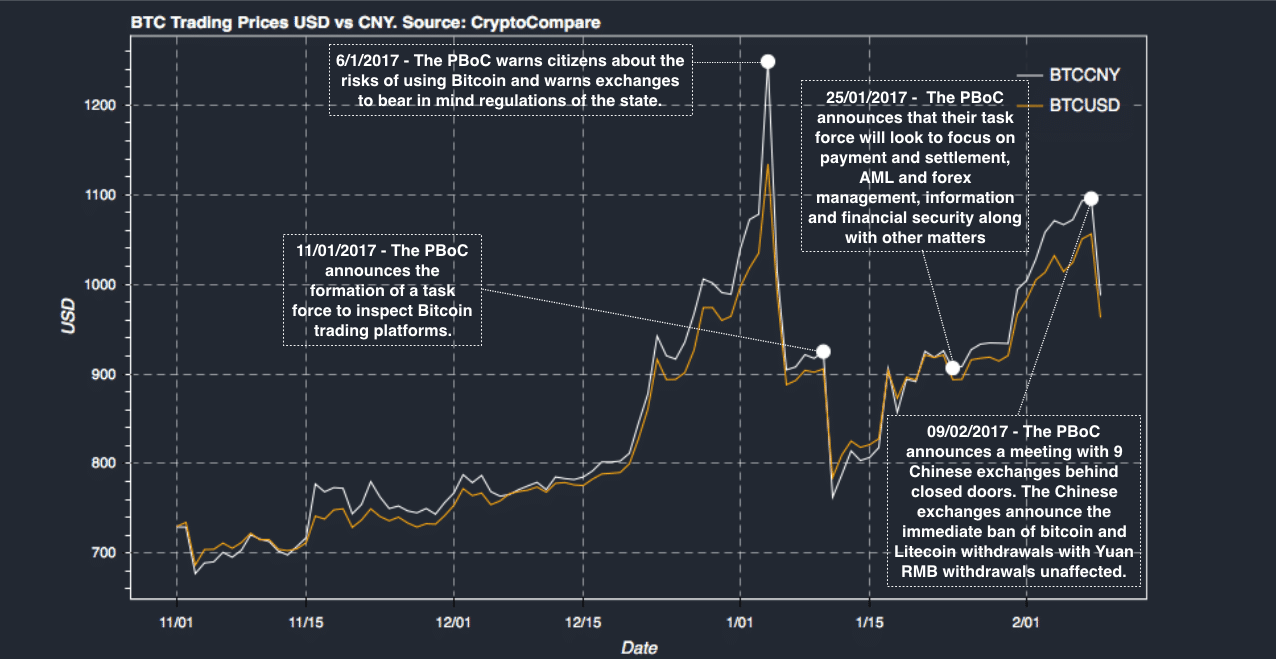

From as high as $1070 recently, the price of Bitcoin fell to as low as $910 today before settling around $985 as of now. This comes after at least two of the leading Chinese exchanges, OKCoin and Huobi, notified clients of an immediate ban on Bitcoin and Litecoin withdrawals, with RMB withdrawals unaffected, while they upgrade their AML systems according to the law which is estimated to take a month.

Want to learn more? Bobby Lee, the CEO of BTCC, will be giving the keynote speech about Bitcoin and China at the iFX EXPO in Hong Kong, register now.

Earlier today, the Chinese central bank officially called on nine of the smaller cryptocurrency trading venues in the country to follow KYC/AML rules but that failed to make a serious impact to the BTC/USD Exchange rate.

Charles Hayter

Charles Hayter, the CEO of CryptoCompare.com, explained: "When China sneezes Bitcoin catches a cold. The PBoC moves to regulate Bitcoin more stringently will bring short term woes but will ultimately strengthen the ecosystem. Volumes can be expected to again slow in China as more friction is incorporated in the form of KYC and AML policies. For the duration of this transition the CNY-BTC pairs can be expected to trade at a discount to other fiat-BTC pairs."

Chinese central bank effect on BTC (CryptoCompare.com)

Hayter added: "The Chinese authorities momentum has been considered and communicative - but past scandals have seen governments make examples - although the Chinese Bitcoin exchanges can't be said to be anything other than cowering at present. At the moment bitcoin is in limbo caught between Chinese regulatory moves on the one hand and scaling, the potential for ETF approval with the resultant flow of institutional money on the other. Then there is global uncertainty with bitcoin acting as a form of digital gold."