this week where a price spike to record highs of over $1,000 per Bitcoin on certain exchanges occured, even though rates on other exchanges were much lower at that same moment. Forex Magnates covered such price anomalies in a similar post about Bitcoin, comparing Bitstamp and Bitfinex rates for the digital currency earlier yesterday.

![Volumes capture [source: markets.blockchain.info]](https://www.financemagnates.com/wp-content/uploads/fxmag/2013/11/Volumes-capture-1024x103.jpg)

Volumes capture [source: markets.Blockchain.info]

In certain Bitcoin exchanges where it is harder to withdraw US dollars, Bitcoins appears to be selling at a higher bid price such as at Mt. Gox, when compared to that of other exchanges as of recently, thus creating a buffer through an added spread that can deter successful scalpers.

According to Forex Magnates' research, the future of mining Bitcoins may belong to large companies or investors that can afford enough mining hardware to turn a profit, as that arms race is reaching an exponential curve, as the current rate of mining difficulty is projected to make current mining systems unprofitable if such growth rates (for mining difficulty) continue. Forex Magnates previously wrote about KnCMiner, a Sweden-based firm that is looking to change that (providing mining solutions for everyone).

The real value could be in owning the asset as it becomes more scarce or harder to retrieve from the crypto-sphere where it originates. In the meantime, market share may shift for global currencies, as they are sold to purchase the digital bitcoin currency. Information on the website, blockchain.info presents recent transactions in BTC recorded to the blockchain, including successful mining efforts.

Forex Market Share and Price Volatility of $BTC

The current market cap of Bitcoin as compared with the number in circulatory existence and subsequent values in USD or EUR, can be seen in a screen-shot below from mining.thegenesisblock.com which also depicts currently the mining of the network.

Source: mining.thegenesisblock.com.

In addition, a calculator tool is provided that enables users to choose from various Bitcoin miner hardware developers and estimate projected revenues based on selected models, costs to acquire the hardware, electricity usage/costs, and projected mining difficulty rates, which point towards a very fast time decay of mining software value productivity.

For reasons like these, the arms race for mining revenue from bitcoins may have a more uncertain future for amateur miners, even though the currency itself may be widely used and adopted if it can continue to acquire market share among the world's currencies. In the diagram on the left, the mining difficulty can be seen to have increased over ten-fold in the last 90 days alone, according to information posted on mining.thegenesisblock.com.

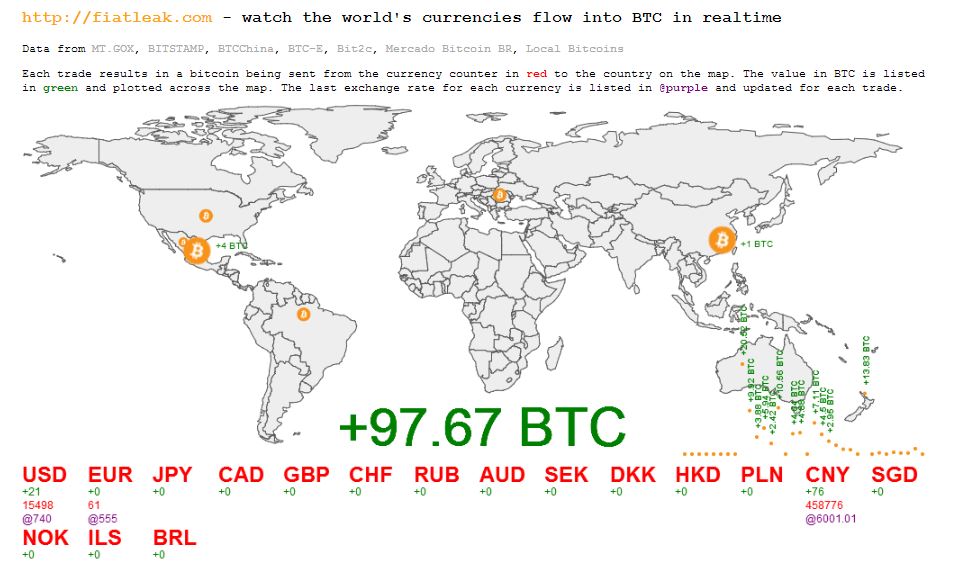

Another website that takes real-time transactions to create a visualization of the number of base currencies that are being sold to effectuate the purchase of bitcoins, depicts these transactions when taken together or individually constitute Bitcoins' gain in market share, which is simply taking up a piece of the existing market of foreign exchange markets.

Source: Fiat-Leak.com

Even though Bitcoin is gaining its piece of the overall market share of foreign exchange, Bitcoin may still be far away from becoming among the world's major currencies, or even the lesser exotic currencies in terms of any market share percentage gained (comparatively).

While the increase in prices could be followed by an equally volatile price decrease, rather than predict the next rate, the important issue that is highlighted is the inconsistency in prices across various trading venues and Bitcoin exchanges.

Inter-market Arbitrage

As explained above, this inefficiency can enable scalpers to act as a form of "bridging the liquidity gaps", which eventually leads to increased market efficiency assuming that providers and exchanges move towards a more efficient and standardized pricing model where there are fewer opportunities for scalping as prices across venues become more similar from moment-to-moment.

Already websites dedicated to displaying such price discrepancies across venues have surfaced, as can be seen in the screenshot below, using tools available on bitcoin-analytics.com, the arbitrage matrix show the largest arbitrage at 11.71% difference in prices where theoretically a scalper could capture that much in a successful arbitrage (not taking into consideration fee's or withdrawal restrictions):

![Arb Matrix [Source: [bitcoin-analytics.com]](https://www.financemagnates.com/wp-content/uploads/fxmag/2013/11/Arb-Matrix1.jpg)

Arb Matrix [Source: [bitcoin-analytics.com]

Earlier this week senior government officials in the US debated Bitcoin related subjects as prospects of digital currencies appear more feasible. Accordingly, it appears that as people believe this could be the next “web 2.0″ or evolutionary step for finance, the drive to purchase Bitcoins is fueling nearly every bit (pun intended) of the bonanza.

Already there are reports that Bitcoin needs a central banker or regulatory oversight from a governing body. Even though it’s presented as a decentralized market, so is the entire foreign exchange market (with the exception of certain exchange traded products), and Forex has seen its share of locally imposed regulations across the globe. It would be no surprise to see such rules surface relating to digital currencies such as Bitcoins.

Bitcoins and Altcoins

While Bitcoin has done well in separating itself from the remaining list of alternative digital currencies (or coins), "altcoins" as they are known, are similarly mined and structured, yet the differences are not as clear as when comparing an available list of alternative coins as can be seen below in the list from CoinChoose, which displays varying degrees of mining difficulty, network hash rates and values relative to the price of Bitcoins for each Altcoin respectively.

![Altcoins [source: coinchoose]](https://www.financemagnates.com/wp-content/uploads/fxmag/2013/11/Altcoins.jpg)

Altcoins [source: coinchoose]

Brokers offering such instruments or hybrid derivatives of them such as synthetic CFDs on Bitcoins and other derived currency pairs or asset classes relative to Bitcoins must adhere to a rigorous risk-management approach as fragmented liquidity coupled with extreme volatility could literally put a broker out of business overnight if such risk turns negative and cannot be covered or offset in-time to counter any losses from market-making.

Such concern was the subject of an article just yesterday with regards to a Forex provider having to alter trading conditions as a result of difficulties in risk managing Bitcoin priced contracts in over-the-counter (OTC) markets.