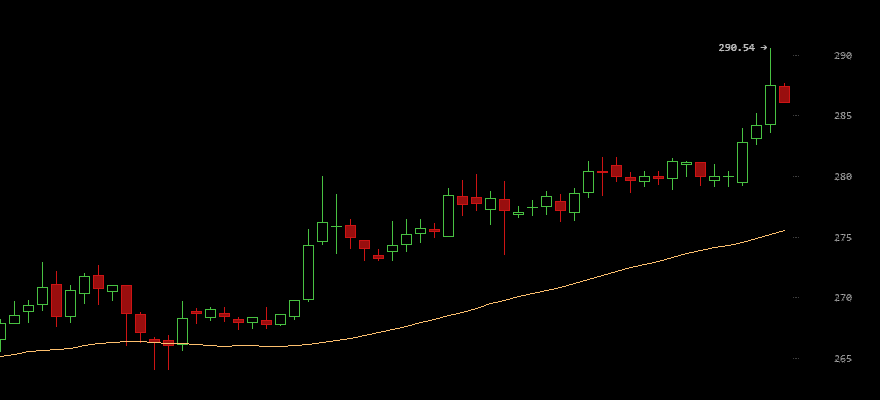

Bitcoin (BTC/USD) has continued its hot streak, rising 4% to $290.50 on Bitstamp- its highest level since July 30.

Today's rise adds to an impressive streak of gains during which bitcoin advanced on 15 of the past 18 days. It has now gained 46% since briefly falling below $200 in late August, and is trading 18% above its 50-day moving average (MA).

Unlike the wild days of October two years ago, the gains have accumulated slowly and steadily and volumes are not markedly higher than prior to the rally.

The newfound stability may be a partial result of the increasing 'institutionalization' of bitcoin trading. Regulated venues now exist, as do publicly traded instruments tracking the value of bitcoin. Though investors may forever grapple with bitcoin's 'true value', its appeal for some may be no worse than gold, whose demand is driven by those seeking a stable long-term store of value but whose current price of $1,162 cannot be scientifically derived.

Particularly noteworthy is the striking correlation between bitcoin and global equity markets during most of the past two months. In late August, Bitcoin fell the hardest simultaneously with stocks during their most volatile showing since the financial crisis. In October- especially during the past week- bitcoin has kept pace with the biggest stock rally in 2015.

In a very 2011-like behavior, the Dow Jones and S&P 500 indices have roughly recovered all their losses in 2015. They were written off with China's economy in late August. Bitcoin too is now within 10% of recovering all 2015 losses, after having shed as much as much as 38%.

The aforementioned institutionalization of bitcoin trading may be a factor in the increasing correlation with global markets. Investors may be adding/removing positions in alternative or risky assets in sync with traditional investments.

Traders are eyeing a return to above the $300 mark, a psychologically key level that, in theory, would unleash a wave of speculative buying from less conservative traders, but in the recent past, has failed to last more than a few days.

Litecoin continues to remain unresponsive to the bitcoin rally, barely budging from $3.05. Thus, the LTC/BTC rate has fallen to 0.0108, its lowest level since mid-June, when litecoin rocketed from below $2.00 to above $3.00 in 24 hours.