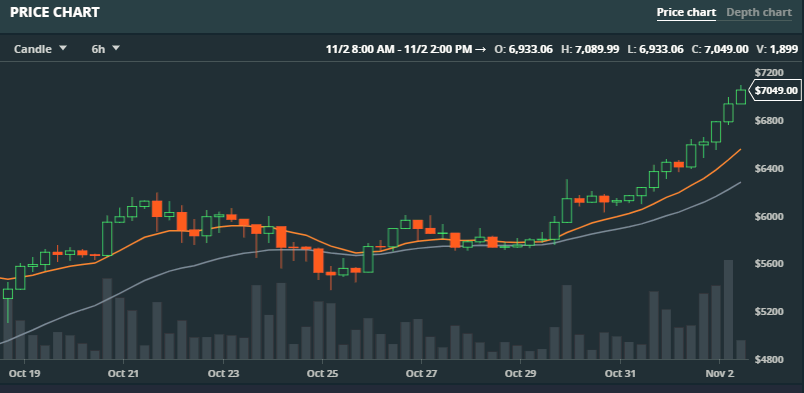

After hitting $6500 for the first time ever yesterday, the price of Bitcoin is now already trading above $7000 at GDAX. The main reason is the new optimism in BTC investors sparked by the revelation that CME Group plans to launch Bitcoin futures by the end of Q4 2017.

GDAX

Coinsource CEO Sheffield Clark said: “Bitcoin is in a phenomenal position right now. People sometimes overlook the fact that bitcoin has been the highest performing currency four of the past five years, and its unprecedented growth in value has been something big money traders have wanted to get their hands on for a while. One of bitcoin’s few setbacks was accessibility to institutional money; now that’s about to change. I’m excited for the CME and for the rising digital currency asset class. Today is a big day for bitcoin."

DataWallet CEO and founder Serafin Lion Engel said: “The CME announcement marks the official inflection point of bitcoin crossing the chasm from being championed exclusively by tech savvy early adopters to starting its proliferation among established financial institutions. While it was easy for critics to label early adopters' enthusiasm as foolish, the adoption of bitcoin by institutions such as CME gives the cryptocurrency a seal of approval that will eradicate even the most well-reasoned criticism pundits may voice. This paves the way for bitcoin living up to its full potential and soaring high into the five digits.”

Enigma Head of Growth and Marketing for Enigma Tor Bair said: “The launch of Bitcoin futures on CME is another signal of the ongoing professionalization of cryptoasset markets. This move by the CME will bring new professional interest in cryptoasset investment and trading. While providing new demand for cryptoassets, it also creates significant opportunities for data-driven investors and traders who stand to benefit from increased Liquidity and volume.”

Leverj CEO Bharath Rao said: “Institutions have been dabbling gently in the crypto market using specialized hedge funds as vehicles, but the introduction of bitcoin futures by the CME opens a huge new opportunity for gaining exposure to cryptocurrency. After all, bitcoin is the bellwether of the entire crypto market, and a regulated, developed exchange product gives confidence to trade large size for many institutions. The ability to hedge against bitcoin enables creation of all manner of crypto products, in addition to simple investment and trading. We are likely to see a flurry of activity in this sphere. CME’s introduction of bitcoin futures may herald the first step in mainstream acceptance of crypto as a real asset class.”

Nucleus CEO Abhishek Pitti said: “On its nine-year anniversary, bitcoin has surged to an all-time price high following an announcement by CME Group to launch bitcoin futures by the end of the year. While it’s not the first to announce plans for bitcoin futures, CME may have a better chance of obtaining SEC approval for its proposal. Earlier this year, the SEC rejected a bitcoin ETF proposal put together by the Winklevoss twins, saying the exchange that wanted to list it could not enter into necessary surveillance-sharing agreements, given that ‘significant markets for bitcoin are unregulated.’ If CME does manage to achieve this feat, one of the largest barriers in introducing a bitcoin-based ETF may soon be removed, which will open up the floodgates for both institutional funds and retail investors who haven’t had exposure to bitcoin to get in on some of the action. We could very well see bitcoin going multiple folds higher when that happens.

However, bitcoin is quite different from traditional commodities like gold, copper, or rice that are currently traded in the futures markets. Thus, there will be a lot of teething issues that CME will face, as it does not have any other commodity that behaves like bitcoin. What’s more, this commodity can be procured in many more unregulated cryptocurrency exchanges around the globe, which could potentially steer away a lot of traditional and conservative investors.”

Tim M. Zagar, Co-founder, CEO ICONOMI, commented: “With the pending release of CME Group’s bitcoin futures contract, the crypto-economy has gone mainstream. The CME will be the first traditional financial exchange to offer trading related to digital assets, and I’m sure the rest of Wall Street won’t be far behind. As well as vastly increasing the liquidity of cryptocurrency markets, the addition of bitcoin to traditional markets will bring in institutional investors who have been eagerly waiting for an opportunity to invest in this new asset class via traditional financial channels. More than ever, financial markets must meet the needs of both institutional clients and individual investors, both of whom require a simple, international, and borderless solution for investing in the crypto-economy, such as the ICONOMI platform.”